Top cryptocurrencies to watch this week

The global crypto market cap shed an additional $150 billion to close the week at $1.92 trillion. This marked the first time in a month the valuation dropped below $2 trillion.

Here are some of the leading cryptocurrencies to watch this week, following their significant price movements last week:

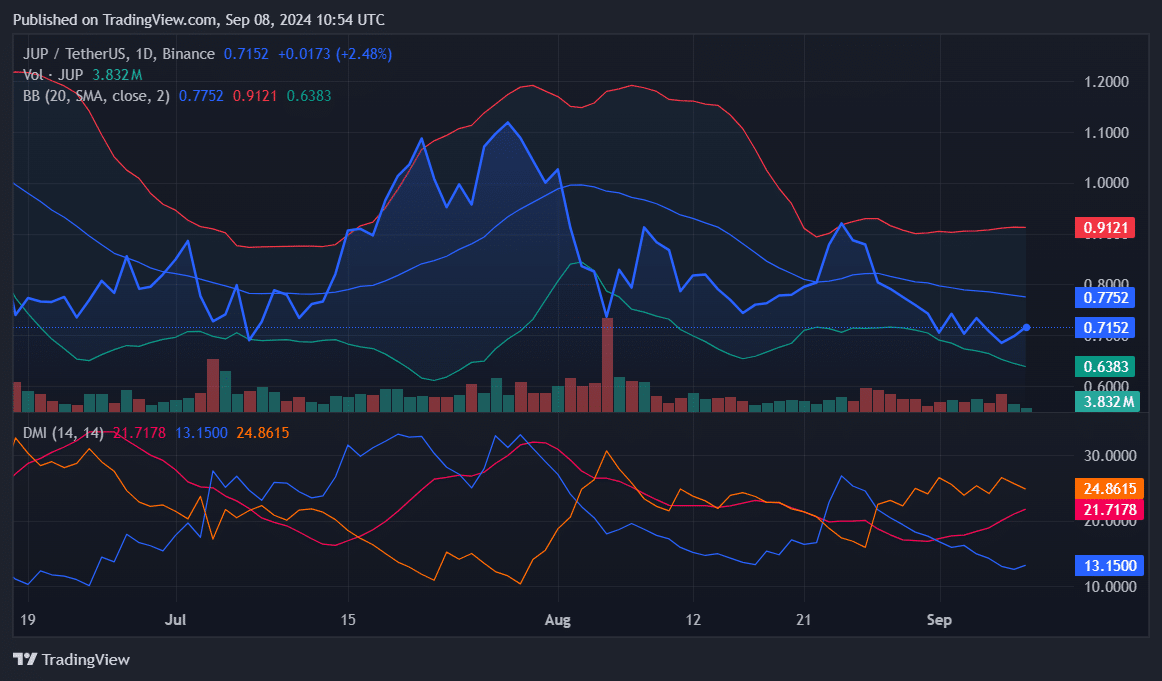

JUP battles at $0.70

Last week, Jupiter (JUP) recorded days of gains and losses, as it battled the $0.70 territory. However, bearish pressure prevailed amid a failing market, leading to a 6% weekly slump and closing at $0.6979.

Currently, JUP trades between the lower and middle Bollinger Bands. The price sits above $0.6383 (lower band), which provides support. However, it remains below the 20-day moving average ($0.7752), indicating resistance overhead.

On the DMI, the +DI at 13.15 shows weak buying pressure, while the -DI at 24.86 highlights stronger selling pressure.

Nonetheless, the +DI appears to be rising as Jupiter begins the new week bullish, with the -DI dropping. This suggests a potential shift toward buyers. The ADX at 21.71 shows a moderately strong trend but still lacks clear directional conviction.

This week, investors should watch for a decisive break above the middle band or below the lower band for clearer momentum in either direction.

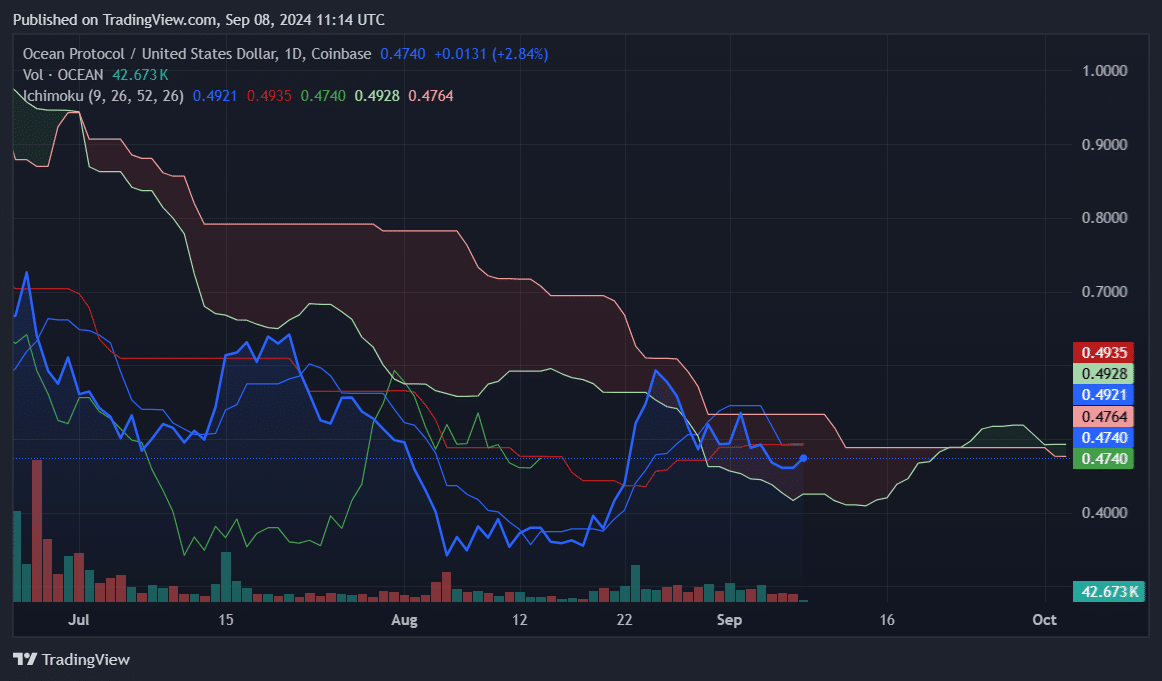

OCEAN faces volatility

Ocean Protocol (OCEAN) had a volatile week. After gaining 9% on Sept. 1 and 2, it quickly reversed course, losing those gains in a sharp 8.82% drop on Sept. 3. It continued to decline, ending the week at $0.4609, a 6.1% weekly drop.

Currently, OCEAN trades below the Ichimoku Cloud, with resistance at $0.4935 (Senkou Span B). The cloud’s bearish structure suggests continued downward pressure. However, OCEAN is hovering near the flat Kijun-Sen ($0.4921) and Tenkan-Sen ($0.4740), indicating some potential consolidation.

OCEAN also begins the week on a bullish note. If the price breaks above the cloud, it may challenge higher levels, with $0.4935 acting as key resistance.

A break below the Kijun-Sen could signal further declines toward $0.46.

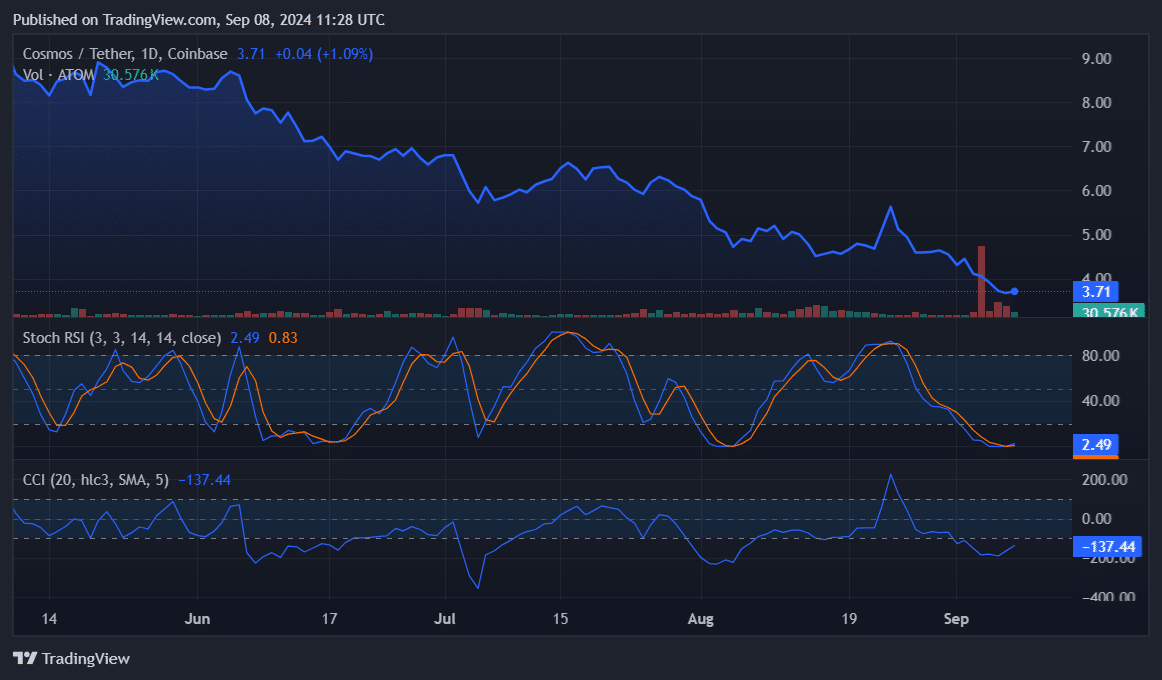

ATOM collapses 18%

Cosmos (ATOM) struggled last week, experiencing an 18.8% drop and closing at $3.67. The persistent bearish momentum kept prices low.

The Stoch RSI’s K line is at 2.49, while the D line has dropped to 0.83, signaling that ATOM is deeply oversold. This could indicate a potential rebound if buyers step in. However, the current trend remains bearish.

A CCI at -137.44 also confirms the oversold conditions. Readings below -100 suggest that the selling pressure is strong, but this can also hint at a possible reversal if the trend weakens.

ATOM may attempt to stabilize in the new week, but the oversold signals suggest a potential short-term rebound. If bearish sentiment persists, ATOM could test lower support levels around $3.50.