Coinbase increases USDC interest rate after SEC confirms stance on stablecoins

Coinbase has reportedly increased interest rates on USDC holdings to 5%, marking a notable improvement from the 4% rate introduced earlier in the year.

The San Francisco-based crypto exchange hiked the interest offered to holders of its USD Coin (USDC) to 5%, only months after effecting another increase that doubled the stablecoin’s annual percentage yield from 2% to 4%.

Rewards for holding such coins are regulatory compliant. The increments have all come following the U.S. Security and Exchange Commission’s (SEC) confirmation that stablecoins, such as USDC, are not regarded as unregistered securities offerings.

Usually, Coinbase’s reward rates are subject to change, and the most recent rates may be seen in user accounts. The 5% annual percentage yield (APY) has not been added to the most recent edition of the company’s public USDC page. However, one observer user who goes by the X handle “The Utility Bull” shared a screenshot apparently showing the increase is being reflected on customer accounts.

Is USDC playing catch-up?

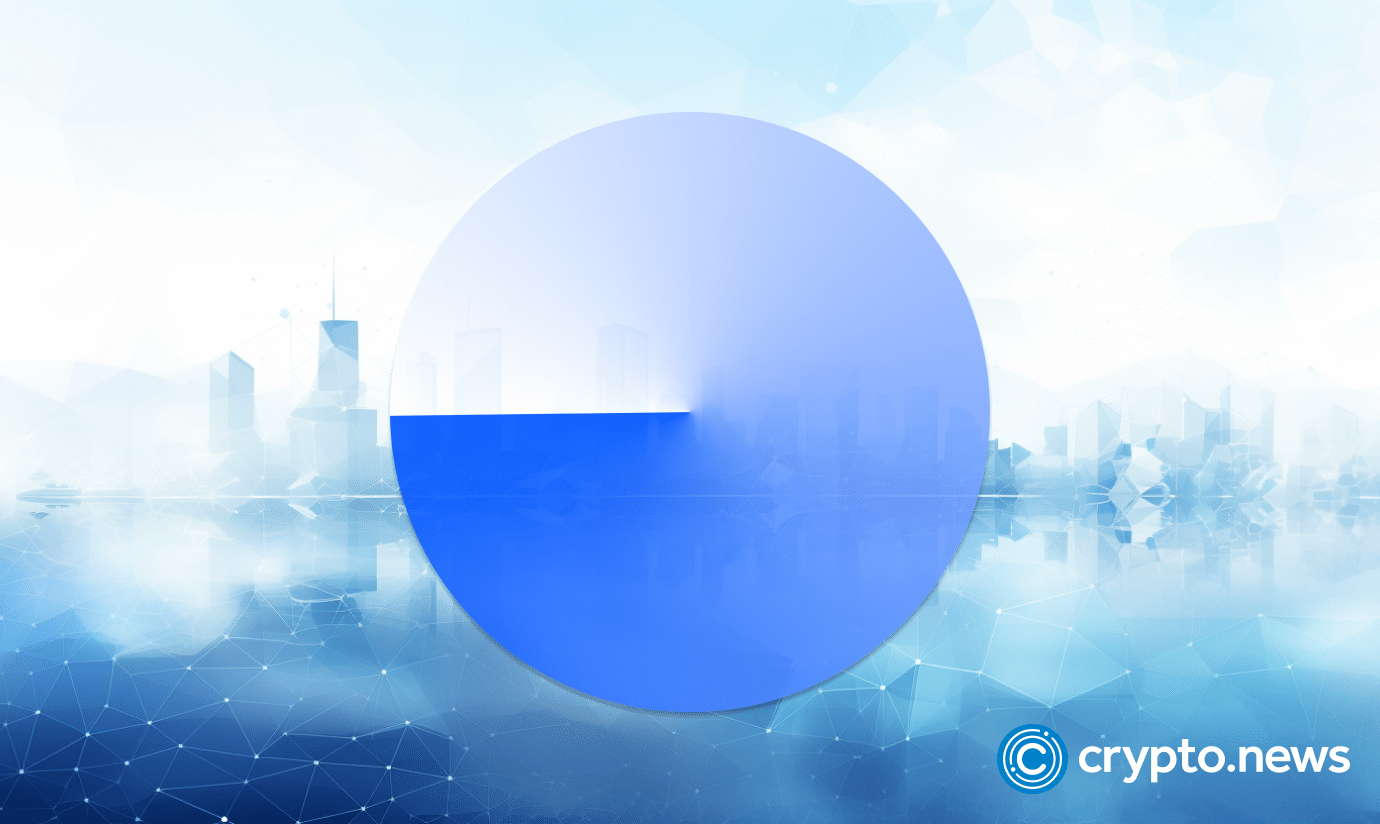

Many observers feel the interest hike may indicate Coinbase’s intention to increase USDC adoption, which is markedly lower than its rival, Tether (USDT).

According to CCData, Tether recorded an all-time high market capitalization of $83.8 billion, giving it a 65% hold on the stablecoin sector. Currently, USDT has a market cap of about $83 billion with a market dominance of 67.3%, whereas USDC is valued at $26.15 billion and controls 22.19% of the stablecoin market, per information from CoinGecko.

USDC has had a rough 2023, mainly when $3.3 billion of its reserves were momentarily stuck at Silicon Valley Bank, which collapsed earlier this year, causing the stablecoin to detach from its dollar peg briefly.

But despite the woes that led to a market cap decrease, Circle CEO Jeremy Allaire believes the stablecoin is showing signs of gaining momentum.

Coinbase recently bought a stake in Circle, paving the way for the dissolution of the Center consortium, which was previously responsible for the management of USDC.