Green investment: This is how Natalie Portman, Harry and Meghan & Co invest

Investing sustainably is becoming more and more popular – even among the stars. In recent years, the number of celebrities investing in green businesses has grown tremendously. From meatless hamburgers to environmentally friendly baby products: A selection of sustainable investments with star power behind them.

Leonardo DiCaprio: Vegetable Sausages

The list of Leonardo DiCaprio’s sustainable investments is almost as impressive as the list of his Hollywood films (The Wolf of Wall Street, The Revenant, Don’t Look Up). The 48-year-old is particularly taken with companies that specialize in vegan nutrition. The Oscar winner has previously invested in several startups focused on cellular agriculture and aquaculture, including Dutch food tech company Mosa Meat and San Francisco-based WildType. DiCaprio has also invested in Hippeas, a vegan snack brand, and Califia Farms, a plant-based milk company. The actor also sits on the sustainability committee of start-up Perfect Day, which develops animal-free milk proteins.

DiCaprio’s best-known investment in vegan nutrition is in Beyond Meat, a US manufacturer of plant-based meat substitutes. He does not reveal how much money the star has invested there. So far, however, the commitment has hardly paid off financially: since the IPO around four years ago, the share has plummeted and is now listed well below the issue price. By the way, it is not known whether DiCaprio is a vegan himself.

In addition to animal-free nutrition, DiCaprio’s portfolio also includes sustainable fashion. Last October, the actor invested in UK-based vegan and cruelty-free sneaker start-up LØCI, which works exclusively with renewable and biodegradable materials. In doing so, he joined other celebrities such as Mila Kunis, Olivia Wilde and Eva Longoria.

The US star with roots in Germany has also invested in a German company: Enpal, a rental company for solar systems based in Berlin, received a financial injection in the millions in 2020 from Princeville Climate Technology, a venture capital fund for green technology. It includes money from DiCaprio.

This investment could still be worthwhile. Founded in 2017, Enpal is one of the fastest growing energy companies in Germany. Sales quadrupled last year, and Enpal made a profit for the first time. The valuation rose to around two billion euros at the beginning of the year after another round of financing. An IPO was already planned for 2021, but is not planned at the moment.

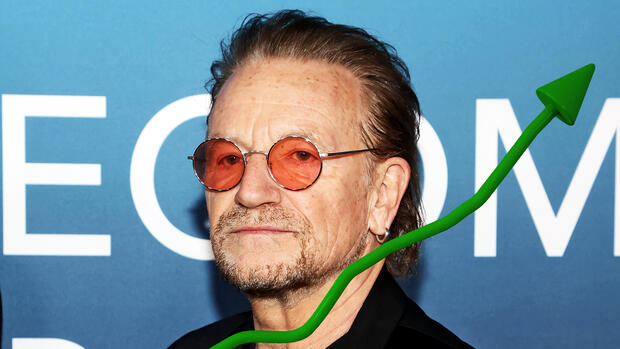

Bono: Green Farming

The musician has not only had a great career with his rock band U2, but also as a green investor. Bono founded the Rise Fund in 2016 with his management company TPG and entrepreneur Jeffrey Skoll, who once made eBay great. It invests in companies that drive social and environmental change in line with the United Nations Sustainable Development Goals.

The Rise Fund has around $14 billion under management and has invested in more than 40 companies worldwide to date. His investment targets include start-ups in the field of green agriculture and the sustainable packaging industry.

A European company also belongs indirectly to Bonos Investments via the Rise Fund: Matrix Renewables from Barcelona, which develops construction projects in the field of renewable energies. The storage of green hydrogen in Europe, the USA and Latin America is one of the main goals of the start-up.

Natalie Portman: Oat Milk

The Hollywood actress (“Black Swan”, “V for Vendetta”) has been vegan since she was nine. When it comes to investments, she also focuses on companies that want to avoid animal suffering. Over the past year, Portman has invested in two startups specializing in vegan meat alternatives: France’s La Vie and US-based Tender Food.

Tender Food has developed a technology that aims to give plant-based meat alternatives a more realistic texture. La Vie focuses on the production of vegan bacon. Last year, thanks in part to Portman, both companies secured several millions in fresh capital to fuel their expansion.

One of the Oscar winner’s best-known investments is her stake in Oatly. In 2020, a group of investors that included Portman, TV presenter Oprah Winfrey, rapper Jay-Z and former Starbucks CEO Howard Schulz invested a total of around $200 million in the Swedish oat milk brand. The following year, Oatly went public.

Private investors who wanted to emulate the stars should be annoyed today: the oat milk business is not going well. Due to inflation and various supply chain difficulties, the Swedes grew less than expected last year and struggled to break out of the red. The issue price of Oatly shares in 2021 was 17 dollars, the equivalent of around 15 euros. In the meantime, the share is bobbing at two euros.

Jessica Alba: Wet wipes

Actress Jessica Alba (“Sin City”, “Fantastic Four”) founded the e-commerce company The Honest Company in 2011 after the birth of her first daughter. It sells chemical-free and environmentally friendly baby and beauty products. Alba was there early on with this business model: The demand for ecological products, especially for babies and in the beauty sector, has grown significantly since then. Still, things are not going well for Alba’s company.

The IPO in 2021 actually got off to a good start. At $16 per share, the issue price was at the upper end of the announced range. A good start was followed by a rapid decline. The share price is currently at $1.66.

Shortly after the IPO, investors sued the company. Her accusation: Contrary to the company name, The Honest Company was not honest about the ingredients. Contrary to what the label suggested, wet wipes were not made from purely plant-based materials, but contained synthetic ingredients. A year earlier, investors had already complained that the company had presented its business prospects too positively during the pandemic and thus downplayed risks in the run-up to the IPO. The share price has not yet recovered from these scandals.

Harry and Meghan: Green Finance

Prince Harry and his wife Meghan Markle, the Duchess of Sussex, have been on the go financially since they broke away from British royalty and relocated to the United States. In 2021, the couple joined Ethic. The green fintech wants to help investors find sustainable investments. According to the company, around three billion dollars have already been invested.

An “impact partnership” was entered into with Harry and Meghan, according to the Ethic homepage. It’s unclear whether the couple brought in their own money, and if so, how much. Harry and Meghan are more likely to act as figureheads here. By the way, since the Netflix series “Harry & Meghan” the two can also be called Hollywood stars.

Also read: How Harry and Meghan turned public attention into a business