Ethereum ETF flows turn positive as BlackRock fund logs $118 million inflows

Key Takeaways

- BlackRock’s iShares Ethereum Trust led with $118 million in inflows, courting major outflows from Grayscale’s fund.

- US spot Ethereum ETFs collectively posted nearly $34 million in net inflows on July 30.

Share this article

![]()

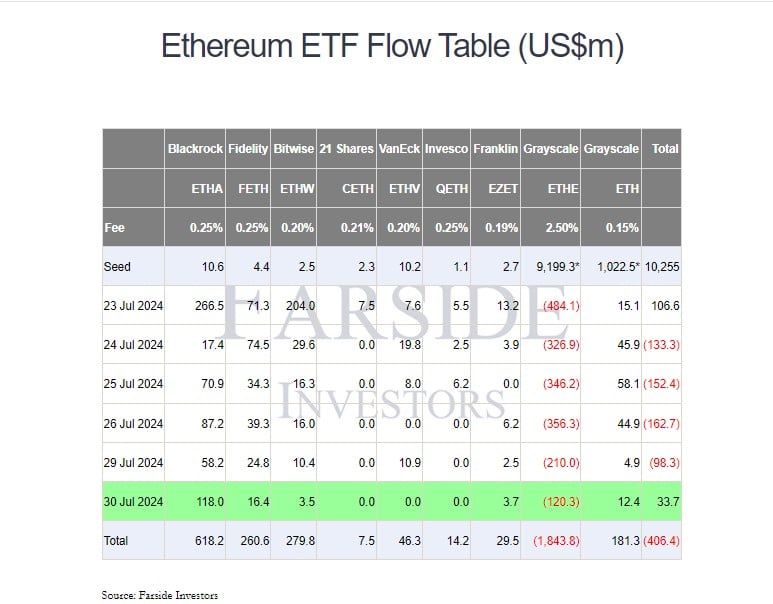

Net flows into the group of nine spot Ethereum exchange-traded funds (ETFs) turned positive in Tuesday trading as BlackRock’s iShares Ethereum Trust (ETHA) raked in $118 million in net inflows, sufficiently offsetting large withdrawals from Grayscale’s Ethereum ETF (ETHE), according to data from Farside Investors.

Investors pulled around $120 million from Grayscale’s ETHE on Tuesday, bringing the outflows after six trading days to over $1.8 billion. Since the fund’s conversion, its assets under management have dropped from over $9 billion to $6.8 billion, according to updated data from Grayscale.

Fidelity’s Ethereum fund (FETH) and Grayscale’s Ethereum Mini Trust (ETH) ended the day with over $16 million and $12 million in net inflows, respectively. Other gains were also seen in Bitwise’s Ethereum ETF (ETHW) and Franklin Templeton’s Ethereum ETF (EZET).

The combined net inflows successfully offset Grayscale’s strong outflows, turning ETF flows positive on July 30. Overall, US spot Ethereum posted almost $34 million in inflows.

While ETF flows reversed course on Tuesday, the current downward pressure on Ethereum (ETH) due to heavy outflows from Grayscale’s ETHE is unlikely to fade away.

However, analyst Mads Eberhardts anticipates the outflow slowdown will happen by the end of the week. Once outflows stabilize, a potential price increase could follow, Eberhardts suggests.

Ethereum is currently trading at around $3,200, down 4% over the past week, CoinGecko’s data shows. The price peaked at $3,500 at the Ethereum ETF debut but dropped 10% in the following days.

The situation is relatively similar to Bitcoin’s price actions following the launch of spot Bitcoin ETFs in January. Pseudonymous trader Evanss6 noted that Bitcoin’s price recovered once outflows from Grayscale’s Bitcoin ETF (GBTC) subsided.

Share this article

![]()