Moonwell price dives, but crypto pros expect WELL to rebound

Moonwell, the third-largest lending decentralized application network on the Base blockchain, has experienced a sharp decline, erasing gains made in October.

Moonwell (WELL) token dropped to $0.07113, its lowest point since Oct. 25 and 36% below its all-time high, bringing its market cap to over $226 million. Despite this, it remains 677% higher than its lowest point in July this year.

Moonwell is a leading lending platform that was initially launched as a parachain on the Polkadot (DOT) ecosystem, where it saw mild reception.

Its growth surged this year when developers expanded to Base, the blockchain network established by Coinbase. Since its launch, the AAVE (AAVE) competitor has seen a big increase in assets in the network. Its total value locked in Base’s DeFi networks has jumped to $116 million.

According to developers, Moonwell has generated about $800,000 in fees on Base and Optimism since October, signaling strong user growth—a trend that could continue in the near term.

Moonwell’s growth has coincided with that of Base, which has come from nowhere to become the sixth-biggest chain in the industry. It has also become the third-biggest blockchain for decentralized exchanges.

Some analysts believe that the ongoing pullback will be a good entry point. In an X post, The Weekend Shift estimated that the WELL token will soar to $1.50 by the end of the year, implying a 1,775% surge.

Moonwell price has strong technicals

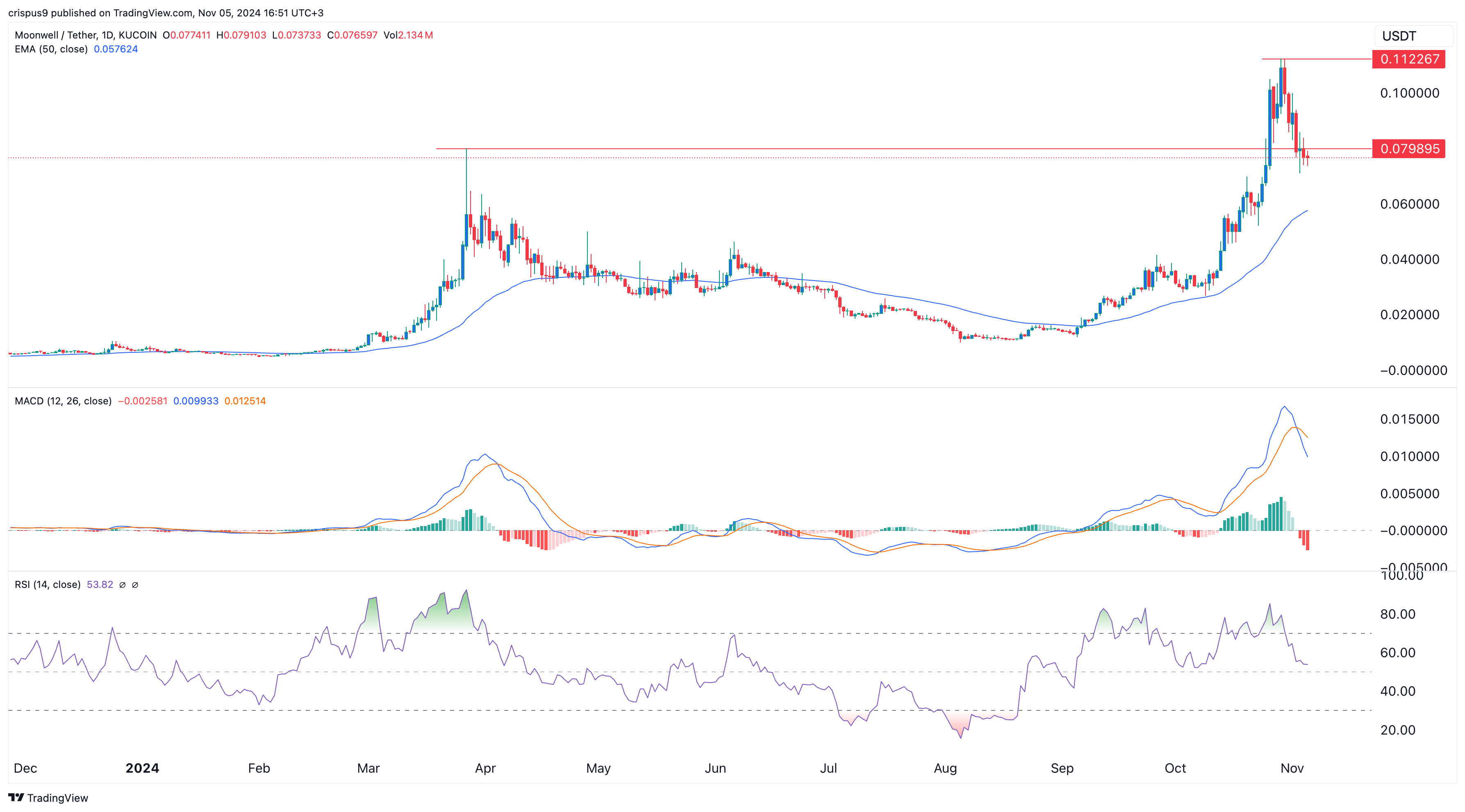

The Moonwell token recently surged to a high of $0.1122 but has since declined as investors took profits. It has dipped slightly below the key support level at $0.080, its highest swing on March 24, and the upper edge of the cup and handle pattern.

The two lines of the MACD indicator have formed a bearish crossover, while the Relative Strength Index is approaching the neutral level of 50. The price remains above the 50-day moving average.

As such, the WELL token could bounce back as it has formed a break and retest pattern, a common indicator of bullish continuation. If this occurs, WELL may rebound and retest the $0.1122 resistance level. However, a break below the 50-day moving average at $0.0576 would suggest further downside.