Bitcoin extends correction following Mt. Gox’s billion transfer

Key Takeaways

- Bitcoin experienced a significant price decline, falling below $66,000 after Mt. Gox’s new Bitcoin move.

- The impact of the Mt. Gox transfer on the market is uncertain, with some analysts suggesting creditors may hold onto their Bitcoin.

Share this article

![]()

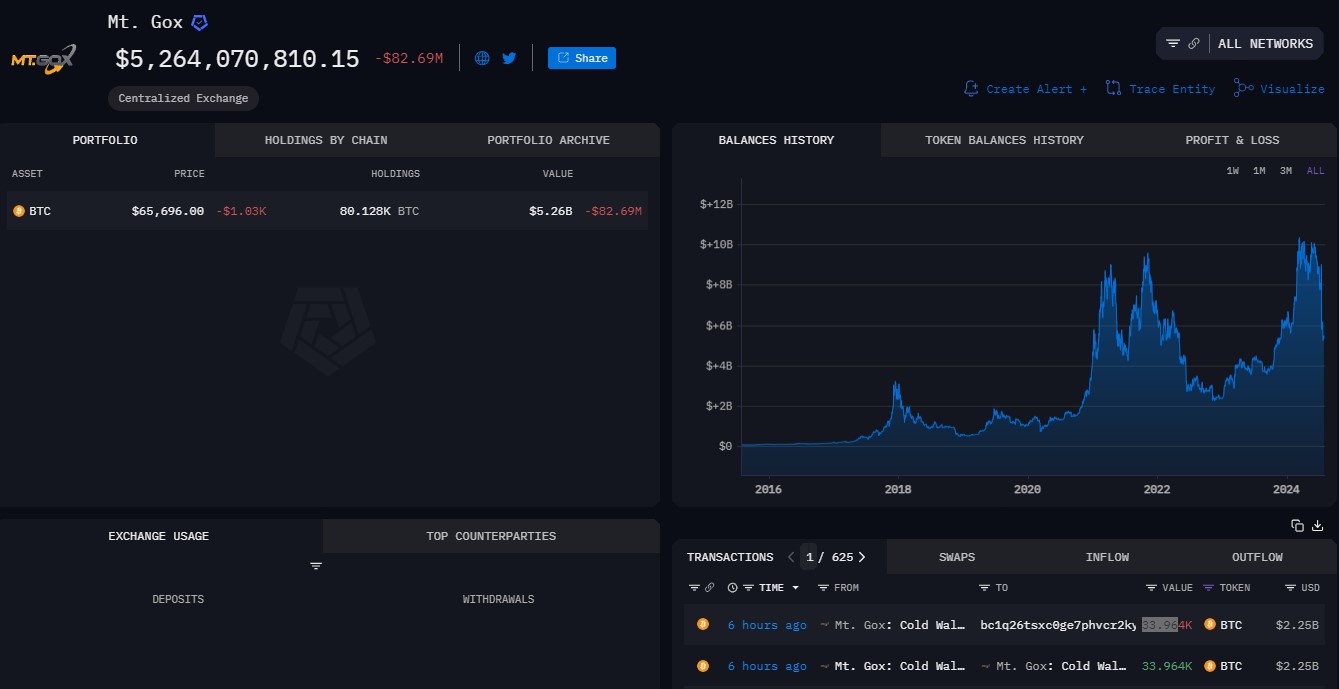

The price of Bitcoin (BTC) fell below $66,00 on Tuesday and hit a low of $65,500 in the early hours of Wednesday, according to TradingView’s data. The extended correction came shortly after Mt. Gox, the defunct crypto exchange, moved over $2 billion worth of Bitcoin to a new address, data from Arkham Intelligence shows.

Specifically, the Mt. Gox-labeled wallet moved 33,964 BTC, with 33,105 BTC sent to an unidentified address that starts with “bc1q26.” The remaining Bitcoin stash was transferred to an address starting with “1FJxu4.”

The latest move follows the wallet’s small Bitcoin transfer made yesterday, suggesting a test transaction in preparation for a major transaction. Similar patterns were observed in Mt. Gox’s previous distribution to Bitbank, Kraken, and Bitstamp – the exchanges designated to handle Mt. Gox’s creditor repayments.

Following these distributions, wallets linked to Mt. Gox still hold over $5.2 billion in Bitcoin.

The impact of these distributions on the market is uncertain, though a report from Glassnode suggests that creditors might choose to keep their assets rather than sell them.

The recent drop could have also been triggered by the upcoming Federal Open Market Committee (FOMC) meeting. A similar scenario was reported by Crypto Briefing ahead of the Federal Reserve’s (Fed) decision in March.

The Fed is expected to maintain interest rates today, but market expectations point to a potential rate cut in September, Crypto Briefing recently reported. Bitcoin’s price has been volatile, but the overall trend toward easier monetary policy could bring a positive outlook.

At the time of reporting, BTC is trading at around $66,000, marking a slight recovery after the recent price decline, TradingView’s data shows.

Share this article

![]()