HBAR price holds support at $0.21 as funding rates remains bullish

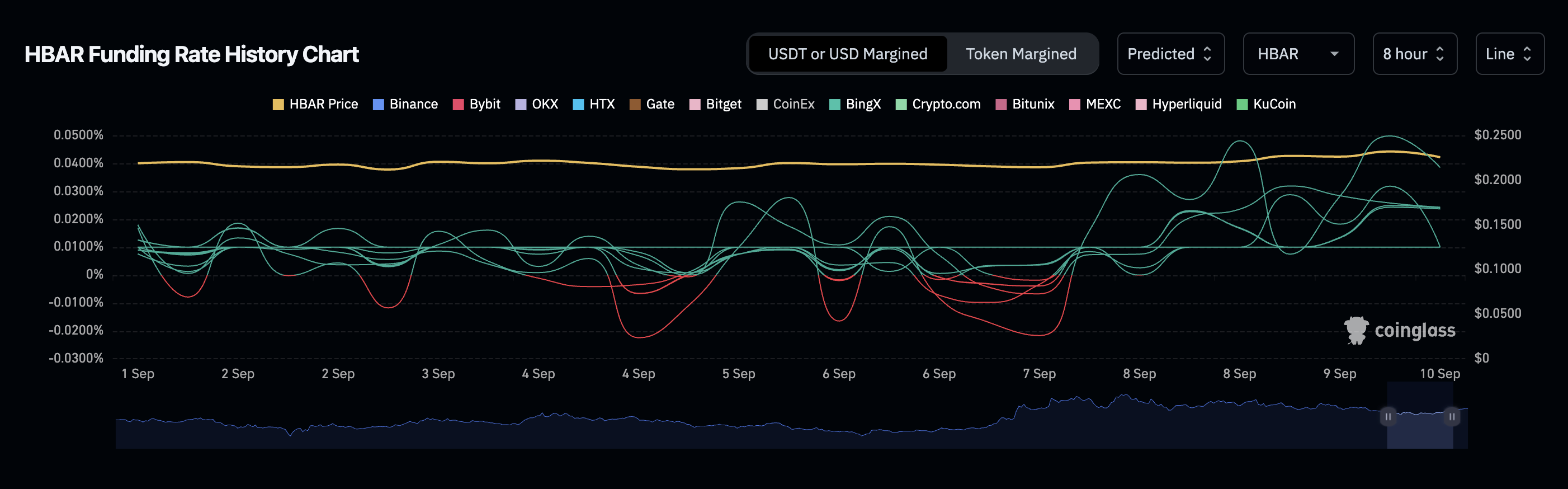

Hedera Hashgraph price has confirmed support at $0.21, sparking a bullish reaction backed by strong technical confluence and rising demand. With funding rates favoring long positions, the token shows signs of continuation.

Summary

- $0.21 support confirmed with 0.618 Fibonacci, moving averages, and volume node confluence.

- Higher lows and bullish structure remain intact.

- Positive funding rates show strong demand for long positions.

HBAR’s (HBAR) price action has reaffirmed its bullish structure after defending a major high–time frame support zone. The convergence of multiple technical indicators at $0.21 has created a foundation that could sustain further upside momentum.

Market sentiment has been reinforced by rising open interest and favorable funding rates, highlighting continued appetite for long exposure. Adding to this optimism, SWIFT has begun testing XRP and HBAR as part of its efforts to enhance cross-border payment infrastructure, further validating HBAR’s long-term relevance.

HBAR price key technical points

- $0.21 confirmed as major support: with confluence from 0.618 Fibonacci, moving averages, and high-volume node.

- Higher lows continue to form: maintaining a bullish market structure.

- Funding rates remain positive: indicating demand for long positions and sustained bullish sentiment.

HBAR has established $0.21 as a decisive support zone, reacting strongly from this level with a clear bounce. The area is significant as it coincides with multiple technical signals, including the 0.618 Fibonacci retracement, moving averages, and the value area high of a major volume node. These convergences highlight the presence of strong institutional interest, making the region a key battleground for continuation. While price was recently rejected at $0.30, the $0.18 support order block remains intact, providing a bullish foundation for further upside potential.

This bounce has likely confirmed another higher low, reinforcing HBAR’s bullish trend of consecutive higher highs and higher lows. The persistence of this market structure signals that buyers remain in control, and the foundation for further upside has been established.

Alongside the technical base, market sentiment indicators add weight to the bullish case. Open interest remains elevated, reflecting continued participation from traders who are positioning for further gains. At the same time, funding rates are positive, showing that long positions are outpacing shorts. This suggests traders are willing to pay a premium to maintain bullish exposure, a dynamic that often drives prices higher as demand strengthens.

From a structural perspective, this funding environment may also trigger a feedback loop. As longs dominate, shorts become more attractive, but if prices continue rising, short sellers are forced to close positions, which further fuels upward momentum. This type of squeeze dynamic could accelerate HBAR’s next leg higher.

What to expect in the coming price action

HBAR remains bullish above $0.21, with strong technical confluence and funding conditions favoring the upside. If buyers maintain control, the token could extend its trend of higher highs and higher lows, potentially targeting new resistance levels in the coming weeks.