From Bitcoin basher to crypto crusader

Cuban has been catapulted back into the news after claiming that Gary Gensler’s anti-crypto stance could cost Joe Biden the presidential election in November.

Billionaire investor and Shark Tank star Mark Cuban hasn’t always been a fan of cryptocurrencies.

A little over four years ago, he was especially dismissive of Bitcoin — declaring that he’d rather have bananas because they have utility.

Fast forward to 2022, and things couldn’t have been more different. In an interview with the comedian Jon Stewart, Cuban revealed 80% of the investments he was making away from Shark Tank were related to digital assets.

The entrepreneur also spoke of his bullishness surrounding decentralized autonomous organizations and smart contracts — and belief that businesses powered by collective governance and self-executing agreements will dominate the 21st century.

But in his eyes, there’s one thing that’s standing in the way of digital assets achieving their full potential, especially in the U.S: regulatory paralysis.

Cuban has emerged as a scathing critic of the Securities and Exchange Commission — arguing that the body, under Gary Gensler, was asleep at the wheel when FTX collapsed.

Last summer, the 65-year-old accused the SEC of arrogance — and said the widespread financial damage caused by Sam Bankman-Fried could have been avoided. Pointing to how Japan learned lessons in the wake of Mt. Gox going bankrupt in 2014, he posted:

“When FTX crashed, NO ONE IN FTX JAPAN LOST MONEY. If the USA/SEC had followed their example by setting clear regulations that required the separation of customer and business funds and clear wallet requirements, NO ONE HERE WOULD HAVE LOST MONEY ON FTX.”

Mark Cuban

The Voyager debacle

Of course, hindsight is 20/20. While Cuban’s significant public profile wasn’t connected with the spectacular collapse of FTX — unlike his fellow Shark Tank star Kevin O’Leary and countless other celebrities — the businessman has been known to back the wrong horses in the past.

Just last week, the Dallas Morning News reported that Cuban is continuing to face legal action over his involvement with the doomed crypto lending platform Voyager Digital.

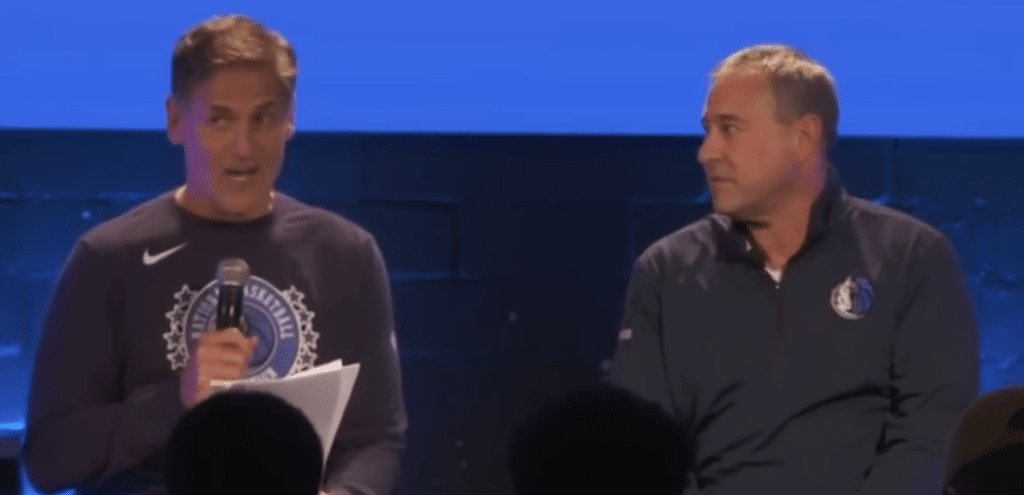

Cuban is the owner of the Dallas Mavericks, and the basketball team had entered into a high-profile, five-year partnership with Voyager in 2021. At the time, the entrepreneur spoke of his ambition to introduce even more sports fans to cryptocurrencies — building on a legacy of accepting Bitcoin and Dogecoin for tickets and merchandise. In quotes at a news conference that really didn’t age well, he had said:

“I think Voyager is going to be a leader among sports fans and crypto fans around the country.”

Mark Cuban

It took just seven months for Cuban to be proven wrong — with Voyager spooking the market by suspending withdrawals and deposits in July 2022 and admitting that customers may never be made whole. A month later, a lawsuit accused him of enticing uninformed clients to place their entire savings in a “Ponzi scheme” — and pointed to a quote where Cuban said Voyager was “as near to risk-free as you’re going to get in crypto.” Ouch.

The latest Dallas Morning News report suggests that, while other sports stars have agreed to pay a total of $2.4 million in damages, Cuban is unprepared to settle — and he has long denied allegations that he misled investors.

As much as Cuban may be jumping up and down about failures to stop FTX, the billionaire’s own track record when endorsing crypto firms isn’t free of blemishes.

What’s happening now?

Cuban has been catapulted back into the news after even claiming that Gary Gensler could cost Joe Biden the presidential election in November. He went on to warn:

“This is also a warning to Congress. Crypto voters will be heard this election. You could solve this problem for Biden by passing legislation that defines registration that is specific to the crypto industry.”

Mark Cuban

Some progress is being made here. Republican Cynthia Lummis and Democrat Kirsten Gillibrand proposed legislation specific to stablecoins last month.

Meanwhile, there’s widespread excitement about news that the Financial Innovation and Technology for the 21st Century Act (FIT21) will head to a crucial floor vote within weeks — potentially giving greater certainty to crypto firms, and greater clarity as to what falls under the remit of the SEC and the Commodities Futures Trading Commission respectively.

With 8.8 million followers on X — and a public profile to boot — Cuban is arguably one of the most visible, and vocal, supporters of crypto.

And while it’s highly unlikely that Biden would lose the looming election based on crypto alone, the billionaire seems determined to use his platform to ensure the future of digital assets becomes an issue of national importance.