AVAX sees 12% price jump as Grayscale launches Avalanche Trust

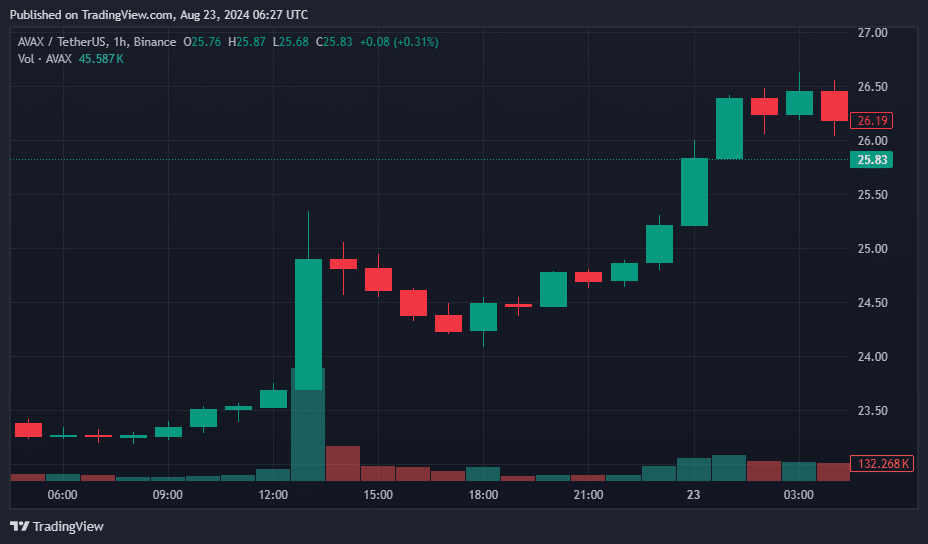

AVAX, the native token of layer-1 blockchain Avalanche, has seen a rise of 12% in the past 24 hours, making it a top performer among the top 100 cryptocurrencies by market capitalization.

After nearly six months of decline, Avalanche’s (AVAX) price appears to be in the early stages of a potential trend reversal. On Aug. 5, the token hit a nine-month low of $17.29. However, over the past two weeks, it has gained 48%, reaching $25.78.

At the time of writing, AVAX’s daily trading volume was around $511 million, with a market capitalization of $10.4 billion, according to data from crypto.news.

Although AVAX experienced a flash crash to $17.55 during Bitcoin’s Aug. 5 correction to $49,500, similar to many other altcoins, it has underperformed the broader market since peaking at $65 on March 18.

The recent positive movement in AVAX’s price may be partly driven by encouraging news. Investors have focused on the Avalanche token unlock schedule, noting that the frequency of token unlock events will significantly decrease after the end of 2024. Many believe these unlocks create selling pressure and hinder long-term ecosystem growth, which is crucial for the token’s value appreciation.

Additionally, on Aug. 22, Grayscale Investments announced the launch of the “Grayscale Avalanche Trust,” providing investors with exposure to the Avalanche ecosystem. On the same day, global asset manager Franklin Templeton expanded its Franklin Onchain U.S. Government Money Fund to the Avalanche network, responding to growing investor interest.

While these developments — such as the token unlock schedule and the announcements from Grayscale Investments and Franklin Templeton — are not directly related to AVAX’s fundamental value, they have likely contributed to more positive sentiment among investors, potentially boosting the token’s price outlook.

AVAX sees bullish sentiment in market

Presently, the price of AVAX is positioned above the upper Bollinger Band, which is at $24.79, suggesting that AVAX is trading beyond the typical range of its recent price fluctuations, and indicating a potentially strong bullish sentiment in the market. Such positioning above the upper band may point to overextension in price movements and could signal an impending retracement or consolidation unless sustained by additional buying pressure.

The Relative Strength Index for AVAX is currently at 61.47, which positions it slightly above the neutral zone but still well below the overbought threshold of 70. This implies that while the market is experiencing some bullish momentum, it is not yet at a level that typically signals an imminent reversal due to overbuying.

The trading volume, noted at 1.072 million AVAX, reflects active participation and can be considered supportive of the current price increase, suggesting a genuine market interest rather than a spurious spike. Given the price’s ascent above the upper Bollinger Band combined with a moderately high RSI and robust trading volume, the market dynamics around AVAX indicate a strong bullish undertone but warrant close monitoring for signs of potential volatility or price corrections.

Investors and traders might consider watching for stability above the upper band or a potential pullback towards the middle band at $21.58 as indicators for future price movements, maintaining a balanced view given the heightened market activity.