Liquid restaking provider Renzo bags $150m volume following airdrop

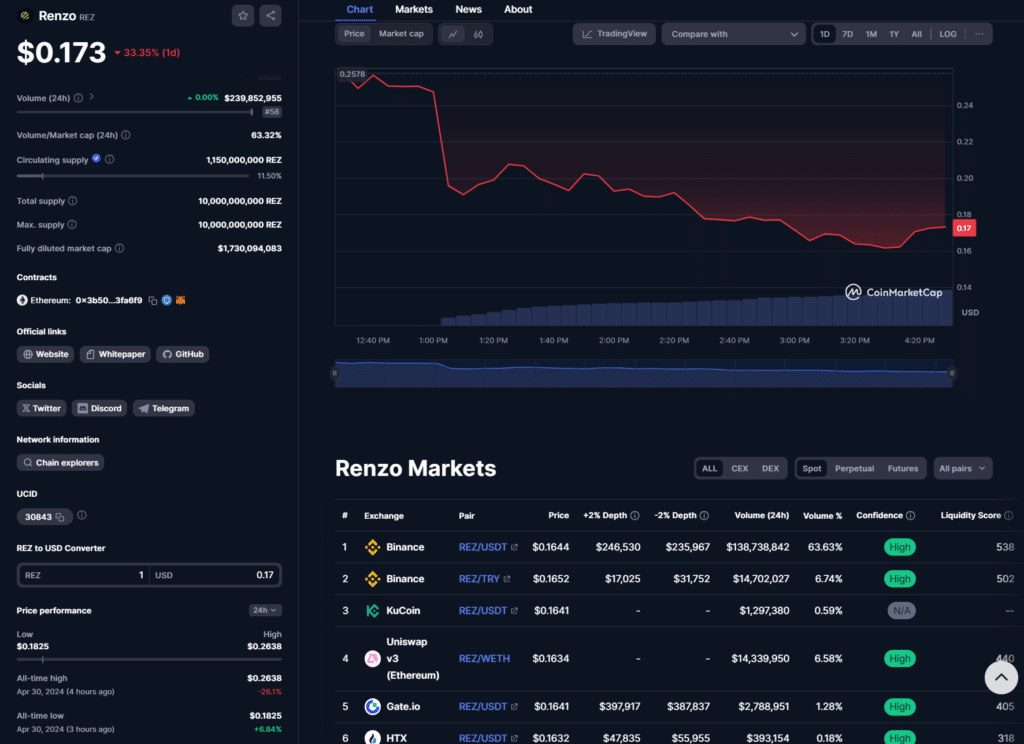

Liquid restaking protocol Renzo launched its token airdrop, which has a market cap of nearly $300 million, as users claimed REZ coins.

CoinMarketCap data showed that Renzo (REZ) garnered over $230 million in trading volume across centralized exchanges (CEX) like Binance, Bitget, HTX, KuCoin, and Gate.

Around the token’s debut on April 30, the Renzo team said its REZ token was only tradable on Ethereum’s (ETH) mainnet via supported CEXs. It was also emphasized that trading pairs were not yet available on decentralized exchanges (DEX).

However, the official REZ token contract is available on the protocol’s website, and traders executed activity on Uniswap. Users had swapped over $14 million of volume on the Uniswap v3 REZ/WETH pair option at press time.

REZ arrived with an initial 1.15 billion circulating supply of a possible 10 billion max supply. The outstanding 8.85 billion tokens are locked up and subject to vesting schedules for up to two years.

Investors are entitled to 31% of REZ’s supply, while 20% was earmarked for core contributors. As reported by crypto.news, the community will receive 32% of the supply after adjusting Renzo’s airdrop distribution plan.

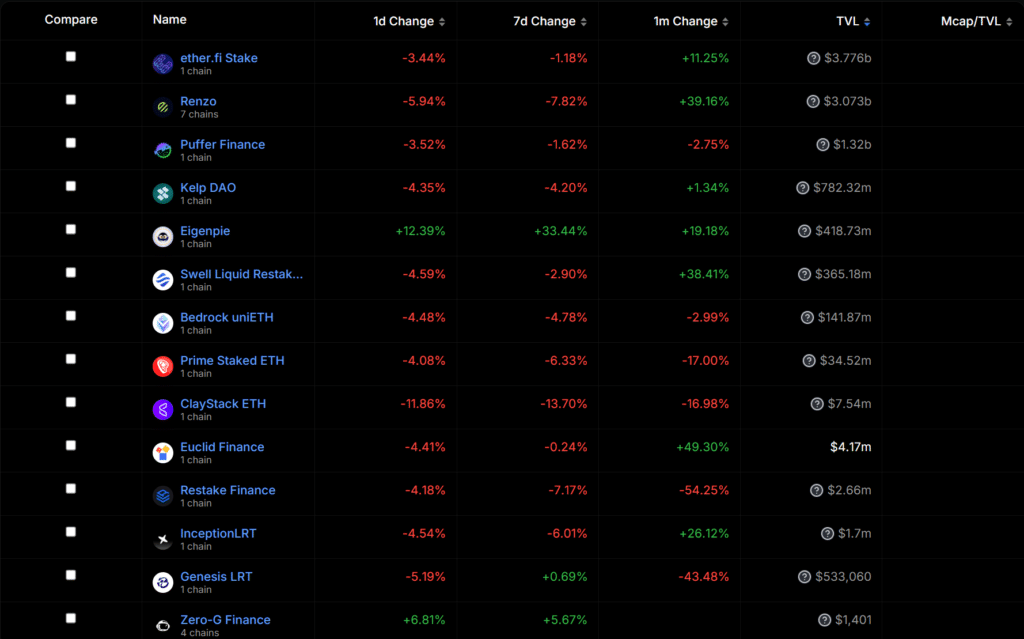

Renzo solidifies spot for second-largest liquid restaker

Like other liquid restaking protocols, Renzo offers exposure to EigenLayer’s platform and allows users to earn yield by depositing ETH. Additionally, the project provides its ezETH as a derivative token to unlock more income for participants within the defi ecosystem.

According to DefiLlama, the REZ team built Ethereum’s second-largest liquid restaking platform. The initiative has amassed over $3 billion in total value locked and is only outclassed by liquid restaking leader Ether.fi.