Ethereum ETFs came too early

Speaking at the European Blockchain Convention, Bitwise CIO Matt Hougan expressed confidence that spot Ethereum ETFs will succeed despite a slow start.

Ethereum (ETH) exchange-traded funds may have launched too early, crypto.news heard Hougan say during an EBC panel on Sept. 25 in Barcelona, Spain. The Bitwise executive noted that Wall Street market players were still acclimatizing to Bitcoin’s (BTC) message, when spot ETH ETFs debuted.

They would have raised five times more assets if we had waited another year. It takes people a long time to digest Bitcoin and be ready for the next thing.

Matt Hougan, Bitwise CIO

ETFs tracking Ether’s spot price launched in late July, over five months after the U.S. Securities and Exchange Commission approved similar products backed by Bitcoin in January. Issuers have applied for options on these products, but the SEC has only approved options for BlackRock’s spot BTC ETF. The SEC delayed its verdict for options for spot ETH ETFs till November.

Outflows, mostly from existing Grayscale ETH funds, have hindered spot Ether ETF success, according to some in the market. However, Bitwise’s Hougan offered a different view, suggesting that Ethereum ETFs will inevitably attract traditional finance investors.

It’s a more complex message, and they were still getting their hands around Bitcoin. But it’ll happen. We’ll wake up a year from now, there will be $20 billion in Ethereum ETFs in the U.S., and everyone will say, ‘Wow, I thought they were a bust.’ No, they weren’t bust. These ETFs just take a while.

As of writing, the Ethereum ETF complex has seen over $624 million in net outflows. The group, led by $10 trillion asset management giant BlackRock, held just over $7.2 billion in assets.

Hougan expects improved spot Ether ETF numbers to align with a resurgence in ETH’s narrative. While Bitcoin has thrived under the “digital gold” narrative and Solana has gained attention for its fast transactions, Ethereum has lagged, according to Hougan.

That will end, though. I think the market is coming back around to Ethereum, but it’s taken some time.

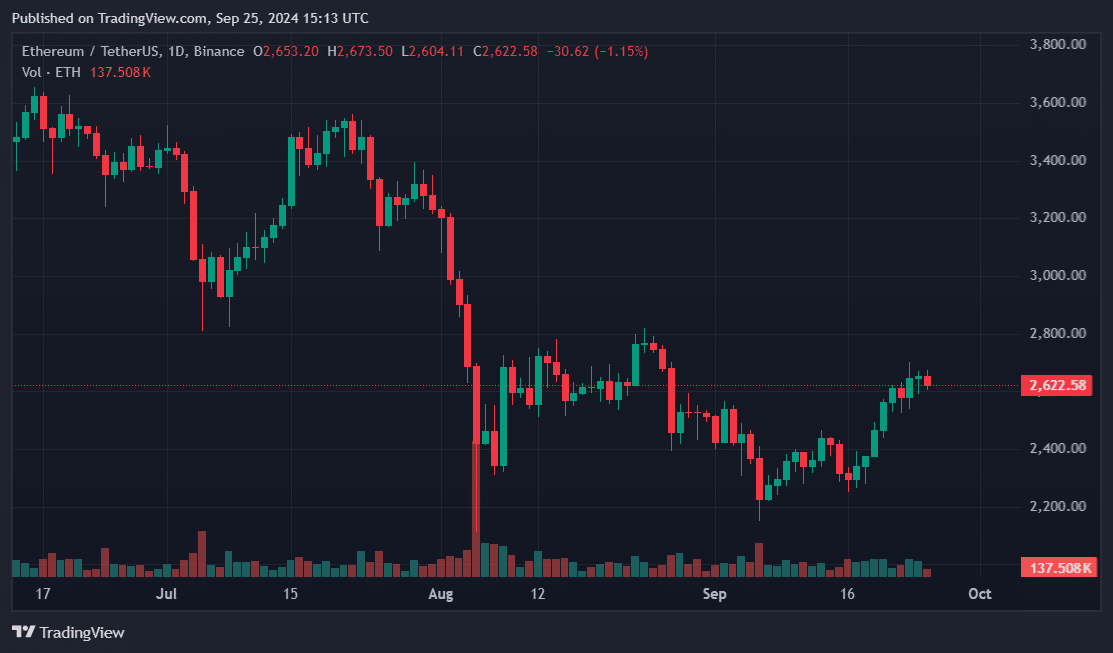

Ethereum has grown 14% in the past week and was back above $2,600. Some experts speculate that the second-largest cryptocurrency could experience a bullish fourth quarter, driven by Federal Reserve rate cuts and renewed optimism in the virtual currency market.