Cardano “coiling up” says analyst, warning of pending volatility

Cardano’s ADA token remains range-bound according to a Nov. 28 video analysis by the popular YouTube crypto analyst behind the More Crypto Online channel.

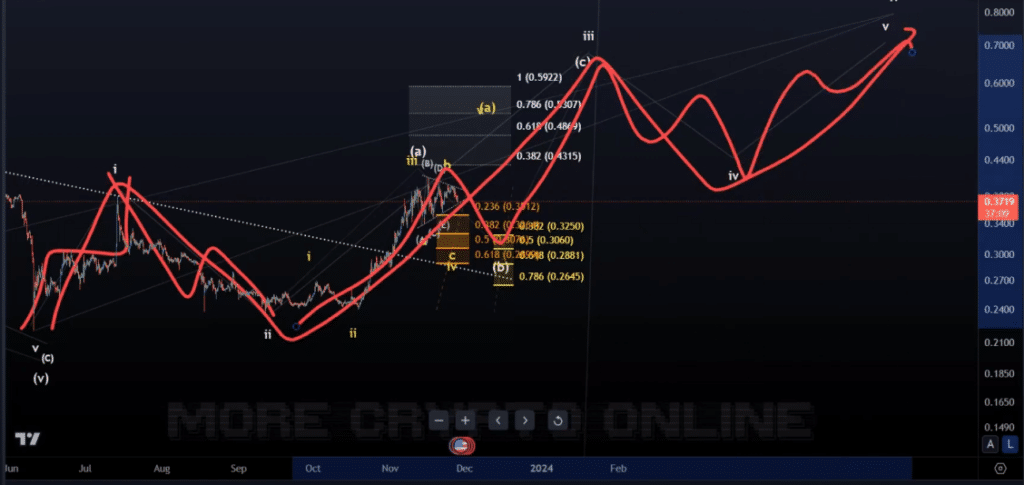

The analyst noted that ADA has avoided making new price highs or lows in recent days, remaining stuck between key support and resistance levels that have formed a apparent triangle pattern on its price chart.

It’s still caught in an overall triangle structure. If it’s an Elliott Wave triangle or not, we will see, but it certainly looks like it. Certainly it’s range bound and bound by these trend lines.

While uncertain if the pattern qualifies as a technical Elliott Wave triangle, the analyst believes a volatile price move is due soon given how ADA is continuing to move towards the apex of the triangle.

The primary scenario the analyst is watching for is “one more high in a wave five” to complete the A wave of a larger corrective structure, which would be followed by a B wave pullback and then a C wave pushing to new highs. This would confirm that a lasting cyclical low was put in place in June.

As long as ADA holds above key support around $0.29, the analyst’s preferred “yellow wave count” remains valid. A drop below $0.29 would force reconsideration of the structure. The other possibility is a more direct rally from the current triangle consolidation pattern.

The analyst stressed the need to watch for a breakout above $0.40, which would signal the start of a new uptrend. A clear move above $0.41 would confirm the breakout and triangle completion, opening the door for renewed upside. Until such a breakout though, the range-bound consolidation seems likely to continue per this analyst’s perspective.

I still need to see a break above at least 40 cents to have an indication that we have a successful breakout and above 41 cents for the breakout confirmation. Essentially to keep it simple, above 29 cents, the yellow wave count is the primary scenario with one more high to come. The lower we go and get closer we get to 29 cents, the better the reward to risk ratio, but there is a chance from here to rally more directly from this triangle pattern. There’s just no evidence it’s doing that now.