A review for aspiring crypto exchange operators

Share this article

Shift Markets provides solutions for businesses looking to launch their own crypto exchange, with services like market making, liquidity, derivatives tools, DeFi access, and crypto payments. These services are integrated within their white-label exchange technology and crypto-as-a-service model, providing a customizable platform that helps businesses launch their own exchange in weeks.

Since 2009, Shift Markets has helped launch over 125 crypto exchanges globally.

In this review, we will examine the Shift Markets platform, discussing its key features, benefits, and potential challenges, along with the associated costs.

White label crypto exchange

The Shift Platform provides a customizable solution that allows businesses to launch their own branded exchanges using a white label exchange service.

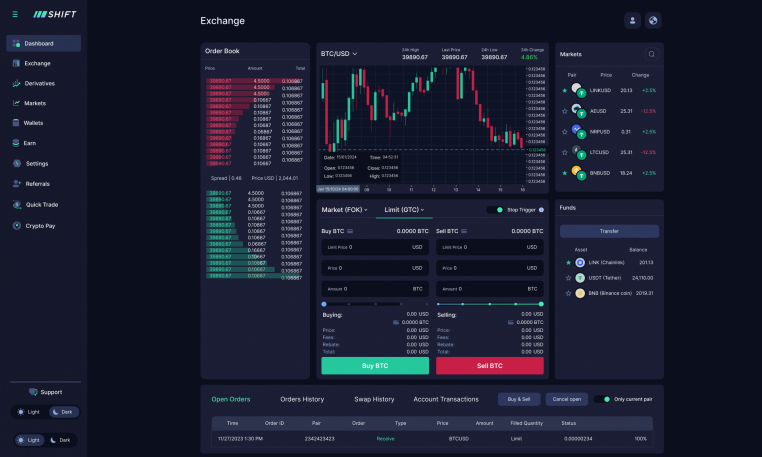

The platform supports both spot and derivatives trading with a single interface, and exchange operators can tailor the UI and UX to align with their brand. The back-office system includes tools for managing user accounts, monitoring trading activity, ensuring compliance, and generating financial reports.

The platform’s matching engine is built for high performance, enabling efficient order execution even with heavy trading volumes.

Advanced trading solution

The Shift Platform’s matching engine supports fast, scalable trading for both retail and institutional traders. The platform offers a user-friendly dashboard with real-time balance updates, portfolio tracking, and integrated market news, suitable for both beginner and experienced traders.

The customizable token watchlist, account activity details, and integrated market news help traders stay informed and in control.

Combine spot and derivatives trading

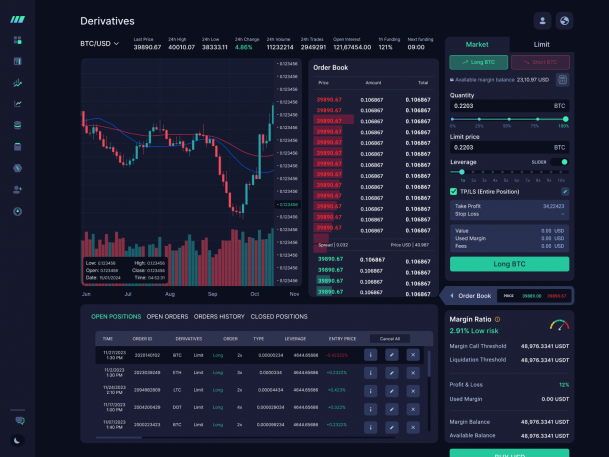

The Shift Platform’s derivatives trading functionality allows exchange operators to offer leveraged trading, attracting a broader range of traders, including speculative and high-frequency traders. The platform supports various derivative instruments, letting users to leverage their positions.

Key features include a profit simulator and hedging tools, helping traders predict market changes, estimate earnings, and manage risk. Offering both derivatives and spot trading adds flexibility and attracts more traders, though it requires stronger operational support to handle the added complexity.

Liquidity solutions

Shift Markets provides pre-sourced liquidity, allowing new exchanges to offer competitive trading from day one by aggregating liquidity from major exchanges like Coinbase, Binance, and KuCoin.

A proprietary market maker manages order books, ensuring deep liquidity and minimal slippage for large orders. It also creates synthetic pairs, expanding trading options by combining assets from different markets.

Scalability, UI/UX, and security

The Shift Platform’s modular architecture allows exchange operators to add or remove features and integrate with other systems. The platform is designed to be accessible for both novice and experienced traders, offering desktop and mobile applications for portfolio management and trade execution.

Security features include continuous pre-configured crypto custody infrastructure, threat monitoring, two-factor authentication, cold storage, SSL encryption for data in transit, and dedicated wallet nodes.

Regulatory support and compliance

The crypto market operates within a complex legal environment that is constantly evolving. Shift Markets assists operators with obtaining necessary licenses and ensuring compliance with legal requirements such as KYC and AML regulations.

Their legal team helps with selecting jurisdictions and preparing materials for licensing applications, covering licenses like broker-dealer, crypto exchange (CASP/VASP), and payment licenses. Support also includes assistance with US Money Transmitter Licenses, state-specific licenses, FinCEN registration, VARA licensing in Dubai, and compliance with the EU’s MiCA regulations.

Despite this support, navigating regulatory landscapes across jurisdictions remains complex and challenging. Legal requirements are constantly evolving, which can lead to additional complexity and delays in launching exchanges.

The Integrations Hub

The Integrations Hub within the Shift Platform enables exchange operators to connect and manage various third-party services, such as liquidity providers, custody solutions, and KYC/KYT providers.

Key functions, including custody, liquidity, regulatory compliance, banking, security, and accounting, are supported through partnerships with established providers.

Integrated compliance tools, such as KYC and AML, help operators meet regulatory standards. The platform also supports secure custody, advanced security measures, and comprehensive banking and accounting services, allowing operators to focus on growth and user experience.

Pricing structure

The pricing for Shift Markets’ services varies significantly depending on the specific needs and scale of the project. The pricing structure includes an initial setup fee for implementation costs such as hosting and other launch-related services. A recurring monthly fee covers ongoing support, maintenance, platform updates, and liquidity provisions. These monthly fees can be adjusted based on specific client needs, typically following a minimum baseline.

The overall cost varies depending on the services and features requested. Market-making for common crypto pairs is generally less expensive, often billed per trade. Conversely, developing a customized white-label exchange with advanced features requires a larger investment.

Conclusion

Shift Markets provides a robust platform for businesses looking to enter the crypto exchange space, offering faster time-to-market compared to building from scratch and a range of features from white-label solutions to advanced trading tools and liquidity management.

In an industry where compliance is increasingly crucial, Shift Markets’ emphasis on regulatory support and built-in compliance features is particularly valuable. This focus not only helps clients traverse the complex legal landscape but also builds trust with end-users.

Businesses interested in Shift Markets and its white label solutions can get more information or request a demo to better understand the platform’s capabilities.

Share this article