Coinbase to launch 24/7 XRP and Solana futures trading on June 13 as derivatives trade heats up

Key Takeaways

- Coinbase will offer 24/7 XRP and Solana futures trading starting June 13.

- The exchange’s continuous trading is a first for a CFTC-regulated derivatives platform in the US.

Share this article

Coinbase announced today it will extend its 24/7 futures trading to include XRP and Solana (SOL) contracts starting June 13, aiming to offer US traders compliant access to altcoin derivatives amid shifting regulatory dynamics.

Starting June 13, we’re enabling 24×7 trading for $XRP and Solana ( $SOL ) futures, unlocking real-time access to U.S. traders, reflecting the always-on nature of crypto markets.

— Coinbase Institutional 🛡️ (@CoinbaseInsto) May 29, 2025

The move follows Coinbase Derivatives’ recent activation of 24/7 trading for Bitcoin and Ethereum futures, which made the entity the first CFTC-regulated derivatives exchange to offer round-the-clock access to crypto futures contracts in the US.

Like Bitcoin and Ethereum futures, the upcoming launch of 24/7 XRP and SOL futures trading is expected to address the gap between traditional US trading hours and global crypto markets.

The move also positions Coinbase to capture a large share of global derivatives flow.

According to the firm, derivatives now make up more than 75% of global crypto trading volume. With the new offerings, the firm seeks to tap into that growing demand, giving US traders more tools to stay active in a market that never sleeps.

“The arrival of 24/7 CFTC-regulated markets is a game-changer for the industry,” said Andy Sears, CEO of Coinbase Financial Markets, in a statement.

XRP and Solana futures trade heats up alongside Bitcoin and Ether

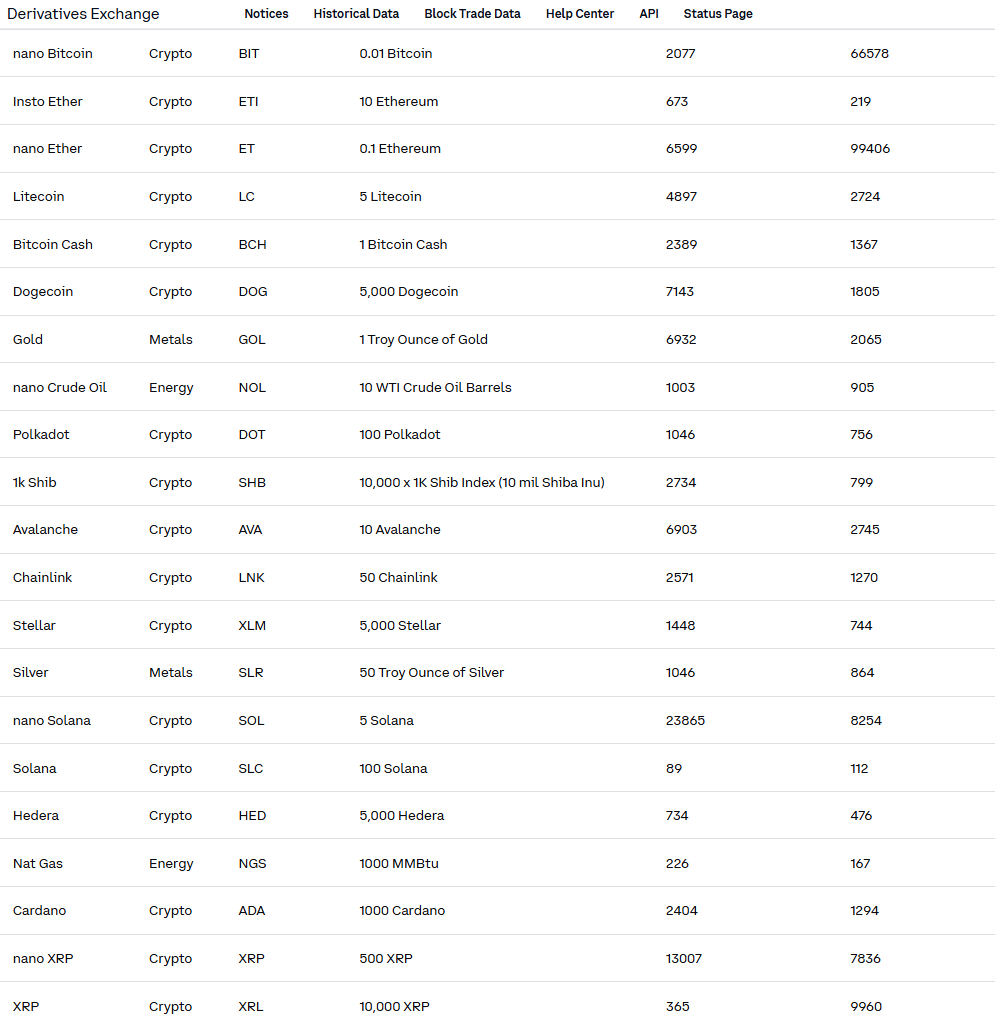

Coinbase introduced Solana futures contracts in February, and just launched XRP and nano XRP futures contracts last month. Despite the fresh start, both assets are already showing strong traction.

According to data from the Thursday trading session, nano Solana led all contracts in daily trading volume with over 23,000 contracts, while XRP futures, across both nano and standard sizes, recorded a combined volume exceeding 13,000.

Bitcoin and Ether remain foundational to Coinbase’s derivatives offering, but this early momentum suggests that traders are embracing altcoin derivatives alongside Coinbase’s more established contracts.

Share this article