Ethereum DEX networks are enjoying major increase in volume

Transaction volume in Ethereum decentralized exchanges bounced back even as cryptocurrency prices retreated.

Ethereum DEX had robust activity

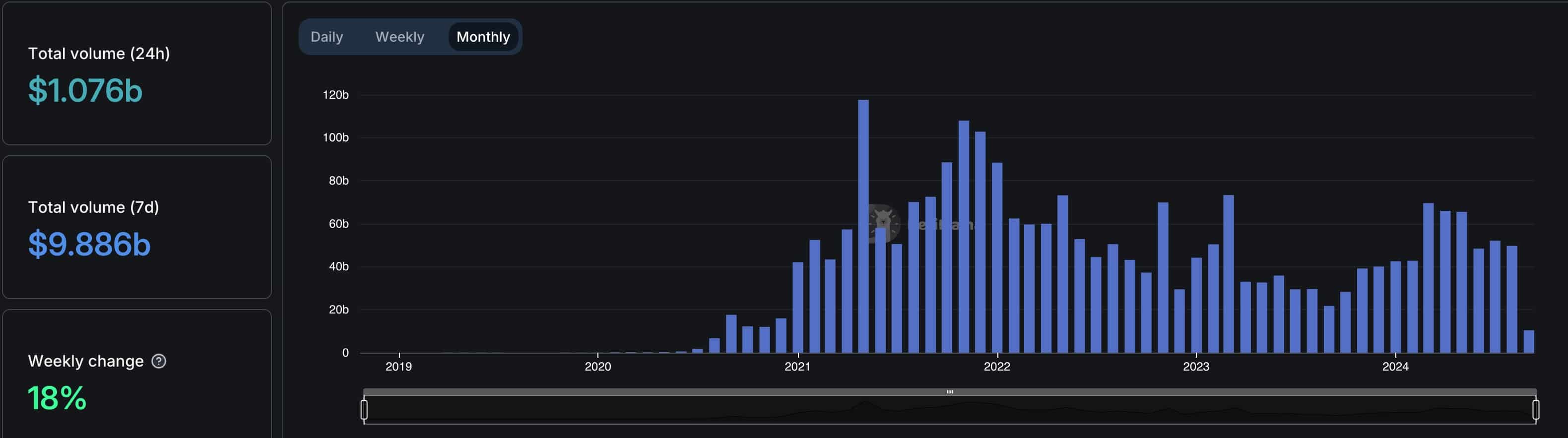

According to DeFi Llama, the volume in Ethereum (ETH) rose by 18% to $9.88 billion as that in other chains retreated. Solana (SOL) DEX volume retreated by 8% while Base, BNB Smart Chain, Arbitrum, and Polygon fell by 4%, 14%, and 10%, respectively.

The worst-performing chain was Tron (TRX) whose volume fell by 52% to over $642 million. This decline happened as the popularity of the recently launched SunPump meme coins eased. According to CoinGecko, most of the SunPump tokens like Sundog, Tron Bull, and Muncat have retreated from their all-time highs.

Most DEX networks in Ethereum’s network had a big increase in volume. Uniswap’s volume rose by 14.2% to $5.7 billion after the company settled with the Commodity Futures Trading Commission over its margin products. It agreed to pay a $175,000 fine and stop offering these solutions in the US.

Curve Finance’s volume jumped by 68% to over $1.48 billion while Balancer’s, Hashflow, and Pendle rose by 68%, 196%, and 85%, respectively.

Bitcoin and most altcoins tumbled

This volume happened in a difficult week for the crypto industry as most assets dived. Bitcoin dropped to $52,550, its lowest point since Aug. 5 and 26% below its all-time high. Ethereum also dropped below $2,200, down by over 44% from its highest point this year. The total market cap of all coins dropped below $2 trillion for the first time in months.

There is a risk that the sell-off will continue as a sense of fear has spread in the market as the crypto fear and greed index has dropped to the fear zone of 34. Cryptocurrencies tend to see more weakness when investors are fearful.

DEX and CEX exchanges also experience weak volume in periods when cryptocurrencies are falling. According to DeFi Llama, the volume in Ethereum DEX platforms dropped to $49.5 billion in August from a high of $69 billion in March as most coins jumped.

The same happened across other DEX platforms as volume fell from over $257 billion in March to $240 billion in August.

Looking ahead, cryptocurrencies may benefit from the upcoming start of interest rate cuts by the Federal Reserve. Data released on Friday showed that the unemployment rate fell slightly in August to 4.2% while the economy created 142k jobs. Risky assets tend to bounce back when the Fed is cutting rates.