Bitcoin Slows Down, Strategy Responds With Another $740M Bet

While the Bitcoin price has cooled off into sideways movement, Strategy has expanded its bet by making yet another large purchase.

Strategy Has Just Announced A New Bitcoin Acquisition

In a new post on X, Strategy Chairman and co-founder Michael Saylor has shared an announcement for the newest Bitcoin acquisition completed by the company.

With this buy, the firm has added 6,220 BTC for $739.8 million to its holdings. This has taken the company’s total reserve to 607,770 BTC and total invested value to $43.61 billion.

According to the filing with the US Securities and Exchange Commission (SEC), the acquisition was made in the week between July 14th and July 20th. In this period, the BTC price only saw sideways movement, but it seems Strategy was unfazed.

Like is usually the case, Saylor also teased this new purchase announcement in advance in an X post. The Strategy Chairman said in the post, “Stay Humble. Stack Sats,” and shared this chart.

The portfolio tracker shared by Michael Saylor on Sunday | Source: @saylor on X

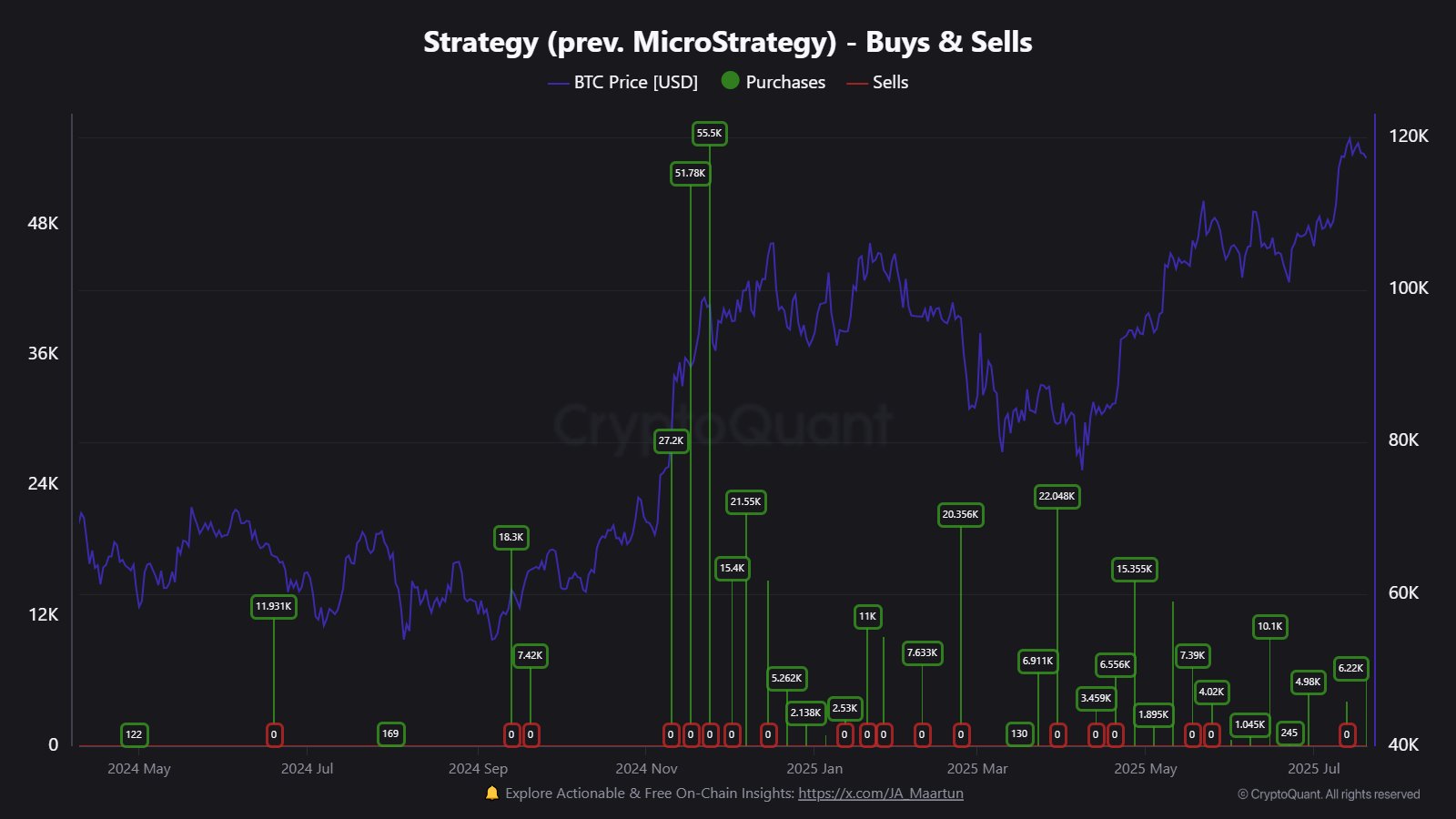

CryptoQuant community analyst Maartunn has shared a chart in an X post that puts into perspective where the latest purchase lines up against the other buys from the past year.

The data of the purchases made by Strategy over the last year | Source: @JA_Maartun on X

As displayed in the above graph, the latest acquisition isn’t too big in BTC terms in the grand scheme of things. Since the asset’s price is trading at all-time highs (ATHs), however, the purchase is still expensive in USD terms.

The analyst has also shared another chart, this one showcasing the amount of profit that the firm’s Bitcoin holdings are carrying at the moment.

The trend in the net BTC unrealized profit/loss held by Strategy since 2020 | Source: @JA_Maartun on X

From the graph, it’s visible that the unrealized gain associated with Strategy’s Bitcoin holdings has blown up alongside the bull run and today, it sits at a whopping $28 billion. This means that the firm is sitting on more than 64% in the green.

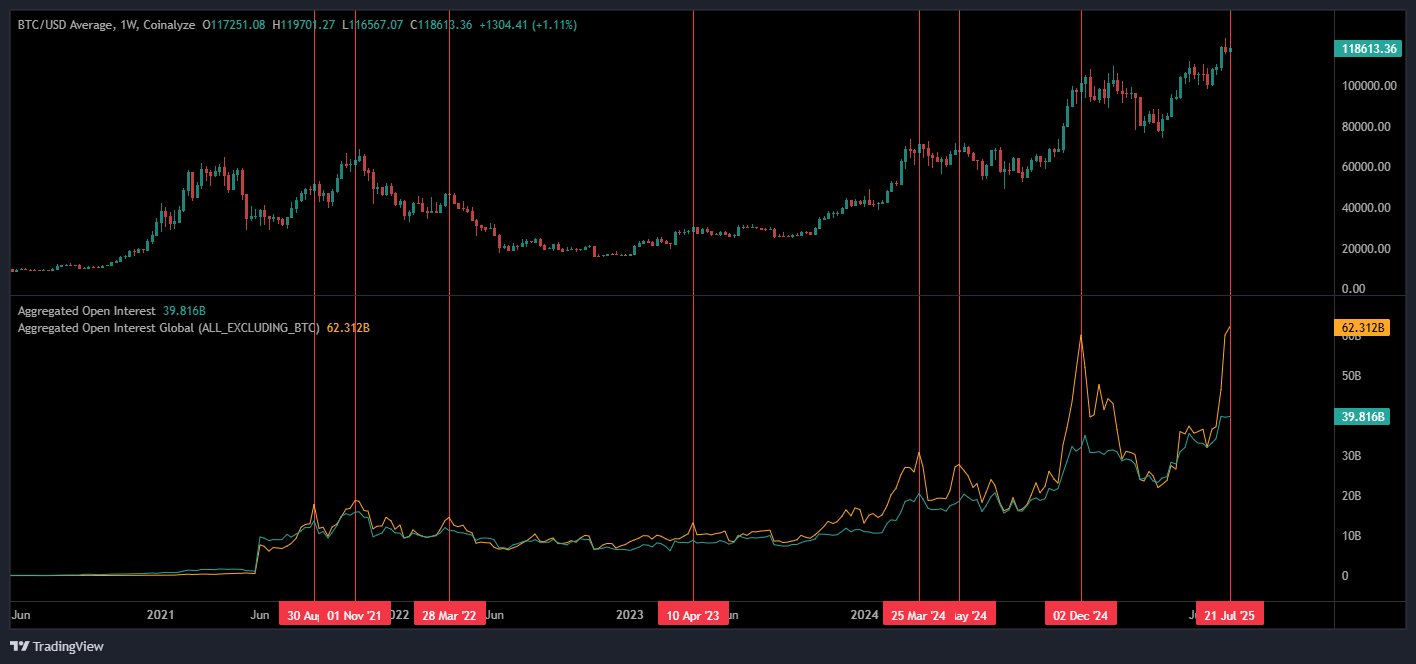

In some other news, the Open Interest is diverging between Bitcoin and the altcoins, as Maartunn has pointed out in another X post.

Looks like the metric has blown up for the alts in recent days | Source: @JA_Maartun on X

The Open Interest measures the total amount of positions related to a given asset or group of assets that are currently open on all centralized derivatives platforms. As is apparent in the chart, the indicator has seen a sharp surge for the altcoins recently, indicating that there has been a flood of speculative interest around them.

Bitcoin, on the other hand, has only registered a relatively small uptick in the metric. In the chart, the analyst has highlighted what happened the previous times BTC and the alts diverged in this manner.

It would appear that all of these instances coincided with some sort of top for the cryptocurrency. It now remains to be seen whether something similar would follow this time as well.

BTC Price

At the time of writing, Bitcoin is floating around $117,800, down almost 2% in the last seven days.

The price of the coin appears to have been consolidating sideways recently | Source: BTCUSDT on TradingView

Featured image from Dall-E, saylortracker.com, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.