Bitcoin Slips Under $100,000 As OGs Wake Up To Take Profits

Bitcoin has plunged back under the $100,000 level during the past day as on-chain data shows the OG whales have been waking up.

Bitcoin OGs Have Transferred Massive Amounts Recently

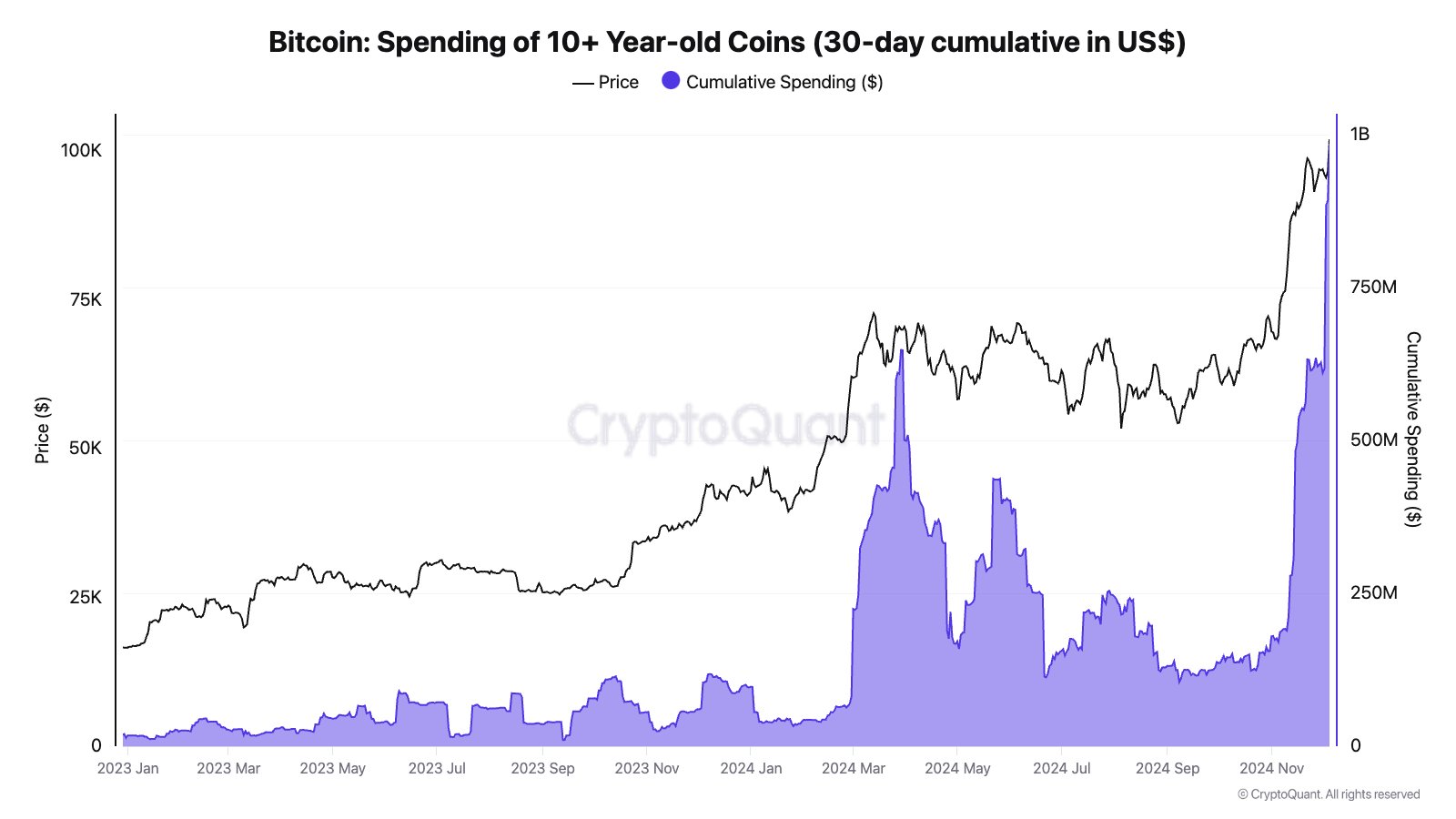

In a new post on X, CryptoQuant Head of Research Julio Moreno has discussed the trend in the 30-day cumulative spending of the 10+-year-old Bitcoin tokens.

This metric basically keeps track of the total number of coins that the investors who have been holding for 10 years or more have been moving on the BTC blockchain during the past month. Below is the chart for the indicator shared by the analyst.

The value of the metric appears to have been pretty high in recent days | Source: @jjcmoreno on X

As is visible in the graph, the 10+ year-old investors have moved a huge number of coins as the rally in the cryptocurrency’s price has occurred over the past month.

Statistically, the longer investors hold onto their coins, the less likely they become to sell said coins at any point. This probability of not selling becomes significant past the 155-day mark, so the investors who manage to hold for longer than this period are termed as “long-term holders” (LTHs).

Naturally, even among the LTHs the resolve of any investor only grows stronger the higher the age of their coins gets. In the context of the current topic, the LTHs of relevance are those with tokens older than ten years, entities ancient even by the group’s standards.

While these investors are certainly very old, it’s hard to say whether they are actually resolute. This may sound contradictory given the earlier fact, but it’s also a statistical truth that coins that get older than 7 years become more likely to have gotten there by being lost than via HODLing.

A token is said to be ‘lost’ when its wallet becomes inaccessible either by being forgotten or by having its keys misplaced. Many of these coins will never enter back into the circulating supply, but some could eventually get rediscovered.

A chunk of the investors who have been spending the ancient coins in the latest rally might have simply found an old stash of either their coins or someone else’s, so they may have never willingly participated in any HODLing at all.

The remaining sellers, however, may actually be the most resolute diamond hands, which they have been holding since 2014 or before. It would appear that these HODLers have become satisfied enough with the $100,000 target that they are willing to finally part with their coins.

In total, the 30-day cumulative spending of 10+-year-old coins almost reached the $1 billion mark just before the latest pullback in the asset. Given the timing, it’s possible that this selling may have had some part to play in this crash.

BTC Price

At the time of writing, Bitcoin is trading at around $97,700, down more than 5% over the last 24 hours.

Looks like the price of the coin has retraced from its latest high | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com