Bitcoin Slips But These 3 Metrics Point To A Solid, Healthy Bull Market

Though Bitcoin might be shaky, dumping in the London session on April 30, IntoTheBlock data now shows that the market is, after all, solid.

In a post on X, the blockchain analytics platform noted that Bitcoin is in a mid-bull cycle. Despite the price cool-off, potentially accelerated by whales exiting, most BTC holders still profit.

86% Of BTC Holders Are In The Money

At press time, BTC is inching closer to the $60,000 round number, shrinking 16% from all-time highs. Bitcoin is moving inside a range after sharp gains in Q1 2024. Analysts have sought clear support in the $60,000 and $61,000 zones.

Conversely, resistance is at the $68,000 level, a price point bulls failed to conquer after April 22.

Even at spot rates, IntoTheBlock observes that 86% of all BTC holders are in profit. Although the number is lower, it could suggest prices are in a consolidation phase following Q1 2024 gains.

Bitcoin had broken above 2021 highs by mid-March, rallying to fresh all-time highs of $73,800. At that price level, all users who had bought the coin, even at 2021 peaks, were in the money.

As prices consolidate, confidence is high across the board. Some analysts expect the coin to explode as bulls resume the uptrend of February through to March.

Bitcoin Market Is Balanced, Are Whales Entering Or Exiting?

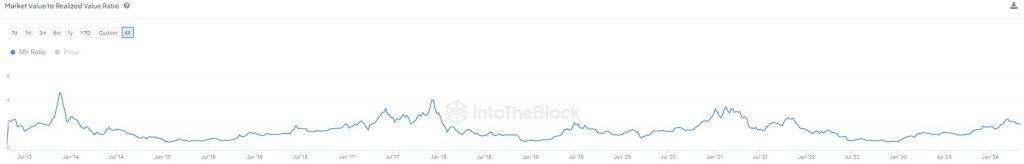

So far, the Market Value to Realized Value (MVRV) ratio is 2.17, which supports this confidence. The MVRV compares Bitcoin’s market capitalization to the total realized value of all BTC in circulation.

Analysts use it to gauge average profit margins at any price point. Usually, when the MVRV ratio is above 1, it suggests that BTC holders are underwater. Meanwhile, when it spikes above 1, as is the case, it signals that investors can choose to exit by taking a profit.

Historical data shows that extreme sell-off happens when the MVRV stands above 3.7. At 2.17, the market is generally neutral, with holders optimistic.

Nonetheless, as confidence rises, IntoTheBlock points out some potential roadblocks that might slow down the upswing or, if bullish, accelerate the rally. Over the past week, the platform observed that whales moving transactions of over $100,000 have generated more than $91 billion in trading volume.

This might mean that deep-pocketed investors, including institutions, might be entering–a net positive– or, worse for bulls, exiting the market, slowing down the uptrend.

Feature image from Canva, chart from TradingView