Adam Back-backed Bitcoin treasury firm plans to amass up to 260K BTC by 2034

Key Takeaways

- The Blockchain Group plans to acquire up to 260,000 Bitcoin by 2034.

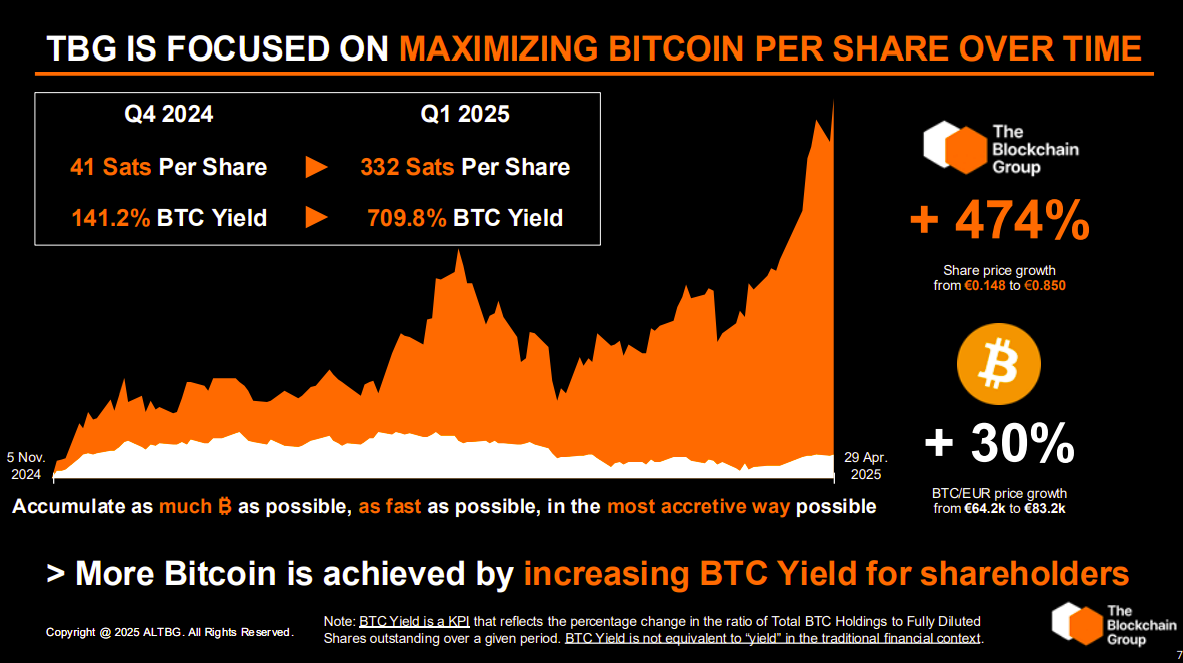

- TBG’s shares have surged 474% in six months due to strategic Bitcoin accumulation.

Share this article

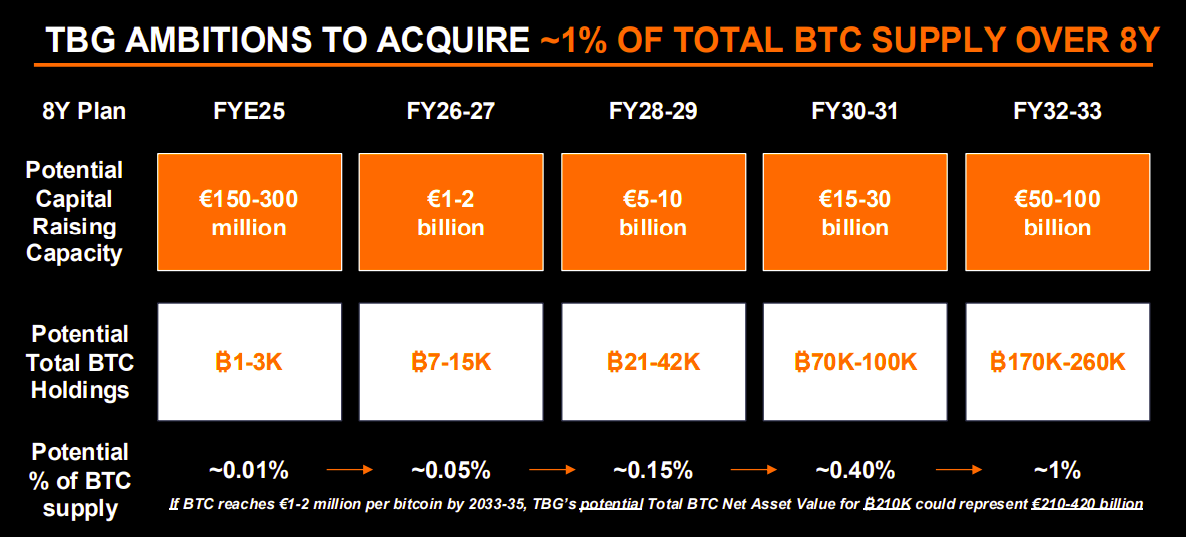

The Blockchain Group (TBG), a publicly listed Bitcoin treasury firm backed by Adam Back, has planned to acquire between 170,000 and 260,000 Bitcoin by 2034, a stake that would represent up to 1% of the total Bitcoin supply.

The plan, outlined in TBG’s latest fiscal report, lays out a phased strategy to expand its Bitcoin holdings over eight years. The company aims to bring its stash to 1,000 to 3,000 BTC this year, and targets 100,000 BTC by 2032.

“If Bitcoin reaches €1-2 million per coin by 2033-2035, holding 210,000 BTC could represent between €210 billion and €420 billion in net asset value,” the company stated in its report.

TBG’s “BTC Yield,” a proprietary performance indicator measuring Bitcoin holdings per fully diluted share, increased around 709% in Q1 2025, with Bitcoin-per-share rising from 41 to 332 sats.

Listed on Euronext Growth Paris under the ticker ALTBG, TBG transitioned to a Bitcoin Treasury Company model in November 2024. The company has grown its Bitcoin holdings from 15 BTC in December to 620 BTC by April through equity placements and Bitcoin-denominated convertible bonds.

The initiative is backed by crypto-native investors including Fulgur Ventures, UTXO Management, and TOBAM. Adam Back is TBG’s strategic advisor.

TBG has stated that it acknowledges the risks tied to its strategy. However, it has asserted that the goal is to “accumulate as much BTC as possible, as fast as possible, in the most accretive way possible.”

The plan is supported by a projected capital-raising capacity of €150 million to €100 billion ($169 million to $112 billion) over eight years, depending on market conditions and investor participation. If successful, TBG could become Europe’s largest corporate holder of Bitcoin.

TBG’s shares have risen 474% in six months

TBG is following in the footsteps of Bitcoin treasury pioneers like Strategy, which started embracing a Bitcoin reserve strategy in 2020 and has since recorded a nearly 3,000% share price increase over five years.

$MSTR is now up more than 3000% since adopting the Bitcoin Standard. pic.twitter.com/ZqBKMHG999

— Michael Saylor (@saylor) May 1, 2025

Since adopting its Bitcoin treasury model, TBG has posted early gains of 120% in the first month, 265% after three months, and 474% at the six-month mark. These figures closely mirror the early performance of both Strategy and Metaplanet, which joined the movement in April 2024.

“Bitcoin treasury companies are the fastest-growing companies in Europe,” the company claims.

Strategy stands as the leading publicly traded corporate holder of Bitcoin, possessing 553,555 BTC. The amount represents approximately 2.6% of Bitcoin’s total circulating supply.

Share this article