Neiro meme coin is firing on all cylinders; nears $1b market cap

Neiro, a viral meme coin, rallied for the third consecutive day, reaching a record high of $0.001875.

Neiro (NEIRO) has soared by over 7,000% from its lowest level in September.

This surge occurred in a high-volume environment, with 24-hour trading volume rising to over $1.13 billion. Most of this volume was concentrated on Binance, followed by Gate.io and Bitget.

The rally also coincided with a jump in futures open interest. According to CoinGlass, open interest in the futures market hit a record high of $175 million, up from this week’s low of $50 million.

Neiro’s market cap has surged to over $742 million, meaning it needs to rise by about 38% from its current level to reach $1 billion. If this happens, it will join Popcat (POPCAT), a Solana (SOL) meme coin whose valuation crossed the $1 billion mark this week.

Neiro’s valuation makes it larger than other well-known companies like Groupon, Nikola, and Sleep Number. It has also surpassed other popular meme coins such as Baby Doge Coin and Book of Meme.

Neiro’s rally happened in a day when Bitcoin and most altcoins were in the red. Bitcoin (BTC) dropped to $62,500 while most coins like Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE) retreated by over 2%.

Meme coins have been some of the best-performing cryptocurrencies this year. All meme tokens tracked by CoinGecko now have a combined market cap of over $53 billion. While Dogecoin and Shiba Inu remain the biggest, newer tokens have climbed the ranks in recent months.

Popcat, launched in December, has grown into a $1 billion token, and Brett, a meme coin on Base Blockchain, has reached a valuation of $884 million.

Neiro could retest $0.00137

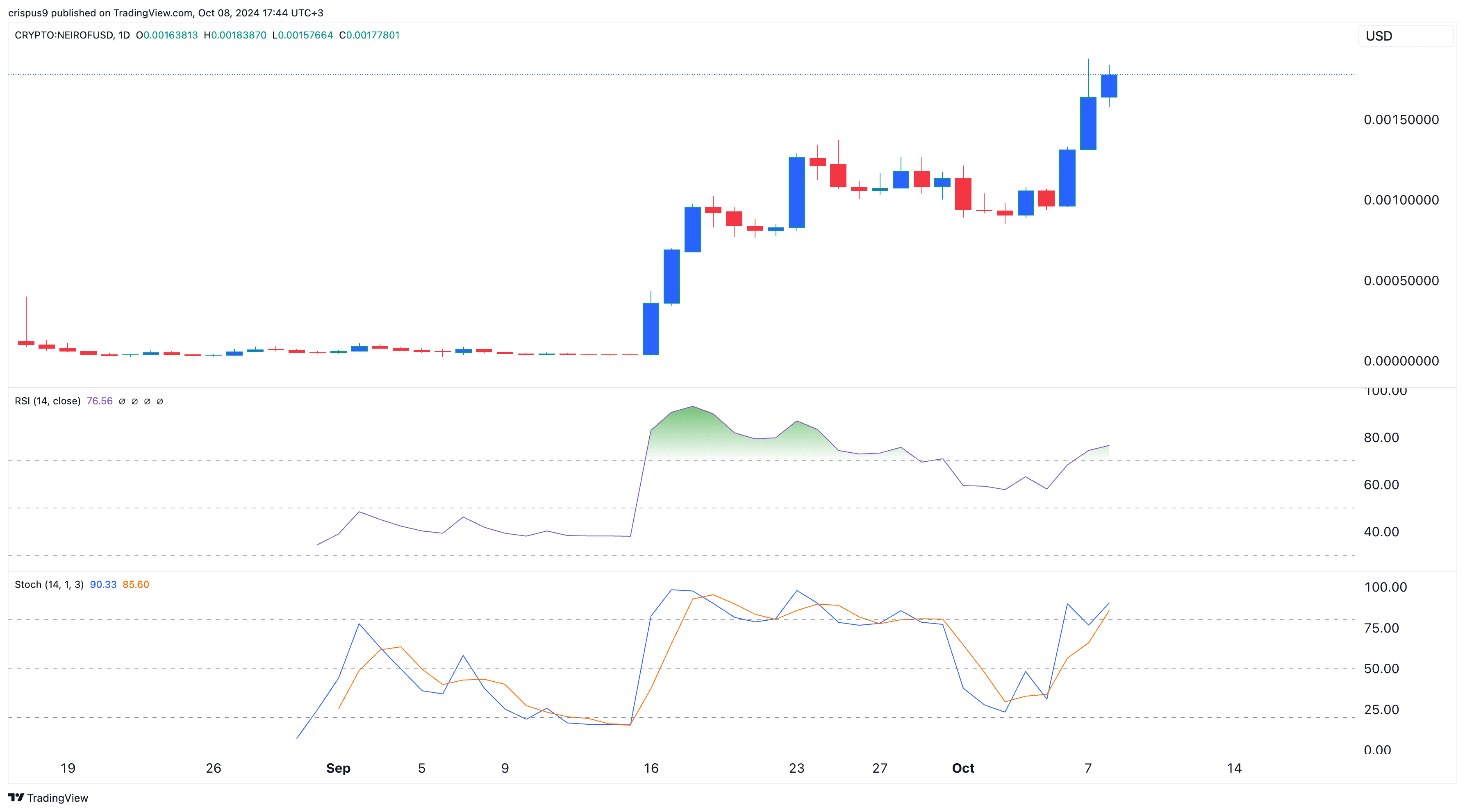

On the daily chart, Neiro rose and broke through the important resistance point at $0.001375, its highest swing on September 25. By surpassing that level, the token invalidated the double-top chart pattern that was forming.

The Relative Strength Index and the Stochastic Oscillator have moved to overbought levels. Therefore, the most likely scenario is that it retreats to retest the support at $0.001375 before resuming its bullish trend.