Bitcoin drops 5%, triggers $312 million in liquidations amid Middle East tensions

Key Takeaways

- Bitcoin’s 5.2% price drop led to $312 million in daily liquidations, mostly affecting long positions.

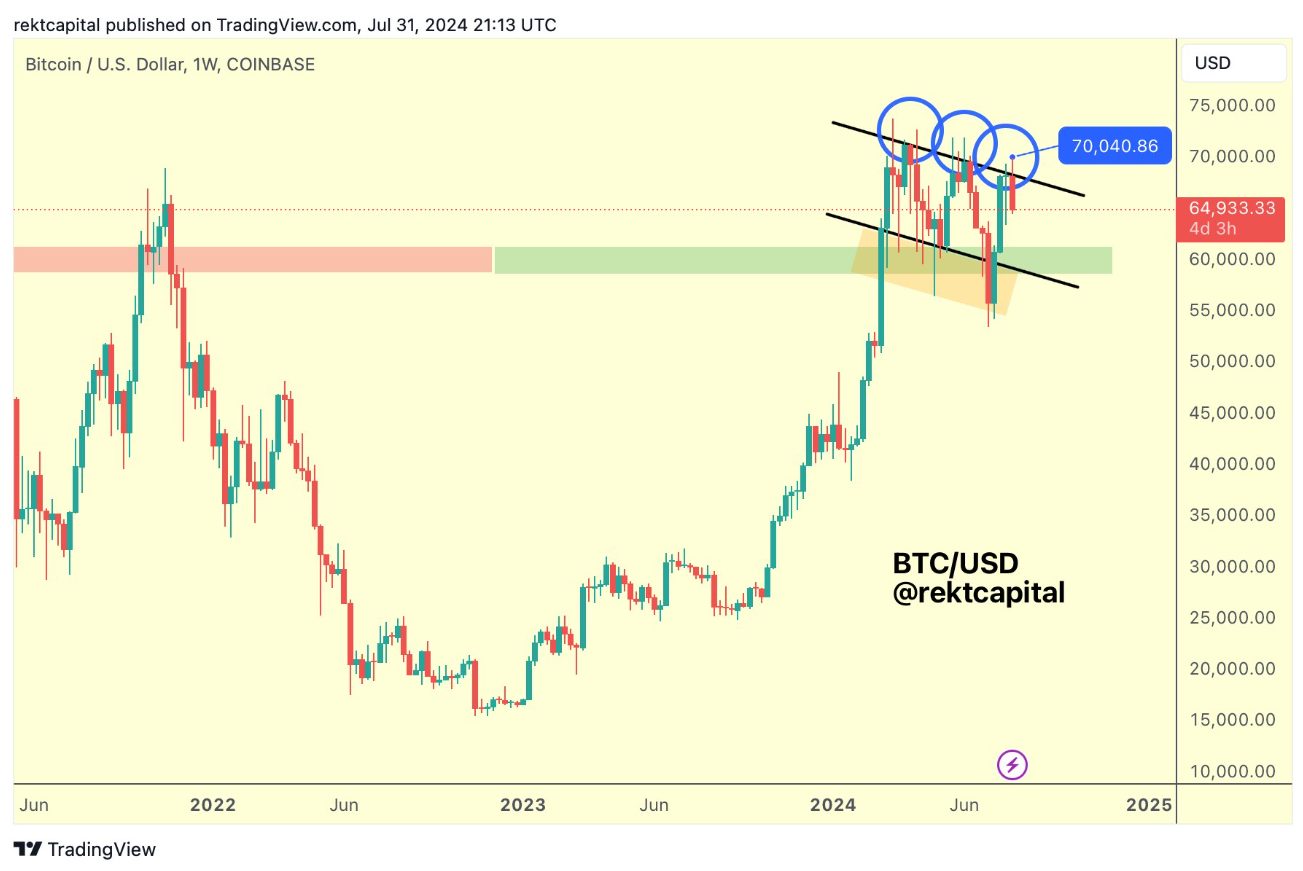

- Middle East tensions and rejection at $70,000 likely contributed to Bitcoin’s price decline.

Share this article

![]()

Bitcoin (BTC) is down by 5.2% over the past 24 hours after being rejected at the $70,000 price level on July 29th and the scaling of Middle East conflicts. The pullback affected major altcoins, such as Solana (SOL), which is down by 10% in the same period. This movement triggered nearly $312 million in daily liquidations.

The liquidation wave hit mostly traders with open long positions, resulting in $287 million in losses. BTC long positions accounted for $69.6 million, while Ethereum (ETH) longs represented $72.3 million of the total liquidated.

Notably, the sharp price was likely triggered by Middle East tensions between Israel and Iran, as Iran’s leader allegedly ordered a direct strike against Israel in response to the assassination of the former Palestinian prime minister.

Moreover, Bitcoin suffered a strong rejection near the $70,000 price level. The trader identified as Rekt Capital has consistently posted on his X account about Bitcoin being stuck in a downward channel. According to the trader’s technical analysis, the channel offers space for a pullback near the $55,000 price level.

Traders expect this accumulation trend, which set the stage for the downward channel, to end by September. The possibility of a US interest rate cut in the same month adds to investors’ expectations.

Share this article

![]()