AAVE flips key resistance as CEX outflows jump

AAVE price pulled back on Tuesday, Sept. 24, as on-chain data showed an increase in centralized exchange outflows.

AAVE (AAVE), one of the best-performing DeFi assets recently, retreated to $164.5, down from this week’s high of $178. However, it remains 131% above its lowest level in July.

According to Nansen, AAVE had CEX outflows of over $6.35 million, a 4.96x increase from the recent average. CEX outflows are often seen as positive for a cryptocurrency, as they indicate that investors are moving their tokens to self-custody, signaling long-term holding.

Additional data shows that the top ten biggest accounts bought AAVE tokens worth over $8.4 million, compared to sales worth over $7.8 million. This suggests that more investors remain bullish on AAVE, hoping for a DeFi renaissance.

Meanwhile, according to DeFi Llama, AAVE has accumulated over $12.53 billion in assets, most of which are in its V3 version. Of these assets, $8.09 billion has been borrowed, and the network has collected over $260 million in fees in the last 12 months, making it one of the most profitable DeFi platforms.

AAVE’s future interest has also remained at an elevated level. Data by CoinGlass shows that daily open interest has stayed above $87 million since Aug. 15, reaching a high of $214 million on Sept. 11. Before that, its highest open interest was $124 million on Aug. 2.

AAVE just flipped a key resistance

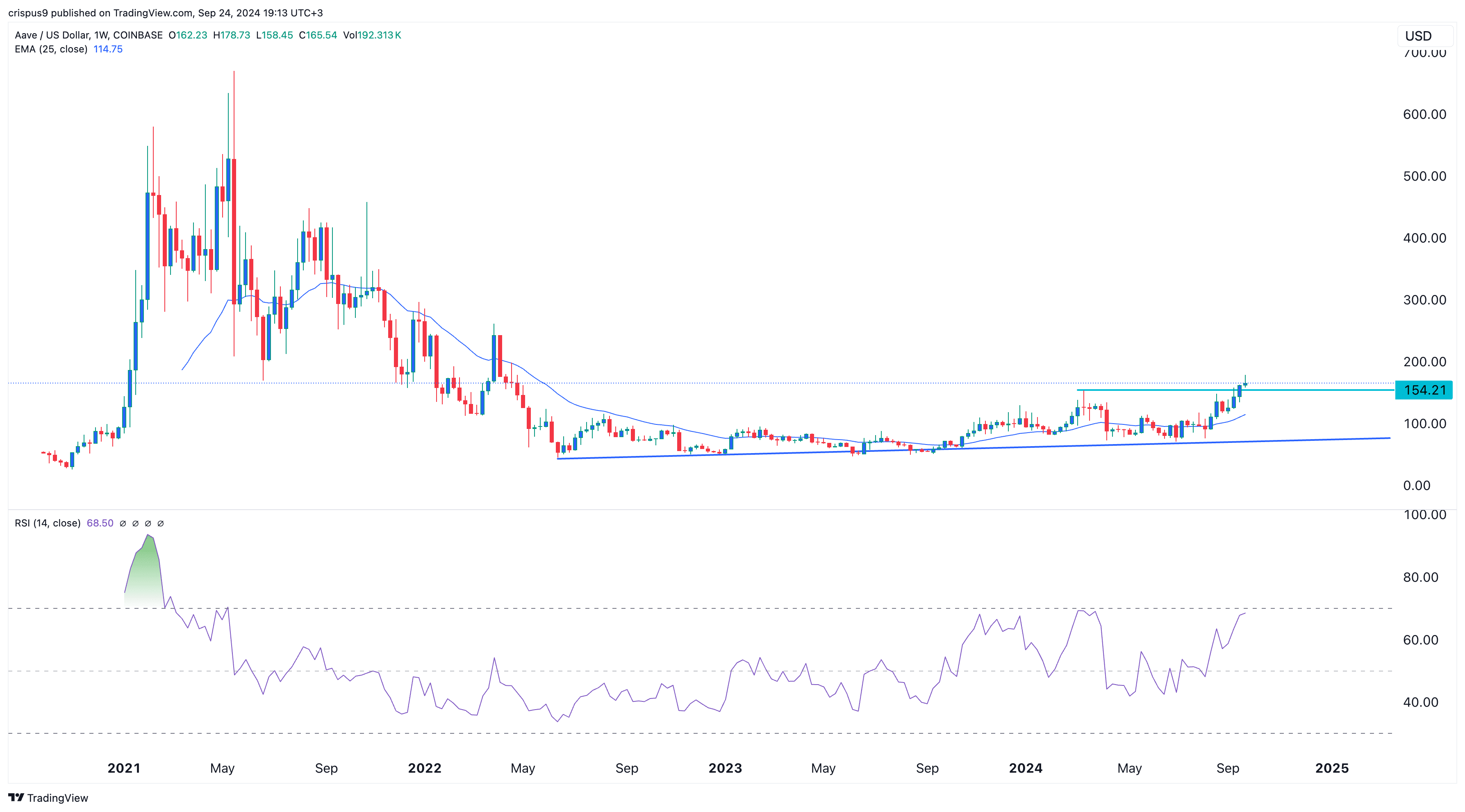

On the weekly chart, the AAVE token has been in a strong bullish trend over the past few weeks. It has remained above the ascending trendline that connects the lowest points since June 2022.

AAVE has also flipped the crucial resistance point at $154.21, its highest swing in March this year. It has jumped above the 25-week moving average, while the Relative Strength Index is approaching the overbought level.

Therefore, AAVE may continue its bull run, with buyers targeting the psychological level of $200.