Crypto Funds See $572M Comeback as US Opens 401(k)s to Digital Assets

Crypto asset investment products recorded net inflows last week, reversing two consecutive weeks of outflows, according to the latest data from CoinShares.

The report showed that total inflows reached $572 million, with activity influenced by both macroeconomic data and regulatory developments. James Butterfill, head of research at CoinShares, noted that investor sentiment shifted significantly during the week.

“Early in the week, outflows reached $1 billion, which we believe were driven by growth concerns stemming from weak US payroll figures. In the latter half of the week, however, we saw $1.57 billion of inflows, likely spurred by the government’s announcement permitting digital assets in 401(k) retirement plans,” he explained. The change in policy appears to have provided a fresh boost for institutional interest in crypto-based investment products.

Regional Trends and Asset Performance

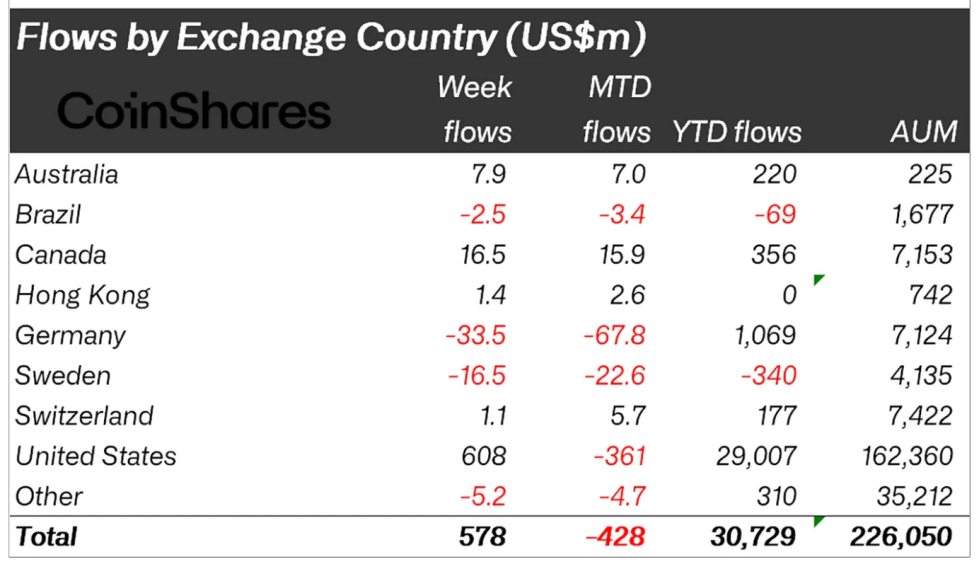

The inflow activity was not evenly distributed across regions. The United States led with $608 million in net inflows, followed by Canada with $16.5 million. In contrast, Europe saw continued investor caution, as Germany, Sweden, and Switzerland recorded a combined $54.3 million in outflows.

CoinShares suggested that seasonal factors, particularly the historically quieter summer trading period, contributed to an overall 23% decline in digital asset ETP trading volumes compared to the previous month.

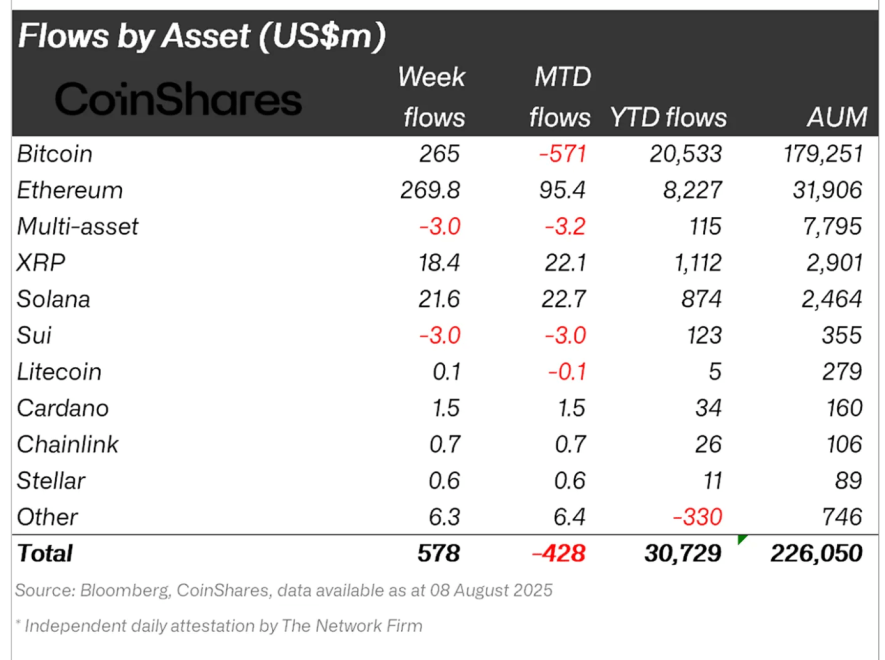

Ethereum products led the market, drawing in $268 million in inflows, the highest among all assets during the week. This pushed Ethereum’s year-to-date inflows to a record $8.2 billion, while price appreciation lifted assets under management to an all-time high of $32.6 billion, representing an 82% increase since the start of the year.

The surge in interest for Ethereum-based ETPs comes amid rising activity in its network, especially within decentralized finance (DeFi) and staking ecosystems.

Bitcoin also saw renewed interest after two weeks of outflows, attracting $260 million in inflows. Short Bitcoin products experienced $4 million in outflows, suggesting reduced bearish positioning among traders.

Other altcoins also posted gains, with Solana bringing in $21.8 million, XRP receiving $18.4 million, and Near Protocol attracting $10.1 million. These figures indicate that while Bitcoin and Ethereum dominate inflow totals, investor appetite for select altcoins remains strong.

Implications for the Market

The return to positive fund flows may signal renewed institutional confidence, particularly in light of the US government’s decision to include digital assets in certain retirement plans.

This policy change could open a substantial new channel of demand, given the size of the US 401(k) market. However, the regional divergence, with Europe still seeing net outflows, highlights that sentiment is far from uniform.

With volumes down from the prior month and macroeconomic uncertainty still in play, the sustainability of these inflows will likely depend on broader market conditions, regulatory clarity, and the performance of major assets like Bitcoin and Ethereum.

Featured image created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.