USUAL token jumps 15% on Binance Labs, Kraken investment

Key Takeaways

- USUAL token surged 15% after Binance Labs invested in the project.

- The Usual protocol aims to create decentralized stablecoins backed by real-world assets.

Share this article

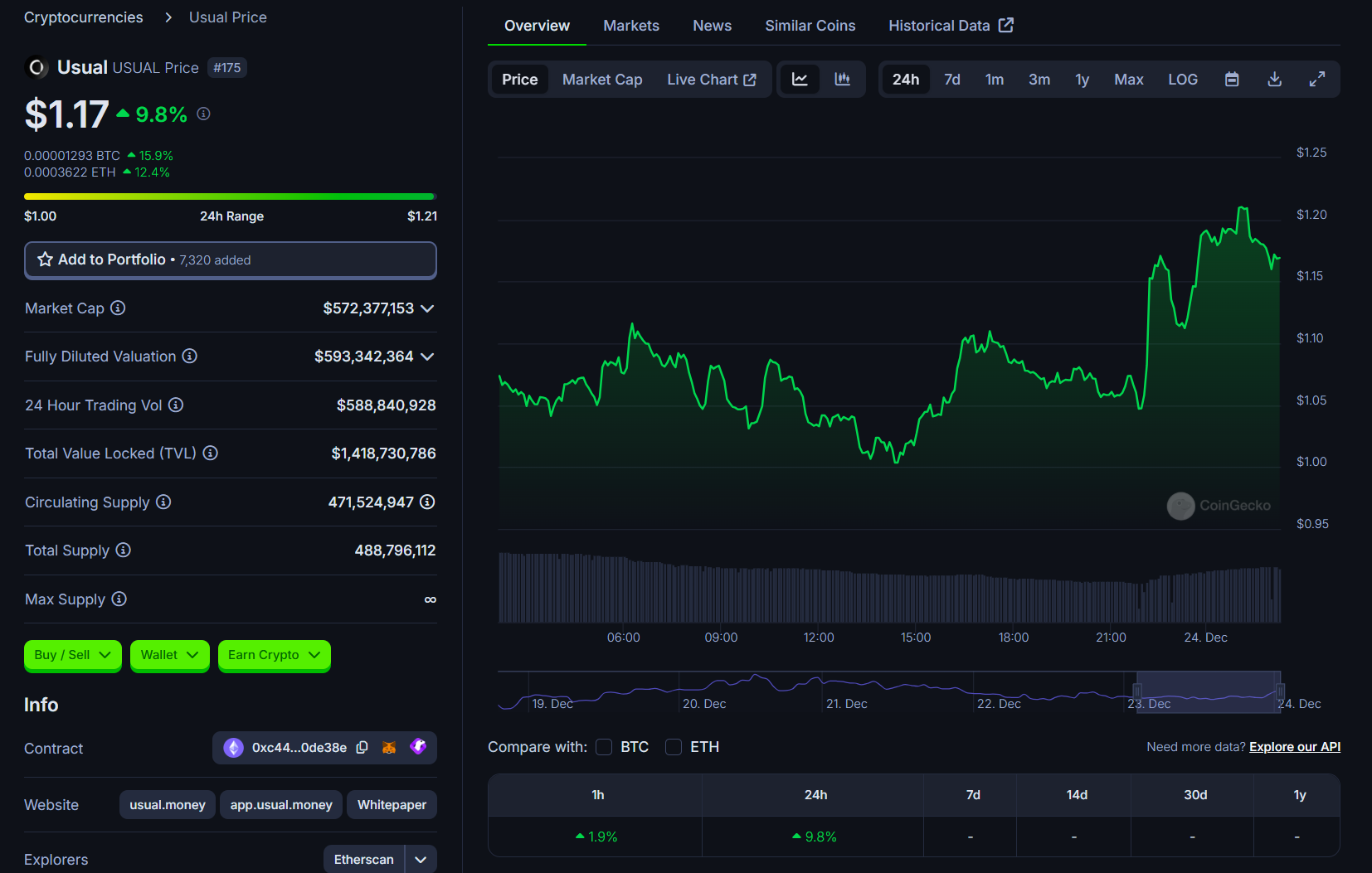

The price of USUAL, the governance token that powers the Usual protocol, soared 15%, moving from $1.05 to $1.21 after Binance Labs disclosed its investment in the project, according to CoinGecko data.

USUAL’s market cap has surged to over $570 million in just over a month since launch. In the last 24 hours, around $588 million worth of the token has changed hands.

The protocol said Monday it had successfully secured a $10 million Series A funding round co-led by Binance Labs and Kraken Ventures, with participation from other prominent investors in the crypto space.

This investment aims to support Usual’s mission to reshape the stablecoin market and enhance decentralized finance (DeFi) solutions.

“Stablecoins have long served as a gateway for onboarding new users into the crypto ecosystem, and Usual’s community-first approach sets a new benchmark for inclusivity and empowerment,” Alex Odagiu, Investment Director at Binance Labs stated.

“In the months ahead, Binance Labs and Usual Labs will continue to collaborate to ensure that the stablecoin market remains at the forefront of innovation and becomes even more community-centric,” Pierre Person, CEO of Usual Labs, said.

The Usual protocol, which debuted in mid-November, was featured as the 61st project on Binance Launchpool, where users can earn USUAL tokens by staking BNB or FDUSD. The total rewards pool for this initiative is 300 million USUAL tokens, representing 7.5% of the total supply.

The protocol debuted with a goal to create a decentralized stablecoin backed by real-world assets, promoting transparency and community governance through its USUAL token. USUAL holders can participate in decision-making processes related to the protocol’s operations and revenue distribution.

USUAL token also plays a crucial role in driving the adoption and use of USD0, the stablecoin issued by the Usual protocol. Backed 1:1 by real-world assets (RWAs) such as US Treasury Bills, USD0 serves as a stable, secure asset that can be used for transactions, trading, and collateral within the protocol.

Binance Labs’ investment announcement comes after Usual disclosed its strategic partnership with Ethena and Securitize, which tokenizes the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). The collaboration will enable USDtb and BUIDL to be accepted as collateral for USD0, integrating traditional finance stability with decentralized finance innovation.

Share this article