Demand still sluggish for US Ethereum ETFs one month after debut—here’s why

Key Takeaways

- Grayscale’s Ethereum ETF has seen over $2.6 billion in outflows since its conversion.

- Regulatory uncertainty around staking features affects investor interest in Ethereum ETFs.

Share this article

The nine US exchange-traded funds (ETFs) tracking the spot price of Ethereum (ETH) have been struggling to attract new capital since their strong start in late July.

Outflows from the Grayscale Ethereum Trust have contributed largely to the daily negative performance, with sluggish demand for other competing ETFs also playing a role.

In this article, we discuss the current challenges facing spot Ethereum ETFs, their circumstances compared to spot Bitcoin ETFs, and how they can be successful with increased institutional adoption and regulatory developments.

Spot Ethereum ETF performance: a snapshot

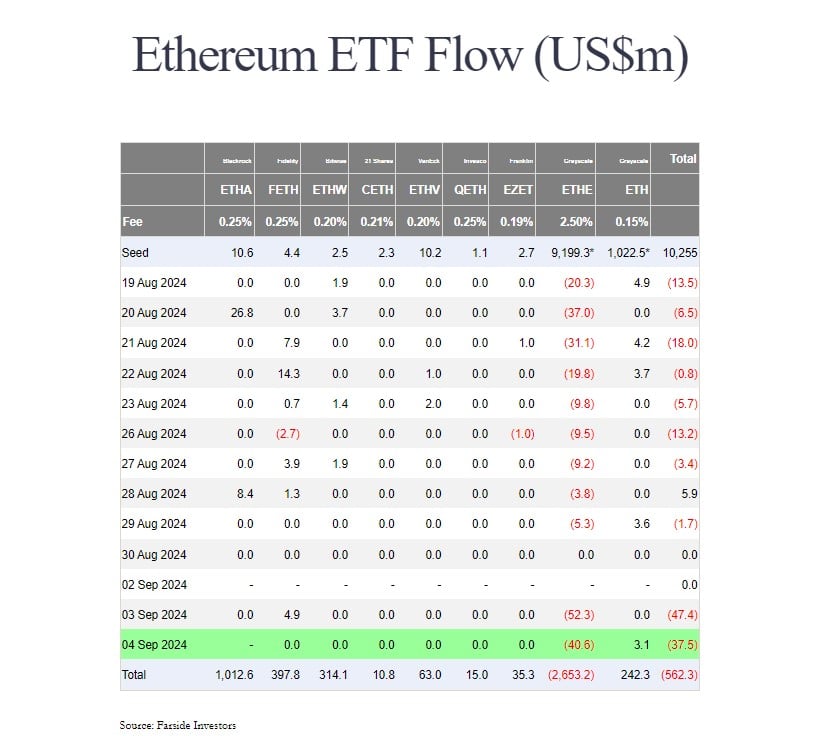

According to data from Farside Investors, Grayscale’s Ethereum fund, also known as ETHE, has seen over $2.6 billion in net outflows since it was converted into an ETF.

Grayscale has maintained a 2.5% fee for its Ethereum ETF, which is about ten times more expensive than other newcomers. Competitors like BlackRock and Fidelity charge around 0.25%, while others like VanEck and Franklin Templeton charge even less.

Yet, the fee structure is not the only factor that matters. Grayscale has offered a low-cost version of ETHE but it is still far from competing with BlackRock’s Ethereum ETF.

BlackRock’s iShares Ethereum Trust (ETHA) has logged over $1 billion in net inflows since its launch. However, its performance has stagnated recently as it has experienced no flows for four straight days.

Three Ethereum ETFs trailing behind BlackRock’s ETHA are Ethereum’s FETH, Bitwise’s ETHW, and Grayscale’s BTC, with $397 million, $314 million, and $242 million in net inflows, respectively. Excluding Grayscale’s ETHE, the rest also reported minor gains over a month after their trading debut.

Staking could be a big deal that’s missing

Staking has become an integral part of the Ethereum ecosystem after its landmark transition from the Proof-of-Work consensus mechanism to Proof-of-Stake. But the Securities and Exchange Commission’s (SEC) perceived stance on crypto staking has discouraged ETF issuers from including this feature in their spot Ethereum ETF proposals.

As a result, all Ethereum products went live staking-free. The lack of staking rewards may diminish the attractiveness of investing in Ethereum through ETFs for some, if not many investors.

“An institutional investor looking at Ether knows that there are yields to be had,” said CoinShares’ McClurg. “It’s like a bond manager saying I will buy the bond, but I don’t want the coupon, which is counter to what you’re doing when you’re buying bonds.”

Similarly, Chanchal Samadder, Head of Product at ETC Group, said holding an ETF without the staking yield is like owning stock without receiving a dividend.

Samadder believes that the lack of staking rewards may deter some investors from Ethereum ETFs, as they essentially become like “a bond with no yield.”

Not all experts view the absence of staking in spot Ethereum ETFs as a major issue.

There is a belief that overall demand for Ethereum will still increase due to the introduction of these ETFs, even without staking rewards. The arrival of spot Ethereum ETFs is expected to attract a broad range of investors, including those who may not have previously engaged with crypto directly.

Nate Geraci, president of the ETF Store, believes staking in Ethereum ETFs is a matter of “when, not if” as the regulatory environment evolves.

Right product, challenging time?

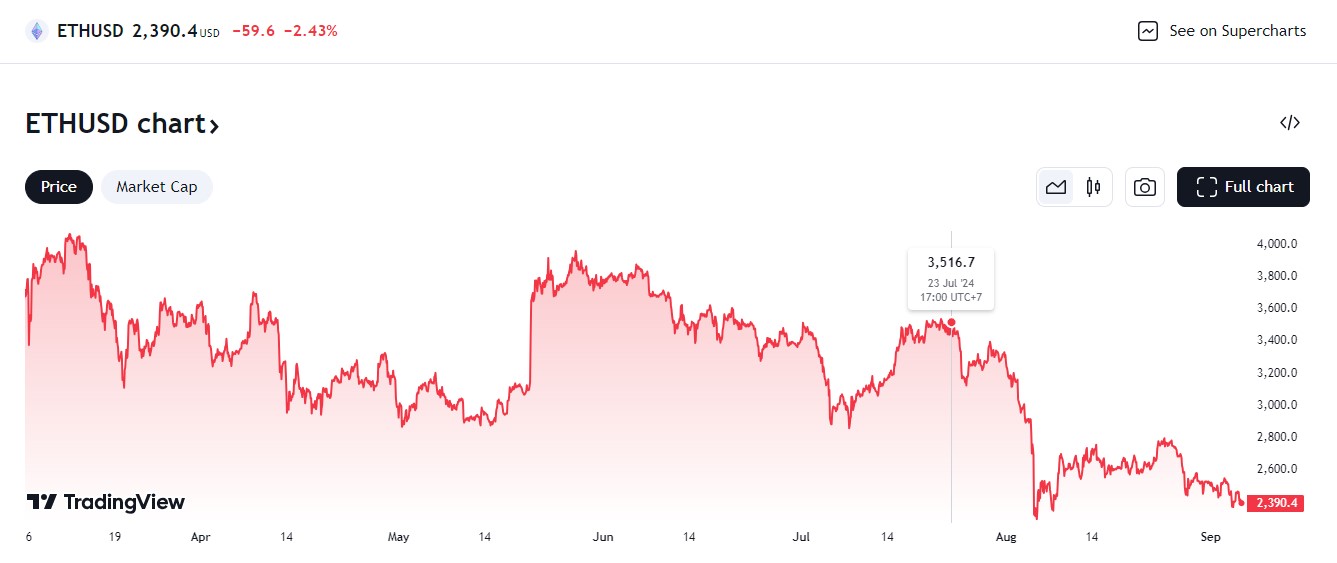

US spot Ethereum ETFs come at a challenging time when the crypto market has entered a sharp correction.

According to data from TradingView, Ether has plunged around 30% since the launch of spot Ethereum ETFs, from around $3,500 on their debut date to $2,400 at press time.

The recent crypto market downturn and Wall Street stock sell-offs have created further pain across crypto assets, and thus significantly impacted Bitcoin and Ethereum ETFs.

As of September 4, US spot Bitcoin ETFs hit a 6-day losing streak, reporting over $800 million withdrawn during the period, Farside’s data shows.

Potential for future growth

On the positive side, Ethereum ETF outflows are not entirely unexpected. Indeed, Bloomberg ETF analyst Eric Balchunas estimated previously that Ethereum ETF inflows would be lower than Bitcoin’s, based on their different characteristics and market dynamics.

Research firms Wintermute and Kaiko also forecasted that Ethereum ETFs might experience lower demand than anticipated, expecting only $4 billion in inflows over the next year. Since starting trading, the group of US spot Ethereum products, excluding Grayscale’s ETHE, has captured over $2 billion in inflows.

While the initial performance of these funds has been mixed, their success may be realized in the future, especially as the crypto market recovers and investors become more comfortable with this asset class.

As long as Ethereum maintains its position as a leading blockchain platform, long-term Wall Street adoption could drive growth in Ethereum ETFs.

Share this article