Celestia price and staking yield at risk ahead of a big unlock

Celestia price continued its sell-off this week and is hovering at its lowest point since November 2023, ahead of a major token unlock.

Celestia (TIA) dropped to $4.15 on Sept. 10, down by more than 80% from its highest level in February. This decline has brought its market cap to over $868 million, down from $3.2 billion earlier this year.

Celestia’s sell-off happened as Bitcoin (BTC) and other altcoins lost momentum. Bitcoin has dropped by over 23% from its highest level this year, while Ether has fallen by 43%.

Celestia’s key challenge is the impending token unlock, which will lead to further dilution of existing holders. Celestia has a maximum supply of 1 billion tokens, with 209 million currently in circulation. This means that over 859 million tokens are yet to enter the market.

According to TokenUnlocks, over 174 million tokens, worth more than $175 million, or 16.4% of the total supply, will be unlocked on October 31. These tokens will be allocated to seed investors, initial core contributors, and Series A and B investors.

Celestia’s last token unlock occurred on Oct. 31 last year, and the final unlock is expected to take place in October 2027.

Token unlocks typically result in more dilution by increasing the number of coins in circulation. In Celestia’s case, this will likely affect its staking yield, which currently stands at 9.96%, according to StakingRewards.

Celestia’s staking revenue is derived from transaction fees, block rewards, and data availability sampling fees. As more tokens are introduced into staking pools, the yield is expected to decline.

TIA’s token has also dropped even as the Celestia network has continued to gain market share in the modular data industry. Data shows that the platform’s share has rise to about 40% while Ethereum Blobs has a 58% share.

Celestia sits at a key support

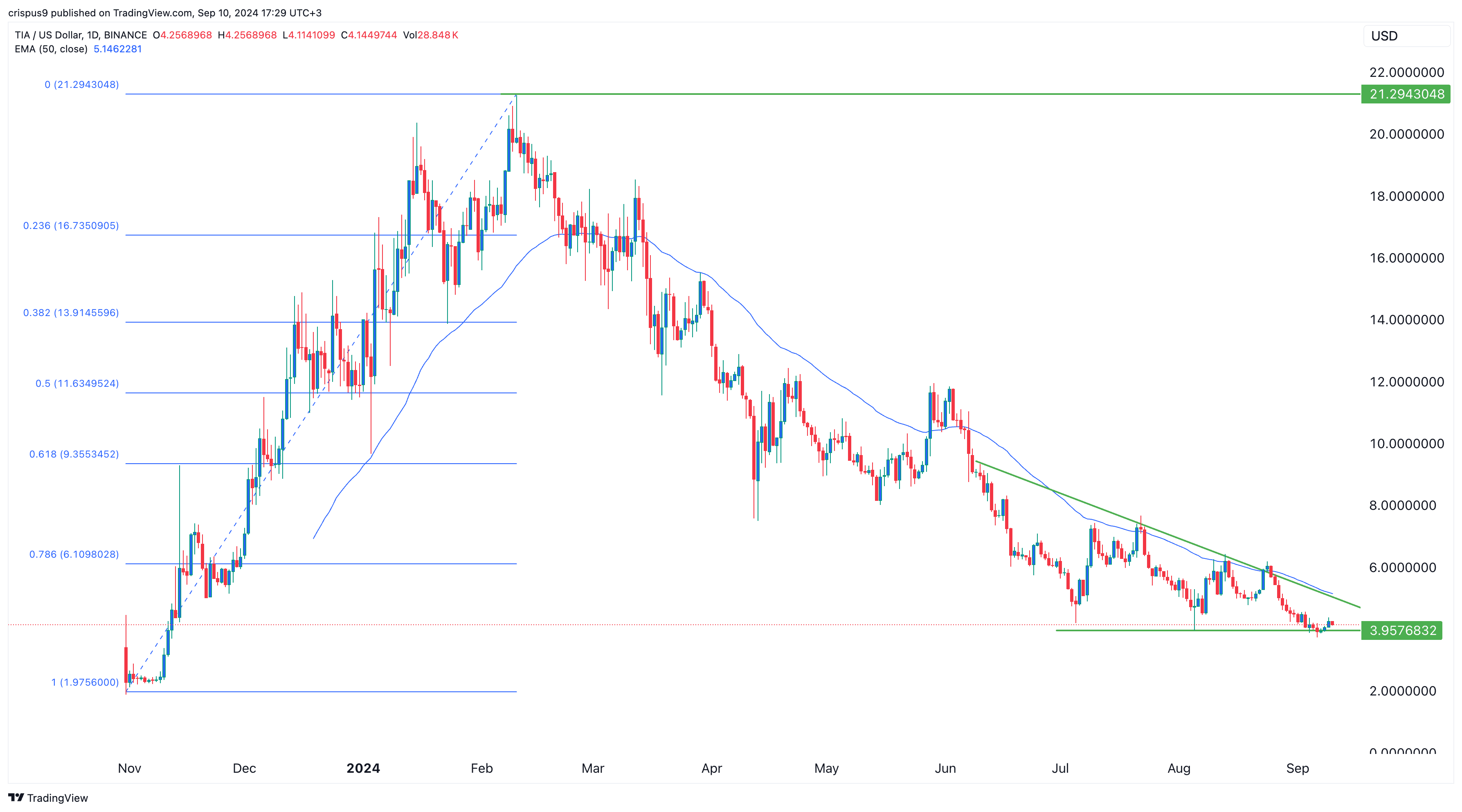

Celestia’s token has been in a strong sell-off, dropping from a peak of $21.30 in February to $4.12. It has fallen below the 78.6% Fibonacci Retracement point and the 50-day moving average.

TIA has also formed strong support at $3.95, a level it has failed to break since July. This price is notable as it represents the lower side of the descending triangle pattern, a popular bearish signal.

As a result, Celestia is at risk of falling to a record low if it breaks below this important support level.