SUI leads top gainers as open interest hits all-time high

Sui, often dubbed the Solana-killer, continued rising on Oct. 8 amid a record surge in its futures market.

Sui (SUI) jumped to an intraday high of $2.14, its highest price level in six months, and 181% above its lowest point last month. This recovery made it the leading gainer among the top 100 cryptocurrencies by market cap on Oct. 8.

At press time, Sui’s market cap stood at $5.46 billion, while its daily trading volume had more than doubled to $2.26 billion.

Key developments fuelling growth

A key catalyst for Sui’s recovery has been the significant demand in the futures market. Data from CoinGlass reveals that Sui’s open interest soared to an all-time high of $564 million on Oct. 8, surpassing the previous record of $502 million. This is a dramatic rise from September’s lows, where open interest hovered below $140 million, suggesting a substantial influx of speculative capital.

Futures open interest measures the volume of outstanding contracts—both buy and sell orders—that have yet to be executed. A surge in this metric typically signals heightened interest and confidence among traders.

Most of Sui’s futures activity has been driven by Bybit, followed closely by Binance and Bitget. Notably, Bybit’s decision to incorporate SUI into its Launchpool, marking the first time a non-Mantle token has been included, has helped bolster market activity.

Beyond the futures market, Sui’s fundamentals are also improving. The total value locked in Sui’s decentralized finance protocols surged by over 61.2% in the last 30 days, reaching $1.089 million, placing Sui among the top seven chains by value.

Further, the Sui network recently surpassed Solana in terms of daily transaction volume, a key metric for measuring network activity. As of Oct. 8, Sui recorded 58.37 million daily transactions compared to Solana’s 35.41 million, underscoring its growing user base and adoption.

Grayscale’s launch of the SUI Trust in September has added another layer of momentum to the token’s recent rally. The trust allows accredited investors to gain exposure to the SUI token, which has likely contributed to the token’s price appreciation by expanding its reach to institutional players.

Technical indicators signal sustained bullish momentum

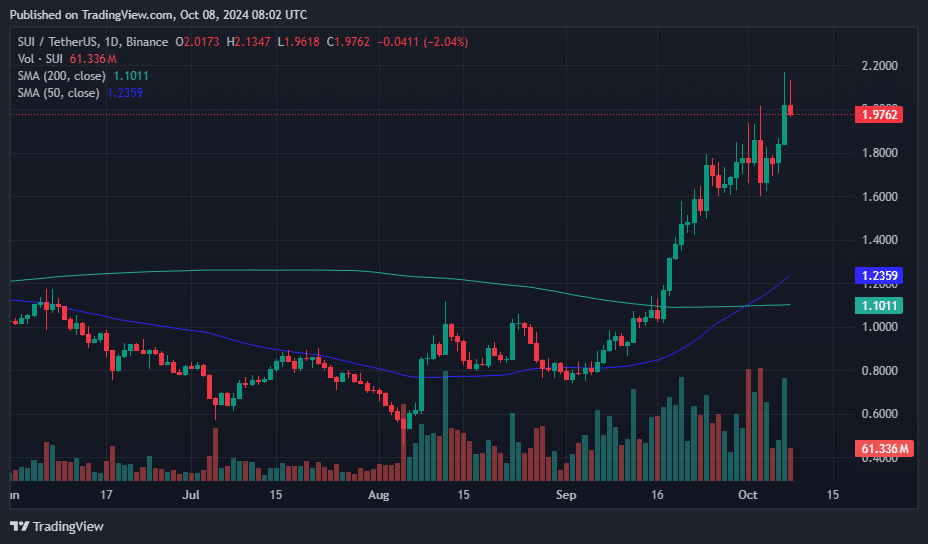

From a technical perspective, Sui’s price action is signaling continued strength. The token is currently trading above its 50-day and 200-day moving averages, which formed a golden cross—a classic bullish indicator—on Sept. 22. This pattern suggests that the short-term trend has overtaken the long-term trend, often leading to further upward momentum.

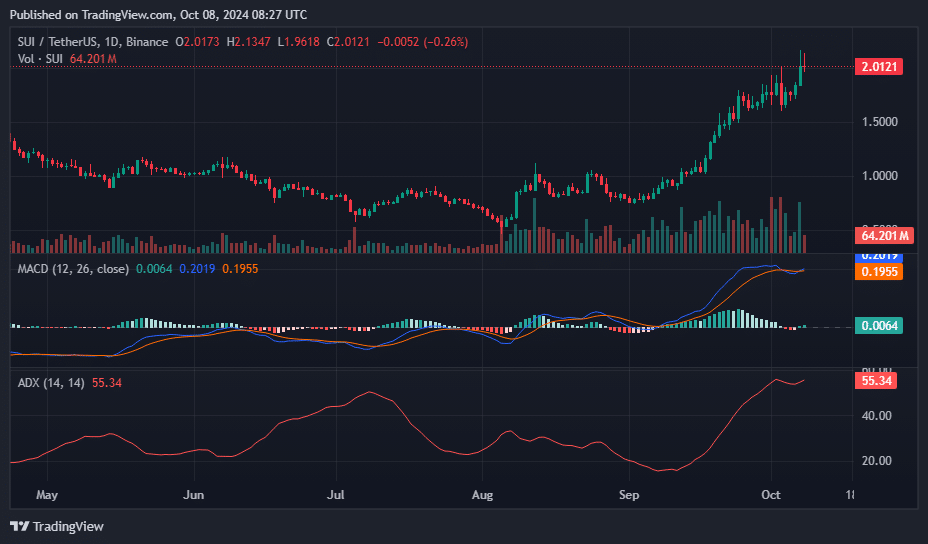

The Average Directional Index, which measures the strength of a trend, has surged to 55, well above the threshold of 25 that denotes a strong trend. The Moving Average Convergence Divergence indicator is also flashing bullish signals, with both the MACD line and its signal line trending upwards. These technical metrics suggest that Sui’s rally still has room to run.

As Sui approaches its previous all-time high of $2.17, this level now serves as a key resistance point. If the token can break through this barrier, it could set the stage for further gains.