40% Of Blockchain Fees Go To Just Moving USDT

Tether CEO Paolo Ardoino has revealed a staggering 40% of all fees that users are paying on the major blockchains are spent to move USDT.

USDT Transfers Make Up For A Notable Portion Of Network Fees

In a post on X, Paolo Ardoino has shared the latest data related to USDT’s transfer fees share on the major blockchains. Transfer fee here naturally refers to the amount that senders have to attach with their network transactions as a reward for the validators.

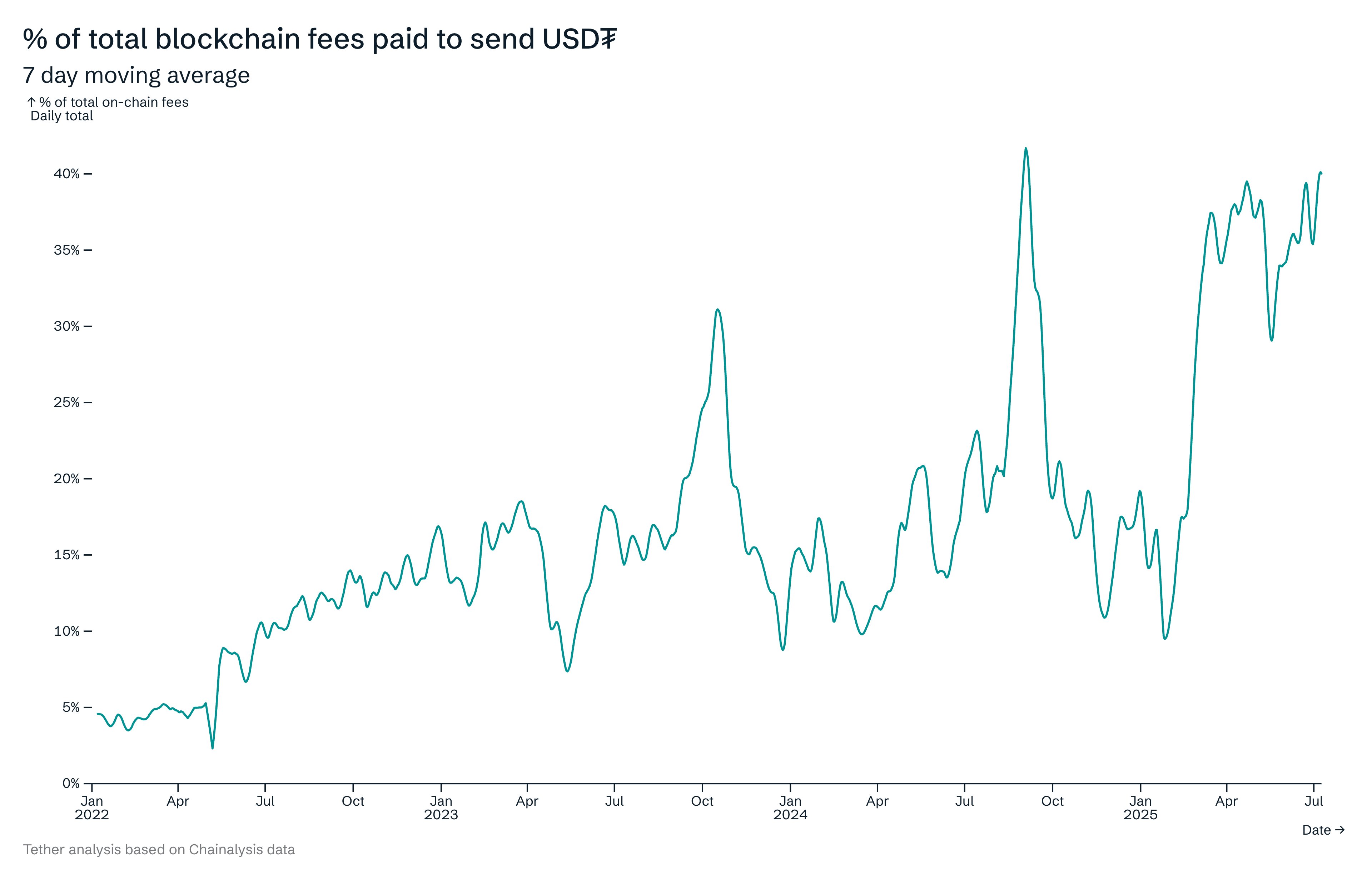

Below is the chart shared by the Tether CEO that shows the trend in the percentage of these transfer fees that users on major networks are paying for making USDT transfers.

The 7-day moving average value of the metric appears to have climbed up in recent months | Source: @paoloardoino on X

Nine networks are included here: Ethereum, Tron, Toncoin, Solana, BSC, Avalanche, Arbitrum, Polygon, and Optimism. From the graph, it’s visible that the 7-day moving average fees share of USDT transfers across these chains recently hit the 40% mark.

Fees usage can serve as a proxy for transaction activity, so this high share would indicate strong user interest in Tether’s stablecoin. “Hundreds of millions of people in emerging markets use Tether’s digital dollar USDt daily, to protect their families from local inflation and devaluation of their national currencies,” notes Ardoino.

On most networks, the transfer fee is paid using the chain’s native token, even when the transaction involves a secondary coin. For example, ETH is required to make any kind of transaction on the Ethereum network.

Since stablecoins like USDT run on blockchains like these, senders also need to own the network’s main token to participate in transfers related to them. Among the chains included in the above data, however, there is one exception: Tron.

This year, the blockchain launched a feature that allows users to pay gas fees in other tokens, including USDT. As a result, Tron has established itself as the dominant network when it comes to the supply of the number one stablecoin.

“Blockchains that will focus on lower gas fees, allowing paying these in USDT will take over the world,” says the Tether CEO.

In related news, the on-chain volume associated with all stablecoins set a new record recently, as institutional DeFi solutions provider Sentora has pointed out in an X post.

The trend in the volume associated with the different stablecoins | Source: Sentora on X

As displayed in the above chart, the combined monthly transaction volume of the stablecoins crossed $1.5 trillion last month, which is a new all-time high (ATH).

ETH Price

At the time of writing, Ethereum is trading around $3,600, down more than 4% over the past week.

The price of the coin appears to have recovered a bit since its low | Source: ETHUSDT on TradingView

Featured image from Dall-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.