Bitcoin retreats after Fed’s preferred inflation gauge shows mild uptick

Key Takeaways

- Bitcoin declined after the Core PCE inflation gauge exceeded expectations, signaling mild inflationary pressure.

- US consumer spending and personal income both decreased, indicating potential weakening in economic momentum.

Share this article

Bitcoin dropped below $107,000 early Friday after the core Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, ticked higher than economists had anticipated.

Data released Friday by the Commerce Department showed that the core PCE index, excluding food and energy, climbed 0.2% for the month and 2.7% over the year, exceeding market expectations. Headline PCE rose 0.1% in May, with the annual rate coming in at 2.3%, in line with forecasts.

Consumer spending declined 0.1% against expectations of a 0.1% increase, while personal income decreased 0.4%, contrary to projected gains of 0.3%. The numbers suggest weakening consumer demand, which drives the majority of US economic activity.

The PCE price index provides expansive coverage of goods and services compared to other measures like the Consumer Price Index, accounting for consumer substitution behaviors and incorporating regular data revisions.

Economic data indicate a gradual slowdown in US economic momentum during the second quarter, with strategists monitoring the impact of potential tariff-related disruptions expected later this summer and fall.

That softening backdrop has kept hopes alive for a potential rate cut at the Fed’s next policy meeting on July 30, though expectations remain muted.

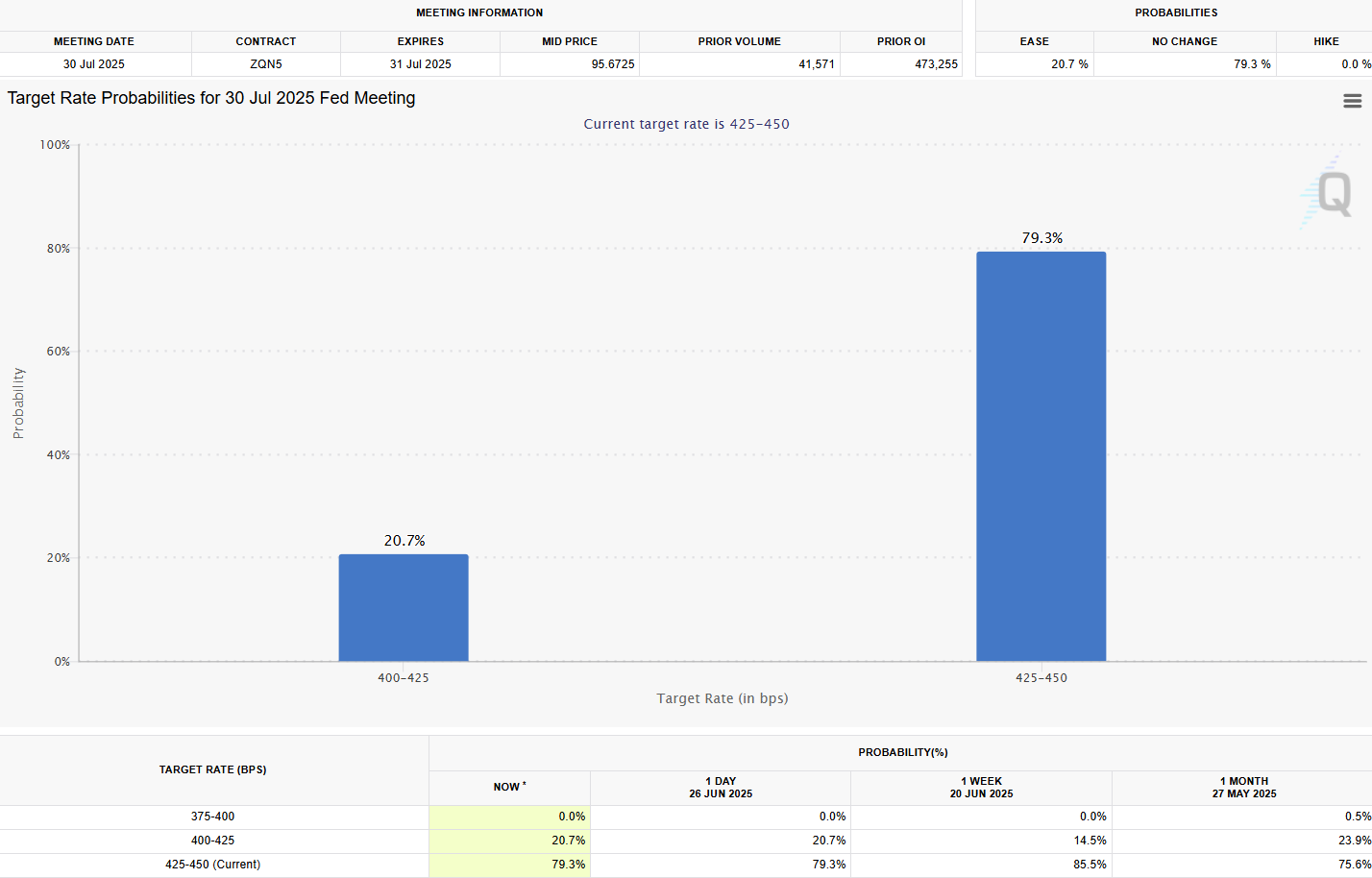

According to the CME FedWatch Tool, markets are pricing in just over a 20% chance that the central bank will lower rates next month. The majority, however, continue to expect the Fed to hold steady for a fifth consecutive meeting.

At its June meeting, the Fed kept the federal funds rate unchanged at 4.25%–4.50%, marking the fourth straight pause. The decision reflects the Fed’s wait-and-see approach as it monitors ongoing economic uncertainties, including sticky inflation and the potential fallout from new tariffs.

While some Fed officials are open to monetary easing, Fed Chair Jerome Powell maintains a cautious stance, despite pressure from President Trump for more aggressive rate cuts. The Fed has signaled that two rate cuts may come later this year.

Bitcoin remains stuck in macro limbo as mildly sticky inflation and weakening economic data leave the Fed with little reason to cut rates soon.

Yet interest in Bitcoin as a corporate treasury asset is rising, lending strength to the long-term outlook even as near-term prices react to economic uncertainty.

The largest crypto asset was trading at around $106,531 at press time, down slightly in the last 24 hours, TradingView data shows.

Share this article