Bitcoin Downward Trend Extends: Here Are The Key Drivers Behind The Decline

Bitcoin’s current downward trend has extended into another day, amplifying investor anxiety and bolstering broader market uncertainty. Since the pullback in late reply, BTC’s price has been falling steadily, with its price now retesting the $113,000 threshold. While bearish pressure intensifies, several crucial reasons have been observed to be driving the ongoing price decline.

Why Bitcoin’s Price Is Declining

After failing to maintain important support levels, Bitcoin is still trading under pressure due to a combination of market whirlwinds. Market experts Arab Chain have delved into the ongoing decline, which began at the end of July, offering insights about the trend in a recent quick take post on the CryptoQuant platform.

Related Reading: This Week In Bitcoin: 4 Things To Keep An Eye On That Could Impact Price

Sharing insights on the pullback, the market experts have classified the development under three main factors that have also displayed waning performance. These key factors also contributed to the previous upward trend, raising questions about BTC’s next price trajectory.

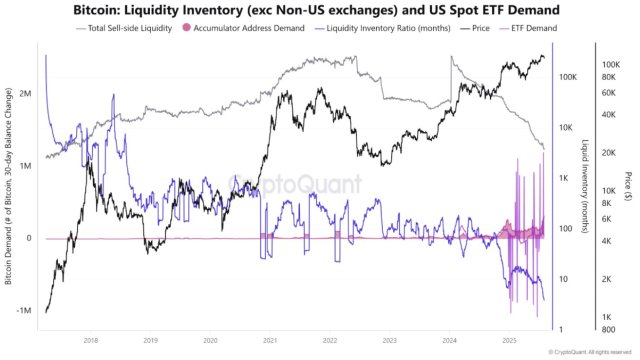

The first driver behind the ongoing bearish trend highlighted by Arab Chain is the Liquidity Inventory Ratio Collapse. Since mid-July, the liquidity ratio, which is measured by the number of months of liquidity available for sale on platforms, has started to decline rapidly and reached previously unprecedented levels of just over three months.

Given the sharp decline in the quantity of Bitcoin currently available for purchase, this signal points to a supply crisis. Typically, when this occurs in healthy markets, it triggers a price increase due to scarcity. However, the exact opposite has occurred.

Without fresh and efficient buying demand, whether from big investors or ETFs, the market has grown brittle and unable to withstand even the smallest sell orders without experiencing a price decline. In this case, market fragility is comparable to that of thin markets, where limited liquidity amplifies the effect of any selling movement, regardless of its size.

Arab Chain’s second key driver mentioned is the volatility and instability in ETF demand. After sharp and rapid peaks in BTC ETF demand, strong negative spikes followed. Such development suggests that during times when capital was withdrawn from ETFs, inflows into the funds were intermittent and unstable.

As inflows faltered, there was no substitute demand to make up for this shortfall. Furthermore, with the inadequate liquidity, this resulted in a reduction in price support from the biggest institutional buyers (ETFs), paving the way for a price drop.

Slow And Steady Accumulation From Smart Addresses

Limited and weak smart portfolio accumulation was the last factor pointed out by the market experts to have contributed to the price decline. As indicated on the chart by a pink area, smart addresses have been accumulating Bitcoin. However, it moved slowly and mostly steadily, with no notable spikes in purchases.

Related Reading: Old Bitcoin Wallets Reactivate: Untouched BTC Movements Close In On 2024 Peak

Despite the fact that accumulation is usually positive, these addresses’ sluggish and restricted movement was unable to provide meaningful assistance during a market weakness. This is because there was latent demand, but it was not active or timed with the drop, fading market resilience.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.