6 Solana protocols crossed $1b TVL

For the first time since Solana launched, six SOL-based platforms held over $1 billion in user deposits.

According to DefiLlama data, Jito (JTO), Kamino, Jupiter (JUP), Raydium (RAY), Marinade, and Sanctum all surpassed $1 billion or more on layer-1 blockchain network Solana (SOL).

Oct. 1 marked the first time in SOL’s four-year history that its top six protocols boasted nearly $9 billion in total value locked. Liquid staking provider Jito led other smart-contract projects, with over $2 billion in TVL.

Solana lender Kamino trailed in second with $1.58 billion in TVL, followed by decentralized exchanges Jupiter and Raydium, which held $1.26 billion and $1.24 billion in user deposits, respectively. Liquid stakers Marinade and Sanctum completed the Solana big six, with users parking $1.21 billion in Marinade and around $1 billion in Sanctum.

Bitget: $180 possible for Solana in October

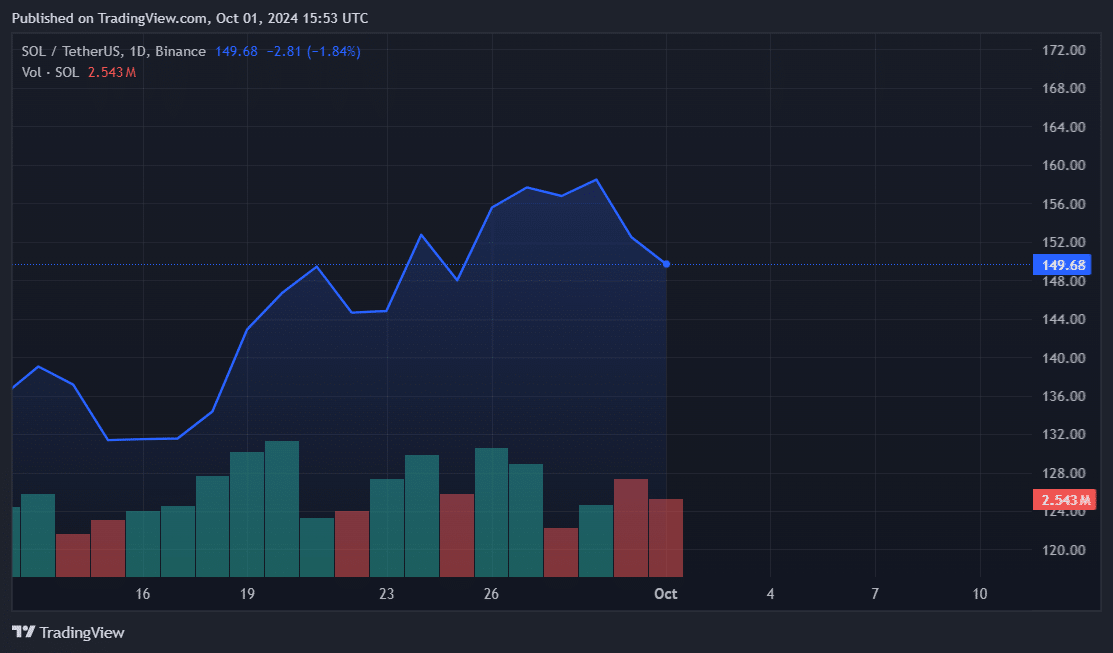

Interest in Solana’s Jito, Kamino, Jupiter, Raydium, Marinade, and Sanctum accelerated alongside an appetite for SOL. The native token has grown by over 547% in the past year, with one token costing almost $150 at press time, per CoinGecko.

Crypto community members applauded SOL chain features like Actions and Blinks as retail adoption funnels. Others argue that fast transactions and memecoin speculation fuel most of SOL’s on-chain activity.

In a note shared with crypto.news, Bitget Research chief analyst Ryan Lee agreed with the memecoin thesis and said SOL could trade at $180 in October due to this hype. Lee added that support from Franklin Templeton and Citibank may also boost SOL’s institutional appeal.

During market downturns, the $110 support level has been exceptionally strong, and during each rebound, SOL has been one of the strongest-performing high-market-cap tokens. The Solana ecosystem’s meme sector has also consistently been one of the most robust during rebounds.

Ryan Lee, Bitget Research chief analyst