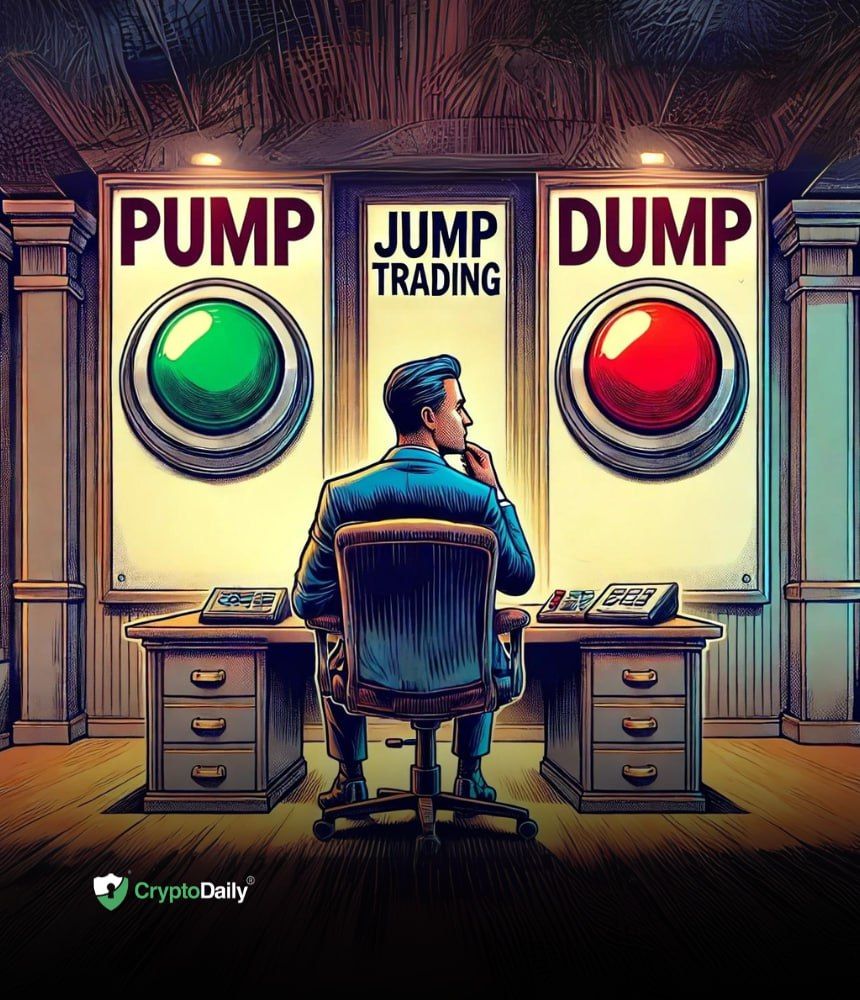

Pump, Dump, and Jump: Trading Firm Faces Lawsuit Over Token Manipulation

Fracture Labs, the developer behind the online game Decimated, has filed a lawsuit against Jump Trading, accusing the market maker of engaging in a pump-and-dump scheme involving its DIO token.

Allegations of Fraud and Market Manipulation

The lawsuit, filed in Illinois District Court on October 15, alleges that Jump Trading manipulated the price of the DIO token for financial gain, severely devaluing the token in the process. According to the lawsuit, the game developer entered into an agreement with Jump in 2021 to assist with the initial offering of the DIO token on the crypto exchange HTX (formerly known as Huobi). As part of the agreement, Fracture Labs loaned 10 million DIO tokens to Jump, valued at $500,000 at the time. Additionally, Fracture Labs transferred 6 million DIO tokens worth $300,000 to HTX.

Pump and Dump?

The lawsuit alleged that HTX enlisted online influencers to promote the DIO token after its launch, which led to a sharp price increase, reaching $0.98. This surge in value made Jump’s borrowed DIO tokens worth $9.8 million. Fracture Labs alleges that Jump Trading subsequently sold all its holdings in a mass liquidation, driving the token price down to $0.005 and profiting millions in the process.

Breach of Agreement and DIO Devaluation

The lawsuit further claims that after the price crash, Jump Trading repurchased the devalued tokens for $53,000, returned them to Fracture Labs, and terminated the agreement.

The lawsuit states,

“The result of Defendant Jump’s fraudulent scheme is that DIO was dramatically devalued, making it harder for FractureLabs to attract investors and interest.”

Fracture Labs also accuses Jump of breaching an agreement to maintain the DIO token’s price within certain limits. The lawsuit alleges that Fracture Labs deposited 1.5 million USDT into an HTX account as collateral, ensuring that it would not manipulate the market during the first 180 days of trading. However, after the price swing caused by Jump’s actions, HTX refused to return most of this deposit, claiming that the DIO token’s price fell outside the agreed parameters.

Way Forward

Jump Trading has strongly denied the accusations, calling them “factually flawed.” The company has stated its intention to fight the lawsuit and defend its actions in court.

Fracture Labs is seeking damages, a jury trial, and the recovery of funds lost due to the alleged scheme. The game developer claims that Jump’s actions not only harmed DIO’s market value but also hindered its ability to secure additional investments.

Previous Controversies Surrounding Jump Trading

This lawsuit is not the first time Jump Trading has been associated with controversy. In 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Terraform Labs, alleging that Jump played a crucial role in helping re-peg the UST stablecoin (USTC) to the U.S. dollar after it lost its peg in May 2021. Although Jump was not named as a defendant in that case, the SEC’s allegations have further added to the scrutiny surrounding the firm’s market activities.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.