CBA Limits Payments to Crypto Exchanges, Crypto Daily TV 9/6/2023

In Today’s Headlines TV CryptoDaily News:

Kraken NFT marketplace launched

Cryptocurrency exchange Kraken has officially launched its NFT marketplace out of beta testing, supporting over 250 non-fungible tokens across the Ethereum, Solana and Polygon blockchains.

Australia’s biggest lender plans to curb payments to crypto exchanges

Australia’s banking sector is making it harder to transfer funds to cryptocurrency exchanges, citing the risk of scams. The latest step came from the Commonwealth Bank of Australia, which plans to impose a A$10,000 monthly limit on payments to digital-asset trading platforms.

Bitcoin halving is coming, and only the most efficient miners will survive

Roughly every four years, the reward for successfully mining a bitcoin block is cut in half. This event, known as the halving, reduces inflationary pressure on bitcoin. Currently, rewards are 6.25 BTC per block, and in April 2024, they will be reduced to 3.125 BTC per block.

BTC/USD exploded 1.0% in the last session.

The Bitcoin-Dollar pair skyrocketed 1.0% in the last session. The Stochastic-RSI gives a positive signal. Support is at 254191, and Resistance is at 278411

The Stochastic-RSI is giving a positive signal.

ETH/USD skyrocketed 1.1% in the last session.

The Ethereum-Dollar pair skyrocketed 1.1% in the last session. The CCI is giving a negative signal. Support is at 1779.5067, and Resistance is at 1920.0067.

The CCI is currently in the negative territory.

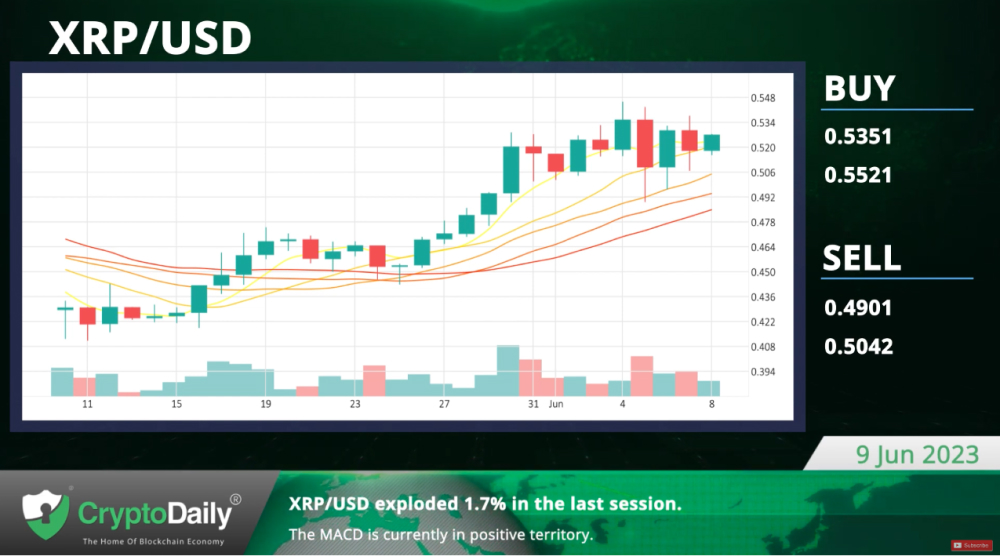

XRP/USD exploded by 1.7% in the last session.

The Ripple-Dollar pair skyrocketed 1.7% in the last session. The MACD is giving a positive signal. Support is at 0.4901, and Resistance is at 0.5521.

The MACD is currently in positive territory.

LTC/USD saw a minor dip of 0.2% in the last session.

The Litecoin-Dollar pair made a minor downward correction in the last session, dropping 0.2%. The MACD is giving a negative signal, which matches our overall technical analysis. Support is at 85.4767, and Resistance is at 92.8767.

The MACD is currently in negative territory.

Daily Economic Calendar:

US USDA WASDE Report

The World Agricultural Supply and Demand Estimates report, published monthly by the United States Department of Agriculture, provides forecasts for agricultural commodities’ supply and demand.

The US USDA WASDE Report will be released at 16:00 GMT, the US Baker Hughes US Oil Rig Count at 17:00 GMT, and Finland’s Industrial Output at 05:00 GMT.

US Baker Hughes US Oil Rig Count

The Baker Hughes Rig Count is an important business barometer for the drilling industry and its suppliers. Active drilling rigs consume products and services produced by the oil service industry.

FI Industrial Output

The Industrial Output shows the production volume of industries, i.e., factories and manufacturing.

AT Industrial Production

Industry is a basic category of business activity. Changes in the volume of the physical output of the nation’s factories, mines and utilities are measured by the index of industrial production.

The Austrian Industrial Production will be released at 07:00 GMT, Japan’s CFTC JPY NC Net Positions at 20:30 GMT, and the UK’s CFTC GBP NC Net Positions at 20:30 GMT.

JP CFTC JPY NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

UK CFTC GBP NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.