What the data really shows

Few platforms have faced as much skepticism as Solana. Critics often portray it as a centralized network plagued by frequent outages. However, such a narrative does not align with the actual data and progress witnessed within the Solana ecosystem. This article seeks to debunk these misconceptions by comprehensively analyzing Solana’s key metrics.

Contrary to the prevailing negative perception, Solana showcases remarkable growth and innovation across several fronts. The increasing volumes of stablecoins transacted on its network, and the higher decentralized exchange (DEX) volumes compared to Ethereum highlight Solana’s expanding utility. Furthermore, the platform’s superior data throughput showcases its technical capabilities and resilience. Additionally, the surge in new addresses and daily active users further reflects the growing confidence and adoption among the broader crypto community.

By examining these metrics, this article aims to provide a balanced and data-driven perspective on why Solana represents an undervalued asset in the cryptocurrency market as of June 2024.

Centralization

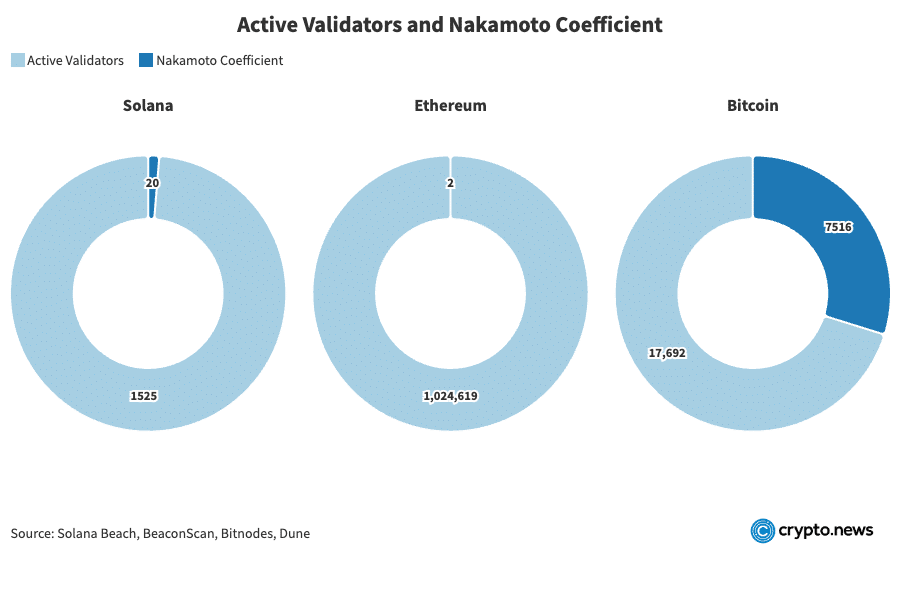

The decentralization of a blockchain network is complex and cannot be evaluated simply on one metric. A deep dive into which network is truly decentralized based on every detail could fill an entire article. Therefore, we will focus on the Nakamoto coefficient. The Nakamoto coefficient measures the minimum number of entities in a network required to collude to disrupt the system. For proof-of-stake networks like Solana and Ethereum, a 33% stake is significant, while for proof-of-work networks like Bitcoin, 51% control is crucial.

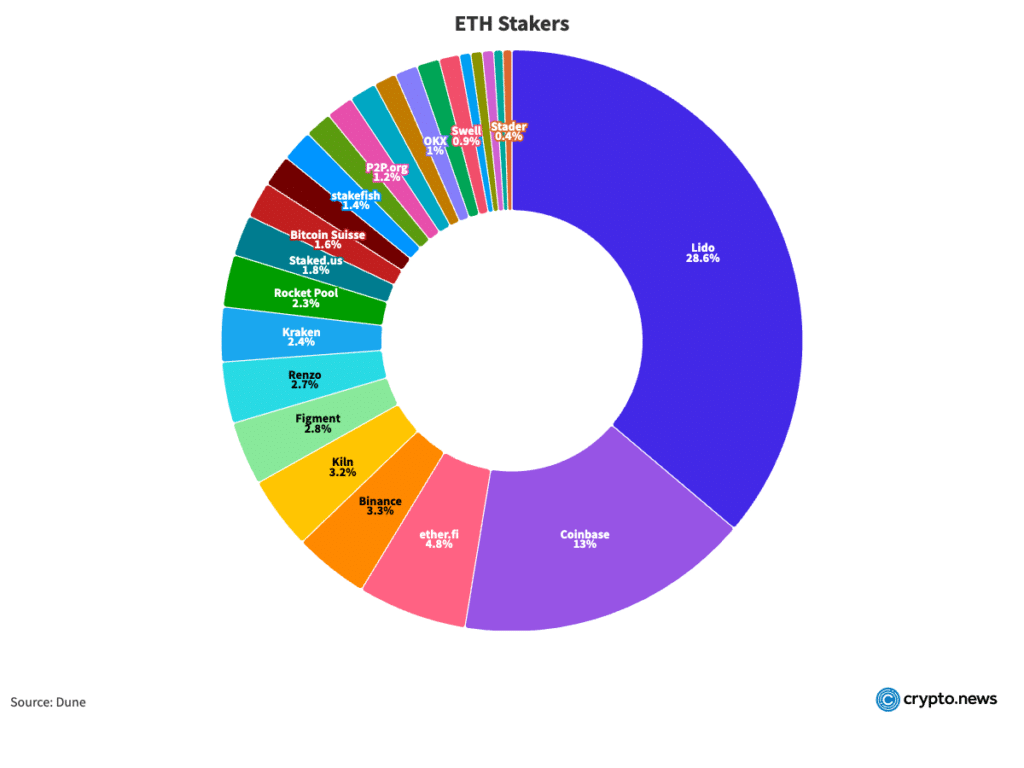

As of June 20, 2024, Solana has 1,525 active validators, with 20 holding more than 33% of the stake. On the other hand, Ethereum has 1,024,619 active validators, with just two entities controlling more than 33% of the stake. A validator must stake 32 ETH to become a node on the Ethereum network. The issue here is that one entity can control multiple validators, masking the actual level of decentralization.

According to Dune, Lido and Coinbase hold more than 33% of the stake in Ethereum. If each node holds 32 ETH, then out of the 1,024,629 active nodes, these two entities potentially control 432,389 unique validators. This concentration of control under two entities compromises the decentralization ethos.

For Bitcoin, the network has 17,692 full nodes that have not been pruned, with 7,516 capable of disrupting the network. Unfortunately, no information exists on each node’s individual hashrate. The calculation of this number used the Peer Index (PIX). The PIX value, ranging from 0.0 to 10.0, updates every 24 hours based on a node’s properties and network metrics, with 10.0 being the most desirable. Nodes with a PIX value of 5 or more were considered.

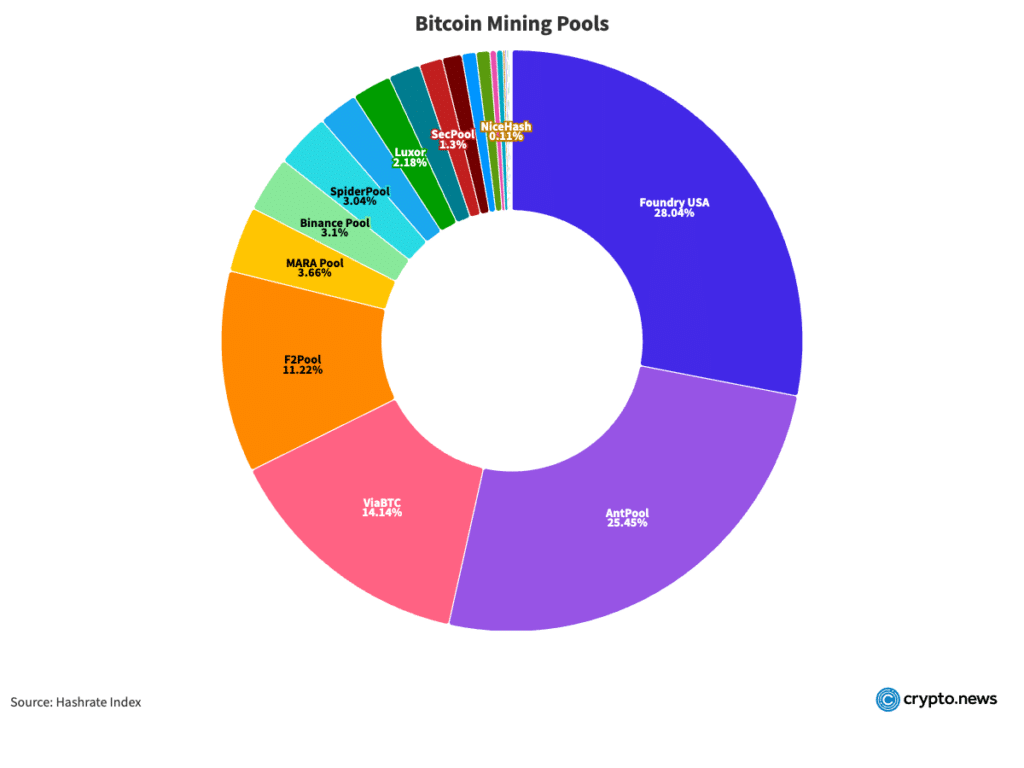

Some may argue that Bitcoin’s decentralization should be evaluated through hashrate distribution. Currently, two mining pools, Foundry USA and Antpool, control more than 51% of the network’s hashrate.

However, it is incorrect to consider these pools as the network’s controllers because they are pools of individual miners. Mining pools allow miners to combine their computational resources to increase their chances of solving blocks and earning rewards. If a pool begins to act maliciously, individual miners can simply switch to a different pool, maintaining the network’s decentralization.

While the decentralization of blockchain networks is multifaceted and cannot be accurately assessed by a single metric, the Nakamoto coefficient provides a useful lens for comparison. Solana’s position is not as concerning as it may initially seem. With a Nakamoto coefficient indicating that 20 validators hold more than 33% of the stake, Solana appears more decentralized than Ethereum, where just two entities hold more than 33% of the stake. Moreover, even though Solana is not as decentralized as Bitcoin, it still maintains a robust decentralization level, contributing to its security and reliability.

Stability

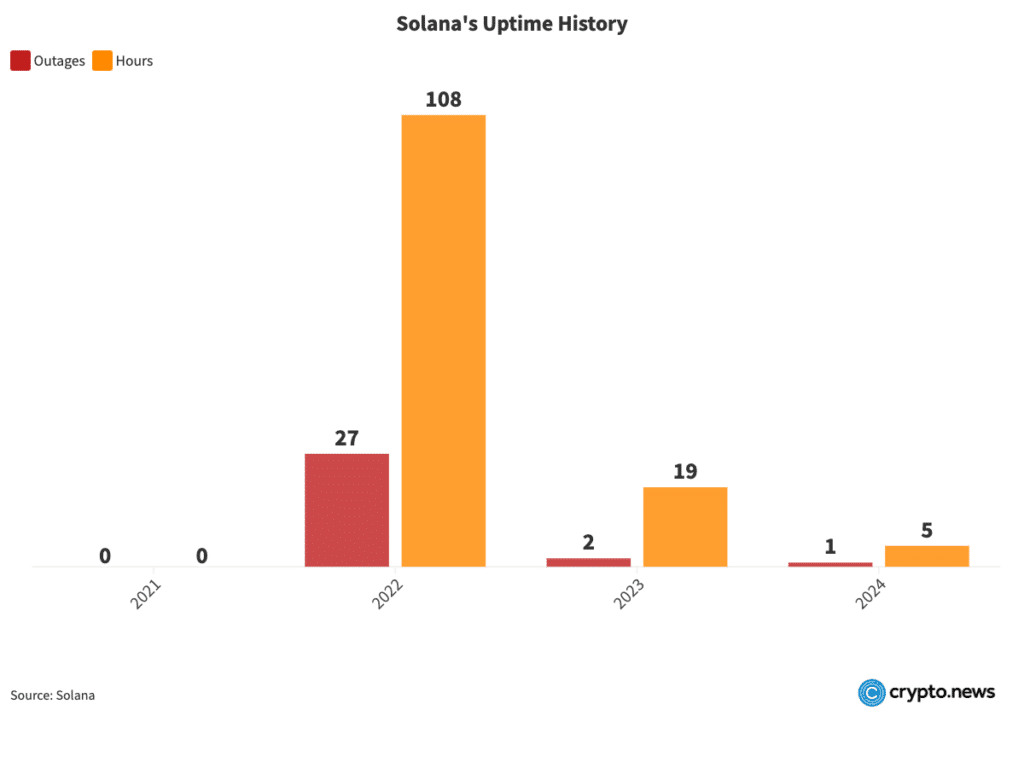

Solana, known for its high-speed transactions and low fees, has faced scrutiny regarding its network stability due to several outages it has experienced in recent years. However, a closer look reveals that the situation might be overblown. The network’s stability becomes apparent despite the occasional hiccup when examining Solana’s uptime history.

In 2021, Solana experienced no outages and demonstrated a full year of uninterrupted service. However, 2022 saw a significant increase, with 27 outages totaling 108 hours. Moving forward, 2023 showed considerable improvement, with only two outages totaling 19 hours. In 2024, up until June 19, the network had just one outage lasting five hours. These numbers, while notable, tell only part of the story.

When considering uptime, these outages represent a tiny fraction of the total operational hours. For instance, in 2022, despite 27 outages, the network maintained functionality for 99.47% of the year. Similarly, the 19 hours of downtime in 2023 and 5 hours in 2024 up to mid-June account for negligible interruptions in an otherwise stable performance.

The main culprit of these outages is Solana’s design. The network prioritizes speed and low costs, which attract heavy usage. This high traffic can lead to congestion and instability. For example, Solana produces a block every 400 ms, much faster than other blockchains. Due to the rapid production rate, when block creation halts for an hour or two, it appears more severe. However, other blockchains, even Bitcoin, also face downtime. For instance, it took over two hours to mine block 689301 following block 689300.

Solana’s strategy of pushing its performance boundaries allows it to encounter and resolve real-world challenges that theoretical models and simulations cannot foresee. This approach resembles SpaceX’s iterative process of learning from failures to achieve rapid innovation. Although some critics view Solana’s historical downtimes as a liability, this rigorous testing and problem-solving phase ultimately provides a significant competitive advantage.

Solana by the Numbers

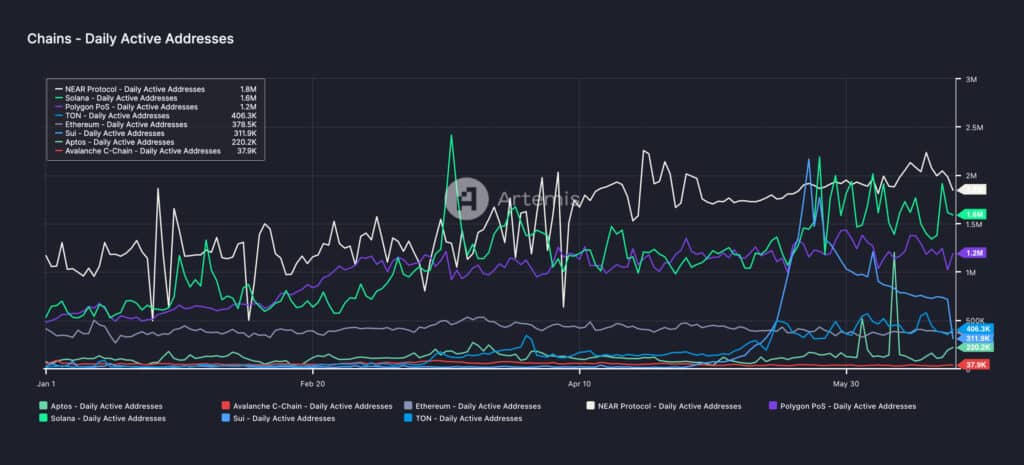

Daily active wallets

Solana currently has 1,600,000 daily active wallets, significantly higher than Ethereum’s 367,000 daily active wallets.

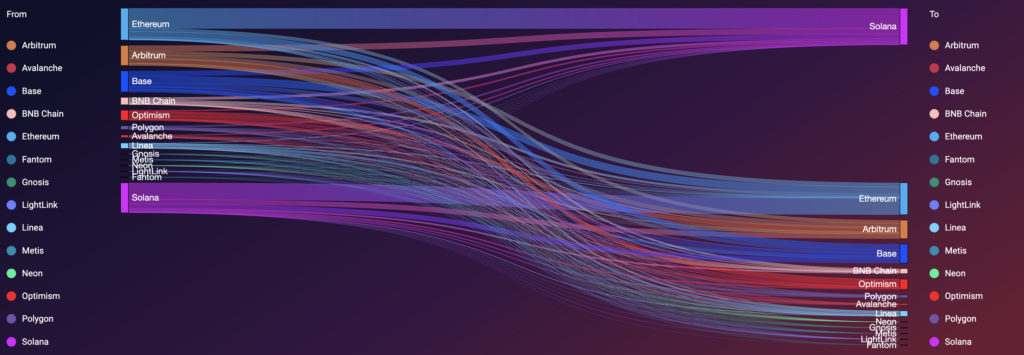

Inflows and outflows

Additionally, between April 2023 and June 2024, Solana had $801.73 million in inflows and $654.21 million in outflows. In contrast, Ethereum had $694.17 million in inflows and $694.1 million in outflows. This results in a net inflow of about $150 million for Solana, compared to Ethereum’s net inflow of approximately $70,000.

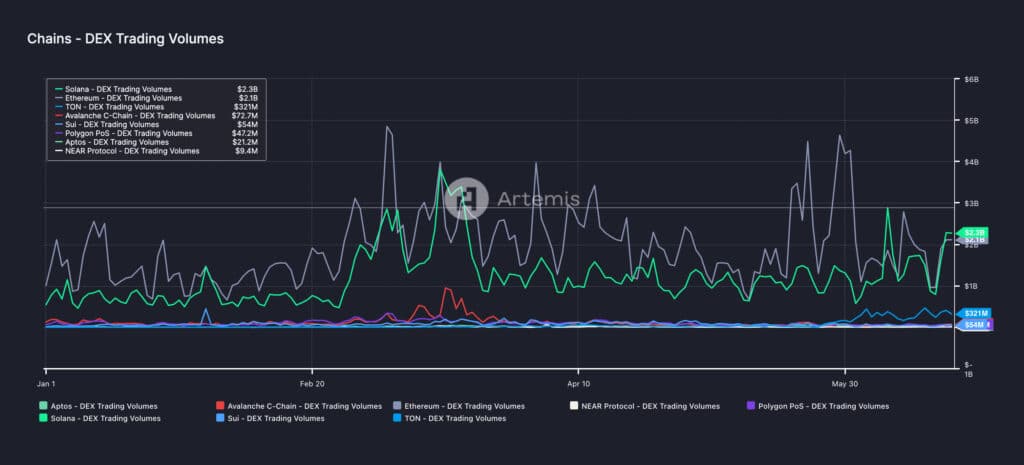

DEX volumes

In terms of DEX volumes, Solana has also performed excellently. It has begun to match or exceed Ethereum’s trading volumes on several occasions. This is significant because Solana’s market cap is about $63 billion, much smaller than Ethereum’s $430 billion. Additionally, Solana’s token was launched only four years ago, compared to Ethereum’s nine years in the market. Despite being newer and smaller, Solana’s ability to compete with Ethereum in DEX volumes showcases its potential.

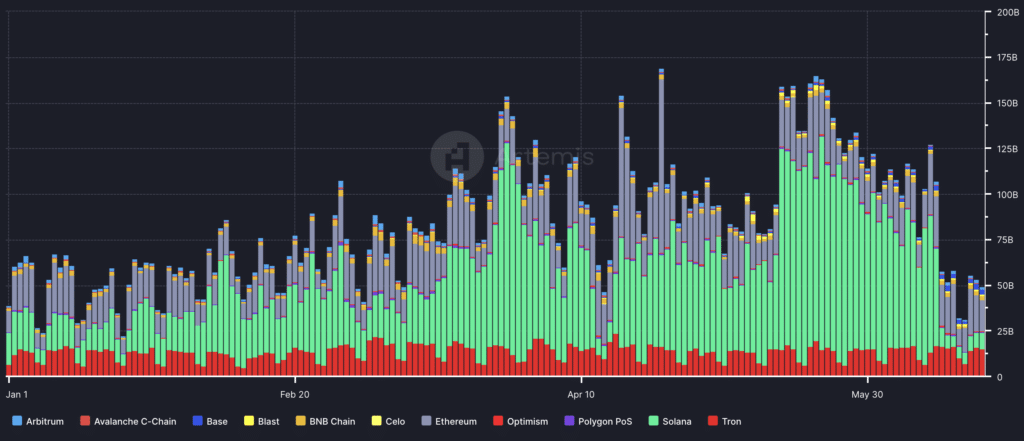

Stablecoin transfer volumes

Solana’s high stablecoin transfer volumes stem from its fast transaction speeds and low fees, making it attractive to users. The network’s ability to process many transactions efficiently supports high-volume activity. Additionally, Solana’s focus on scalability and user-friendly experience further drives its dominance in stablecoin transfers.

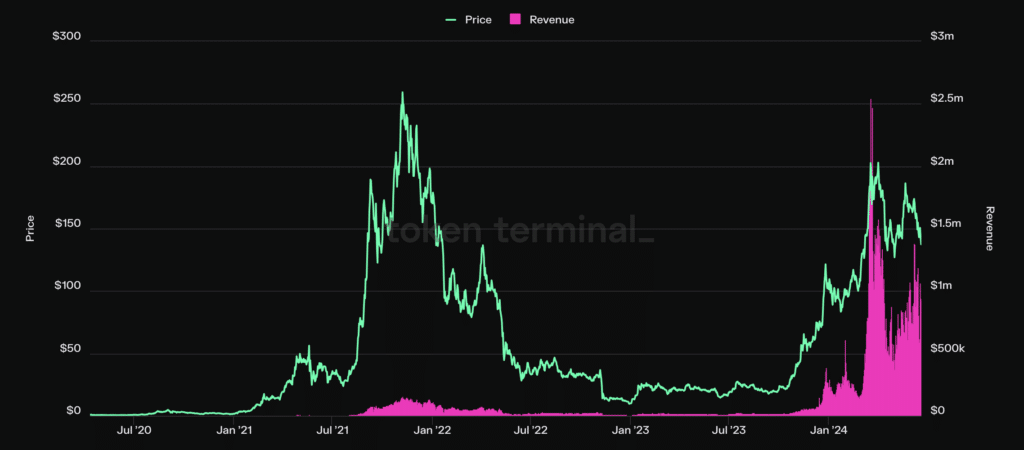

Revenue

Solana’s revenue has surged to 50% of Ethereum’s in mid 2024, an unprecedented high. Historically, during the peak activity periods of 2021 and 2022, Solana’s revenue was less than 1% of Ethereum’s. At the beginning of 2024, this figure was approximately 10%. This dramatic increase in revenue ratio indicates Solana’s growing usage and economic activity on the network.

Conclusion

Solana’s narrative as a centralized and unreliable network does not hold up against the actual data. With its robust technical capabilities and growing adoption, Solana demonstrates significant progress and resilience. The Nakamoto coefficient shows Solana’s decentralization is more favorable than Ethereum’s, with fewer entities required to collude to disrupt the network. Although not as decentralized as Bitcoin, Solana still maintains a substantial level of decentralization, which contributes to its security and reliability.

Network stability, often criticized due to past outages, shows marked improvement, with substantial uptime and continuous enhancements. Solana’s strategic focus on high performance and scalability results in occasional instability but also rapid innovation and resilience akin to iterative development seen in other cutting-edge tech fields.

Metrics such as daily active wallets, inflows and outflows, decentralized exchange volumes, and revenue indicate Solana’s rising prominence in the cryptocurrency ecosystem. Despite its smaller market cap and younger age, the network’s ability to handle high transaction volumes at low costs positions it as a formidable competitor to Ethereum.

Overall, Solana’s performance and growth reflect a platform that is not only maturing but also setting new standards in the industry, challenging prevailing negative perceptions and establishing itself as a valuable asset in the market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.