Tether’s USDT supply up $4.5b in 30 days

USDT’s market cap climbed to new highs during November 2023 as tokens in the broader crypto ecosystem and defi recorded price sprints due to significant cash inflows.

Tether’s USDT, crypto’s largest stablecoin, achieved an all-time high of $89 billion on the back of increased minting activity by the digital asset payments giant since late October 2023 according to Arkham Intelligence, an on-chain analytics provider.

USDT’s market cap grew by $4.5 billion in 30 days with the lion’s share of this new supply minted on Tron, the cryptocurrency network created by HTX advisor and Poloniex founder Justin Sun. Tether minted $3 billion on Sun’s blockchain.

Additionally, the Kraken deposit wallet ‘TQef1’ received $2.5 billion, while $400 million of these new Tether tokens were created within a week.

Paolo Ardoino, Tether’s CEO, reiterated that massive USDT mints from the company’s treasury were designated to ensure liquidity on Ethereum and Tron. Ardoino was appointed Tether’s boss after former CEO Jean-Louis van der Velde transitioned to an advisory role.

An uptick in stablecoin market cap is typically associated with bullish momentum and could signal renewed demand for cryptocurrencies. The U.S. dollar-pegged tokens serve as a gateway for traders to exchange their digital assets for fiat currencies and vice versa, also known as on-off ramps.

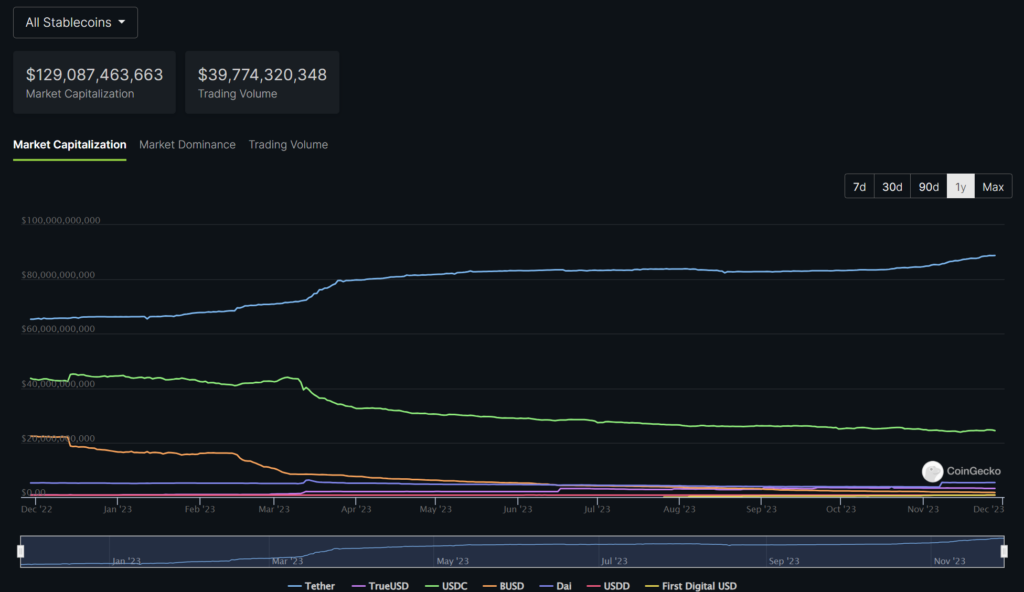

While Tether’s market cap noticeably increased, other stablecoins have seemingly stalled in growth per data available on Coingecko, and USDT dominated the market at press time. Its closest rival, Circle’s USD Coin (USDC), boasted a $24 billion market cap, down from over $40 billion a year ago.

Circle was reportedly caught amidst a U.S. banking crisis during the first half of 2023 where crypto-friendly financial houses like Silicon Valley Bank and Silvergate suffered bank runs. USDC’s issuer, however, remained optimistic concerning future operations.