Ethereum Foundation makes $13.3m ETH transfer, prompting market speculation

A wallet reportedly linked to the Ethereum Foundation has liquidated $13.3 million in ETH, raising eyebrows and sparking conversations about a possible price decline.

The Ethereum Foundation‘s decision to liquidate $13 million worth of Ethereum (ETH) has left investors contemplating the transaction’s potential impact on the price of the world’s second-largest cryptocurrency by market capitalization.

Traditionally, the foundation’s actions are considered precursors to market shifts, triggering concerns about a potential decline. Despite this, Ethereum displays bullish signals as the charts look today.

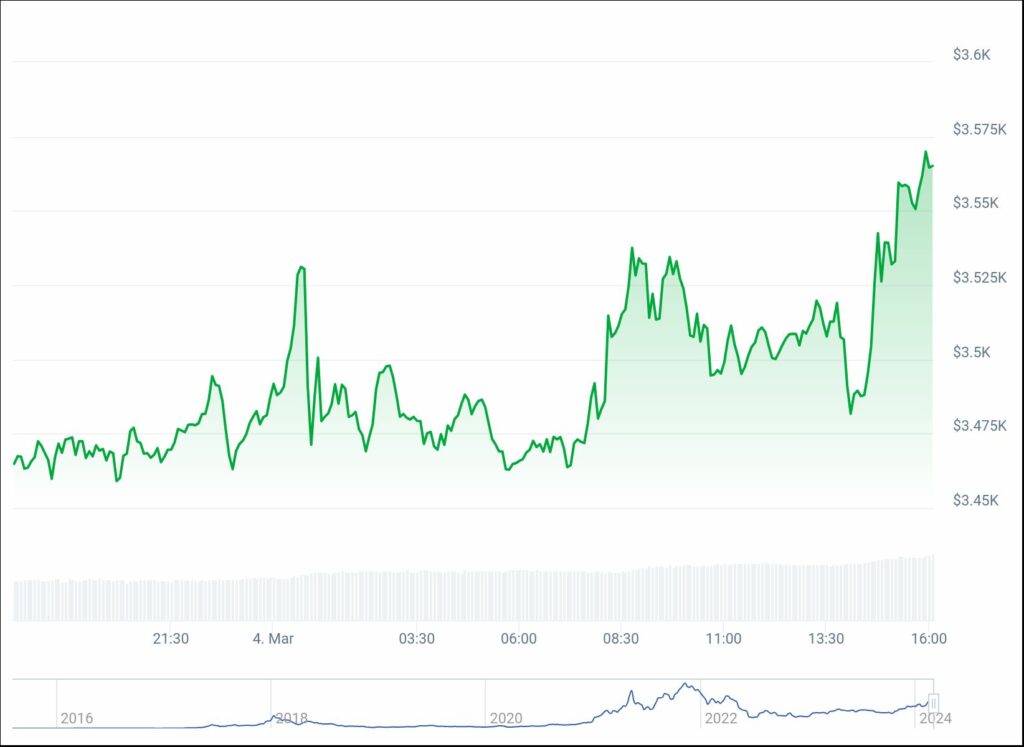

The Ethereum price chart presents an optimistic view with a strong uptrend, marked by consistently higher highs and lows. Currently trading at $3,550, Ethereum has experienced a 14.6% increase in the last seven days, commanding a market cap of $420 billion and a crypto market dominance of 17.8%, according to CoinGecko.

Though market pullbacks are natural in an uptrend, they induce investor anticipation as the market awaits its next move. The weekly Relative Strength Index (RSI) stands at 89.95, approaching the overbought zone, suggesting a possible correction, which aligns with the Ethereum Foundation’s recent sell-off.

In the broader market context, Bitcoin (BTC) has gained over 28% in the last seven days, nearing its all-time high of $69,000 in November 2021. At the time of writing, the price of BTC is hovering around the $67,000 region.

Meanwhile, the Ethereum network is preparing to activate the Dencun update, combining Cancun and Deneb updates. Scheduled for Mar. 13, this improvement intends to significantly reduce layer-2 transaction fees while enhancing Ethereum’s scalability, efficiency, and security.

On Feb. 27, the Ethereum Foundation announced that it had successfully activated the upgrade on test networks.

Last month, Ethereum experienced substantial growth, attracting 1.8 million new users to its network. Santiment’s metric tracking funded Ether wallets revealed a surge, with the total ETH holders reaching 115.5 million addresses.

In contrast, BTC witnessed a decline of 70,000 wallet addresses during the same period, underlining Ethereum’s market dominance.

The growing demand from new ETH addresses and a $2.3 billion decrease in exchange supply positions Ethereum favorably for a potential advance towards $4,000 in March 2024.

Spot Ethereum ETF prospects

Amidst Ethereum’s positive trajectory, multiple issuers are seeking approval for spot Ethereum ETFs, mirroring the success of spot BTC products. However, SEC delays and commissioner comments hint at challenges on the road ahead.

An upcoming meeting between the U.S. Securities and Exchange Commission (SEC) and spot Ethereum ETF applicants later this month, will determine the fate of Ether-based investment vehicles. Decisions on the products are postponed until May at the earliest, with VanEck’s filing leading the queue. The SEC’s approval or rejection by May 23 will influence other issuers, including BlackRock, Franklin Templeton, Grayscale, and Invesco Galaxy.

The approval of spot Bitcoin ETFs in January marked a significant development after years of rejections. This decision, influenced by a Grayscale lawsuit against the SEC, was seen as a turning point in legitimizing crypto adoption and investment in the United States.