Bitcoin’s funding rate shows potential rebound on the way

Bitcoin’s fall below the $60,000 mark has triggered a market-wide downturn but its funding rate hints at an incoming price surge.

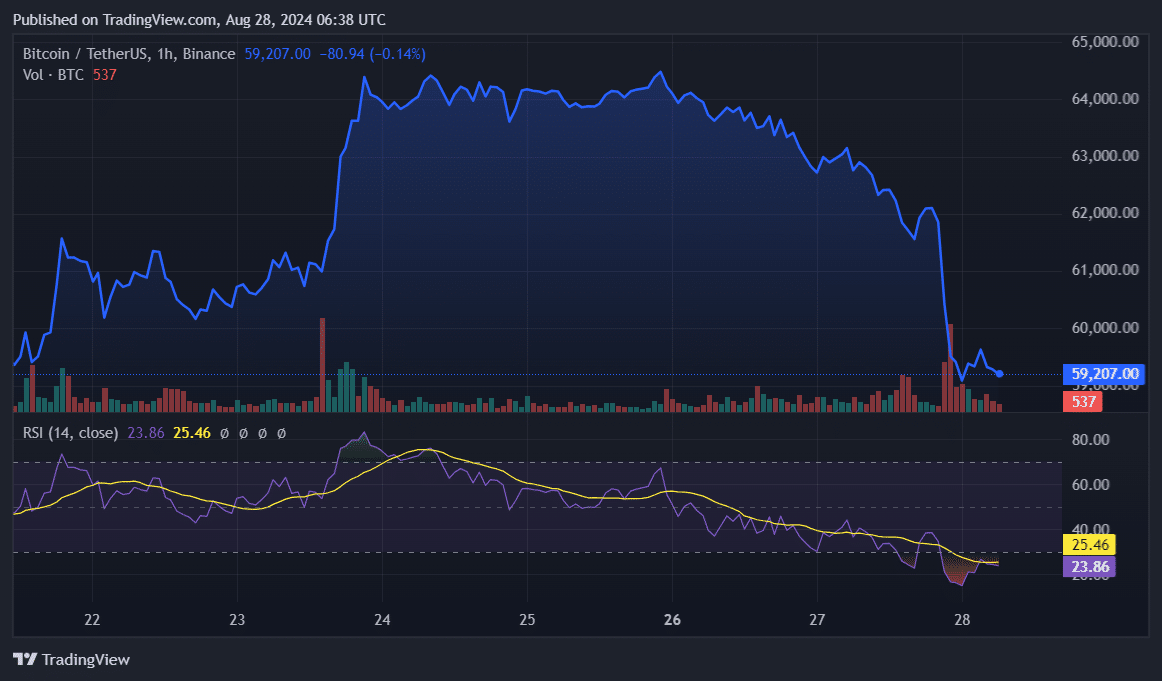

Bitcoin (BTC) slipped 6% in the past 24 hours and is trading at $59,200 at the time of writing. Its daily trading volume saw a 46% surge, reaching $41 billion. Notably, the BTC price touched a local bottom of $58,100 as fear dominated the crypto market.

CryptoQuant analyst Julio Moreno shared in an X post that Bitcoin saw increased exchange inflows on Aug. 27, before the selloff. Large BTC holders also took part in the inflows as the cryptocurrency market and the leading asset showed signs of being overbought.

Data from crypto.news shows that the Bitcoin Relative Strength Index rose to 75 on Aug. 24 and has been consistently declining over the past four days — currently sitting at 25. The indicator shows that Bitcoin is currently oversold at this price point.

According to data provided by Coinglass, Bitcoin’s funding rate plunged to negative 0.004% after the massive selloff. The sudden shift in the funding rate shows that the amount of trades betting on BTC’s price fall has increased after the asset saw $96.5 million in liquidations over the past 24 hours.

Historically, a sudden shift in an asset’s funding rate usually sends the price in the opposite direction. In this case, Bitcoin’s price could see a short-term rebound.

In total, the crypto market witnessed over $320 million in liquidations over the past day — $285 million longs and $35 shorts have been wiped out.

The global cryptocurrency market cap also declined by 7% and is currently sitting at $2.17 trillion with a 24-hour trading volume of $108 billion, per data from CoinGecko.

However, it’s important to look out for major macroeconomic events and political movements that could potentially influence the financial markets.