Spot Bitcoin And Ethereum ETFs Hit Record $40B Volume In Past Week – Details

The United States crypto exchange-traded fund (ETF) market has been in red-hot form in the past few weeks, with the Ethereum ETFs hitting new milestones every week. In its latest feat, the ETH-linked investment hit a new volume record alongside its Bitcoin counterpart.

This increased activity for the Bitcoin and Ethereum ETFs mirrors the current optimistic state of the market, with investor sentiment remaining fairly positive in recent weeks. Unsurprisingly, this positive trend is also reflected in price action, especially for ETH.

Ethereum ETFs Record $2.85 Billion In Net Weekly Inflow

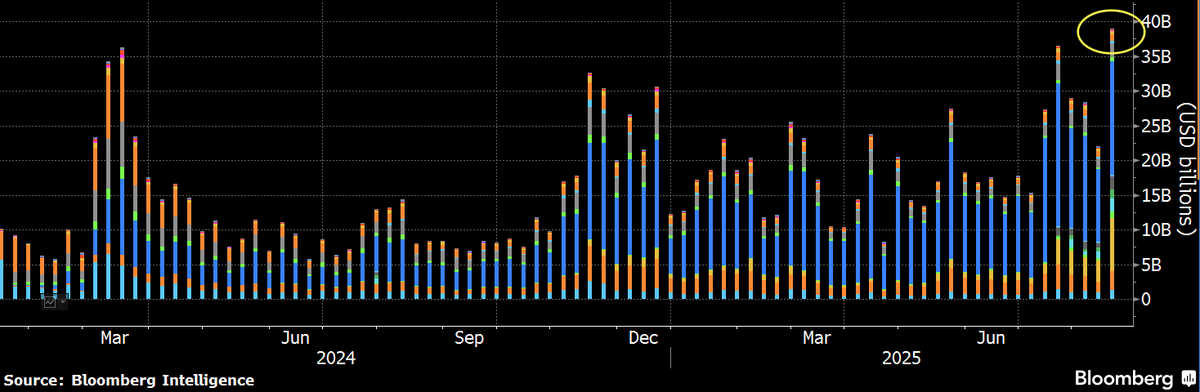

In an August 15 post on social media platform X, Bloomberg ETF analyst Eric Balchunas revealed that the US-based spot Bitcoin and Ethereum ETFs recorded around $40 billion in trading volume in the past week. This figure represents the highest volume ever registered by crypto exchange-traded funds.

According to Balchunas, the $40 billion figure is one often associated with the volume of a top five exchange-traded fund or a top 10 stock. However, the spot crypto ETFs have achieved a similar feat in terms of trading volume, thanks to the Ethereum exchange-traded funds stepping up.

Source: @EricBalchunas on X

The Bloomberg ETF expert disclosed that the US-based spot Ethereum ETFs did about $17 billion in trading volume in the past week. Balchunas acknowledged the change of fortune the Ether-linked products have witnessed in the past week, saying they “crammed one year’s worth of action into the past six weeks.”

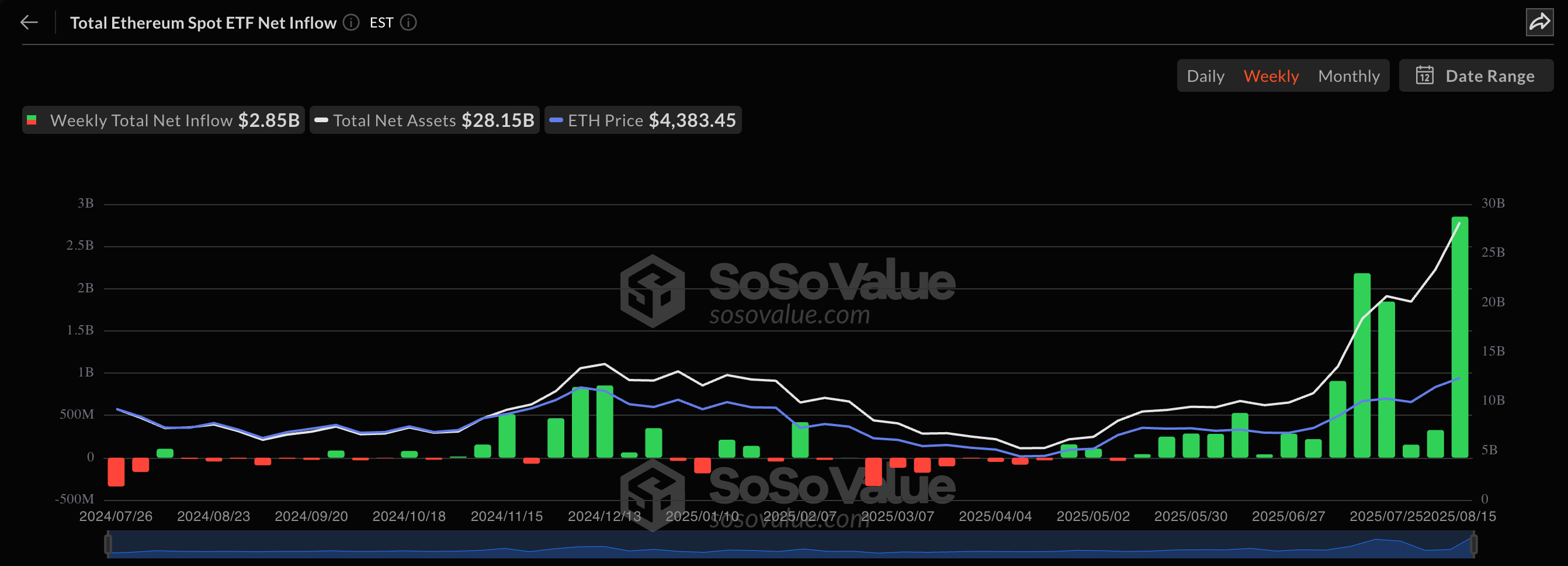

As seen with their trading volume, the Ethereum ETFs have also enjoyed increased capital inflows in the past few weeks. According to data from SoSoValue, the crypto-linked investment products were on an eight-day inflow streak until Friday, August 15, where they registered a net total outflow of $59.34 million.

However, this latest round of withdrawals was not enough to stop the ETH exchange-traded funds from recording their best weekly performance since launch in 2024, posting $2.85 billion net total inflow in the past week. This marks the 14th consecutive week of positive inflows for the Ethereum ETFs, with the funds particularly picking up in the last six weeks.

Source: SoSoValue

Meanwhile, the spot Bitcoin ETFs recorded a $128.53 million net outflow on Friday, breaking the funds’ seven-day inflow streak. According to market data, the BTC exchange-traded funds eventually registered a net total inflow of $547.82 in the past week.

Bitcoin And Ethereum Price

Bitcoin reached a new all-time high of around $124,100 over the past week, reflecting the continuous positive correlation between spot ETFs and the price of their underlying assets. Similarly, the Ethereum price flirted with its former record high just above the $4,800 level.

As of this writing, the price of BTC stands at around $117,400, reflecting a 1% decline in the past 24 hours. Meanwhile, the ETH token is currently valued at around $4,420, reflecting a nearly 4% price decline in the past day.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.