Peanut gains $1.2b market cap, entering top 100 cryptos

Peanut the Squirrel, a newly launched meme coin on the Solana blockchain, has recently become the top gainer among the leading 100 crypto assets amid a massive rally.

Created as a tribute to Peanut, the squirrel controversially euthanized by the New York State Department of Environmental Conservation last month, Peanut the Squirrel (PNUT) faced initial selling pressure after its early-November launch.

The coin dropped to a low of $0.03104 on Nov. 4. However, PNUT quickly found its footing, rebounding as it joined a broader market uptrend following Donald Trump’s victory in the just-concluded U.S. presidential election.

The rally intensified on Nov. 11 as PNUT soared by 256%, hitting a new all-time high of $0.47, with Binance confirming its listing yesterday. PNUT is up 170%% over the last 24 hours and is trading at $1.2 at the reporting time.

Amid this uptrend, PNUT entered the top 100 crypto assets, with its market cap surging above $1.2 billion million.

The asset became the fastest-growing meme coin to reach a $1 billion market cap in less than 10 days.

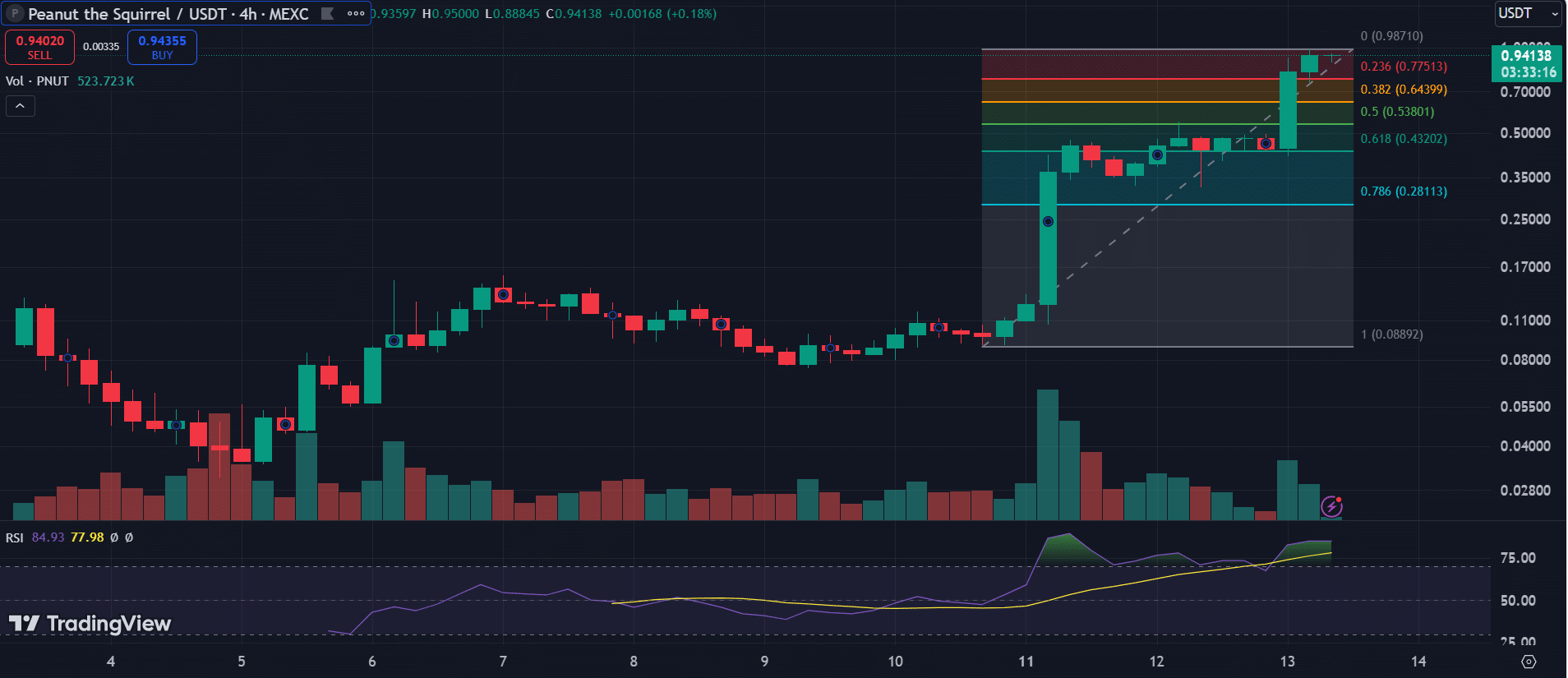

The four-hour chart for PNUT shows the important zones at the 23.6% Fibonacci level, around $0.7751, the 38.2% level at $0.6439 and the 50% region, around $0.53801. These represent notable support zones if the price faces a pullback.

Notably, these levels could provide buying opportunities for investors if the price retraces, as they are often areas where demand increases in bullish markets.

Currently, PNUT is trading near the upper end of the Fibonacci scale, suggesting bullish sentiment. However, if it encounters resistance near its recent highs, traders should watch for possible retracements toward the 0.382 or 0.5 Fibonacci levels, as these could serve as healthy consolidation points before another leg up.

The meme coin’s Relative Strength Index is currently at 84.93, placing PNUT in overbought territory. This high reading suggests that PNUT might be overextended, and a correction could be on the horizon, especially as volumes start to drop.

However, a strong trend can keep PNUT’s RSI elevated, meaning PNUT could maintain its uptrend if buying pressure persists. This would require a recovery in volume.