Bitcoin Exchange Net Flows Signal Continued Accumulation – Investors Favor Holding Over Selling

Bitcoin has seen significant selling pressure recently, following a strong push above the $100K mark. The flagship cryptocurrency briefly celebrated a major milestone before dropping sharply to a low of $92,500 within three days. This rapid decline has sparked concerns among investors and analysts about the sustainability of Bitcoin’s recent gains.

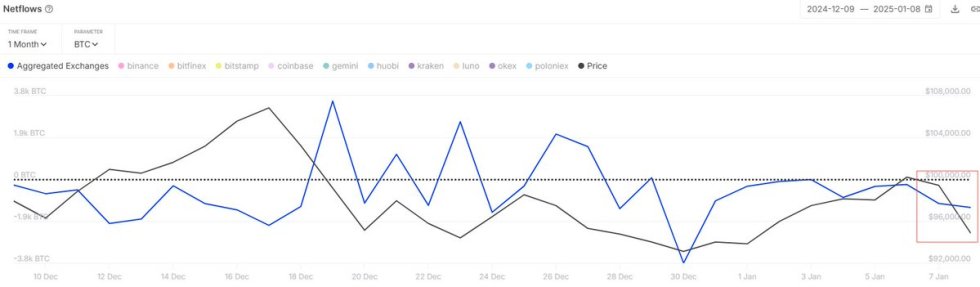

Despite the dramatic price action, data from blockchain analytics firm IntoTheBlock reveals an intriguing trend: exchange net flows for BTC remain negative. This indicates that more BTC is leaving exchanges than entering, a signal often associated with accumulation as investors move funds to cold wallets for long-term holding.

This divergence between price action and on-chain behavior highlights a complex market dynamic. While selling pressure has driven prices lower in the short term, the negative net flows suggest that investors may still see BTC as a strong long-term asset.

The coming days will be critical for Bitcoin to stabilize above key support levels. Market participants are closely watching for signs of a rebound or further downside as Bitcoin’s performance sets the tone for broader market sentiment. Will BTC reclaim $100K, or is a deeper correction in store?

Navigating Recent Volatility with Long-Term Confidence

Bitcoin’s recent price action, while dramatic, aligns with the broader trends seen during periods of strong market activity. Since early November, BTC has climbed in an almost unstoppable fashion, breaking key psychological levels, including $100K. However, after such a meteoric rise, a pullback was inevitable, leaving investors questioning whether the current drop signals a deeper correction or merely a temporary pause in the bull run.

Investor fear is palpable, as many anticipate a move below current support levels. Yet, the broader sentiment reflects resilience and optimism. Data from IntoTheBlock highlights that, despite the recent price drop, Bitcoin’s exchange net flows remain negative. This means more BTC is being withdrawn from exchanges than deposited—a clear indicator of accumulation. When investors move BTC to cold wallets, it suggests long-term confidence in the asset rather than immediate plans to sell.

This trend of accumulation contrasts sharply with the price volatility, indicating that while some traders might be taking profits or reacting to short-term movements, the broader market sees BTC as a store of value.

As BTC consolidates around key levels, the ongoing accumulation provides a foundation for future growth. Whether the market experiences a deeper correction or regains upward momentum, the long-term outlook for BTC remains strong. Investors appear to be holding firm, betting on Bitcoin’s continued dominance in the financial landscape.

Critical Support Test Above $92,000

Bitcoin is trading at $93,400, navigating a precarious position as it faces increasing risk with each moment spent below the $95,000 mark. The bulls lost control after a brief surge above $100K earlier this month, failing to sustain support above this psychological level. This decline has left BTC vulnerable to further downside, with investors closely watching key support levels.

For bulls to regain momentum, reclaiming the $95K level is crucial. Beyond this, the $98K mark must also be retaken to confirm a bullish consolidation and signal strength in the market. Until then, uncertainty looms, with Bitcoin’s current range reflecting a lack of decisive control by either side.

The critical $92K support level now acts as a short-term safety net. However, losing this level would expose Bitcoin to lower demand zones around $85K, a key area that could attract buyers and stabilize the price.

The next few days will be pivotal as BTC either stages a recovery or risks a deeper correction. Traders and investors remain on high alert, navigating this consolidation phase with caution, as the broader market sentiment continues to weigh on Bitcoin’s price trajectory.

Featured image from Dall-E, chart from TradingView