Bitcoin is in dangerous position as demand dries up

Bitcoin (BTC) finds itself in a critical position, experiencing a decrease in demand despite a recent break above the $28,000 price level.

This prevailing bearish scenario provides no substantial backing for the asset’s current price movement to counteract further declines.

A recent analysis conducted by CryptoQuant shed light on the current situation, emphasizing that bitcoin’s initial upward momentum was fueled by a burgeoning market demand, which appears to have significantly diminished in recent times.

According to data extracted from bitcoin’s trading volume on exchanges, the report observes that the price surge that commenced earlier this year was sustained by a notable rise in BTC trade volume across spot and derivatives exchanges.

Notably, BTC experienced a remarkable ascent from its starting price of $16,541 at the beginning of the year to a high of $26,386 in March, representing a notable 59% surge within three months. Data indicates that bitcoin’s trade volume witnessed substantial growth on both spot and futures exchanges.

The increased demand during the rally served as a hedge against potential price corrections, but trade volume on spot exchanges experienced a significant decrease after BTC hit $26,000. However, volume on derivatives exchanges remained high, offering sufficient support for the asset to reach the milestone of $30,000 in April.

The CryptoQuant report stresses that demand on futures exchanges has also dropped, leaving bitcoin with a dearth of demand. This exposes the asset to further declines should the bears take control of the scene.

Bitcoin hits $28,000 for the first time in 20 days

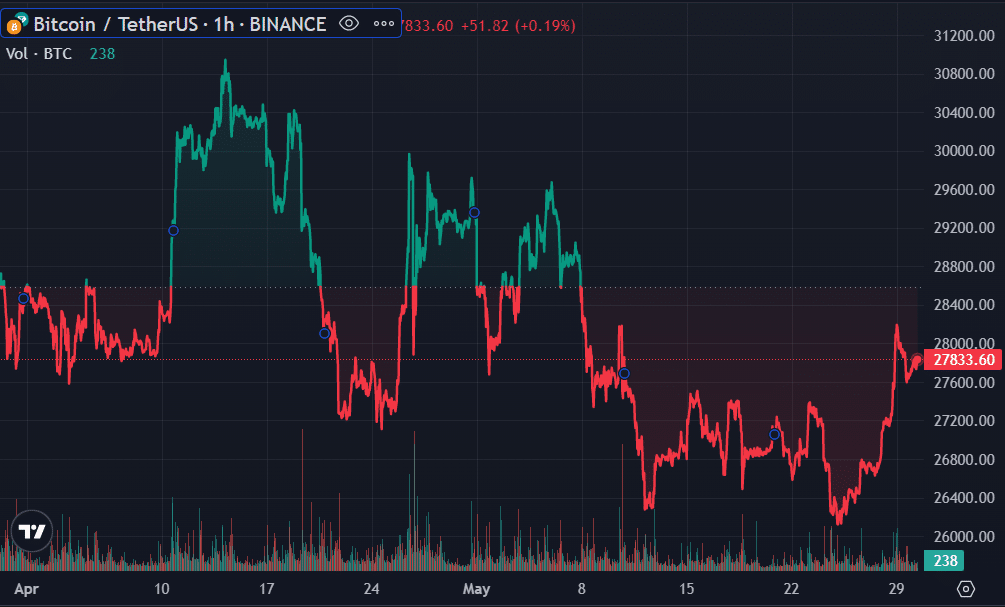

This decline in demand has emerged amid bitcoin’s recent reclamation of the $28,000 level after 20 days. The month of May has proven to be challenging for BTC. The asset has engaged in an uphill battle to prevent further declines below the $25,800 threshold.

BTC started May at $29,233, but dropped to $25,811 as of May 12, reflecting an 11.7% decrease in less than two weeks. Subsequently, the asset recovered from lows below $26,000 but has struggled to maintain a position above $27,000.

After a notable gain of 4.51% on May 28, BTC successfully regained the $28,000 level, as reported by crypto.news. However, subsequent declines have led to its current value of $27,786 at the time of this report. Despite these recent fluctuations, the asset has managed to maintain a 3.4% increase over the past seven days.