Tron Network Captures $23 Billion In USDT Supply In 2025, What This Means For TRX

With Tron’s user base and adoption rising sharply in the dynamic blockchain sector, the leading network is taking the spotlight in the stablecoin market. In 2025 alone, the total supply count of Tether’s USDT stablecoin recorded on the network has experienced a massive surge.

USDT Supply On The Tron Network Skyrockets

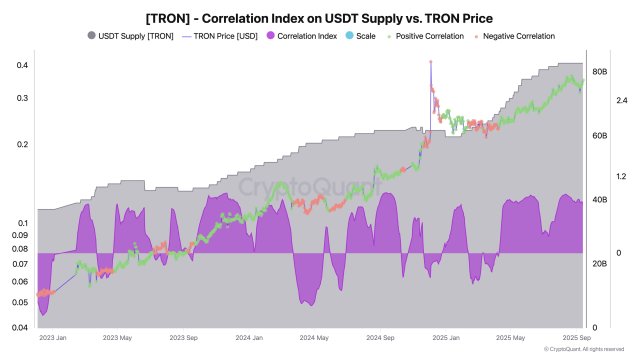

Tether’s USDT, the largest stablecoin in the crypto market, on the Tron blockchain, is ramping up at a significant rate and scale. The development was reported by Darkfost, a market expert and author, after thoroughly examining the Correlation Index on USDT Supply vs. Tron Price metric.

Since its inception, the network founded by Justin Sun has been renowned for its close ties to USDT and the DeFi services that are accessible on the network within its blockchain ecosystem. Tron has now reached a significant milestone in 2025, as the amount of USDT issued on its blockchain has increased by an incredible 23 billion tokens in a few months.

Following the $23 billion in USDT recorded this year, data shows the total supply of the leading stablecoin circulating on the network is currently over 82 billion USDT. With this massive supply, the Tron blockchain is responsible for nearly 50% of the USDT quantity that is in circulation, which is now valued at about 170 billion. While reaffirming Tron’s position at the core of the global digital payments ecosystem, the dramatic growth underscores growing demand for USDT.

This surge in USDT supply on the blockchain comes as TRX’s price gains bullish traction. According to the on-chain expert, the evolution of USDT supply and TRX price action shows a strong association with one another.

What this means is that when USDT supply grows, TRX prices frequently tend to follow this upward trend. On the other hand, TRX typically goes through a phase of correction or consolidation when USDT supply slows down or declines. With the 23 billion USDT captured in 2025, Darkfost highlighted that both metrics are presently in the positive territory.

Within this wave of bullish performance, the expert noted that it’s crucial to understand that the rise in USDT supply on Tron can be interpreted as an indication of blockchain demand and user activity. Furthermore, given that TRX is essential to the environment, this activity probably results in a need for TRX.

Underneath this growing need for TRX, users are likely to benefit from quick, low-cost transactions and gain access to several Decentralized Finance (DeFi) services. These include borrowing, lending, and staking.

A Surge In Network Revenue

With the increased demand for on-chain apps, DeFi protocols, and stablecoin transfers, the network’s financial strength is clearly expanding. Tron continues to ride a wave of momentum, with its revenue surging sharply and topping the charts in recent sessions.

Data shows that the network recorded a total of $1.13 million in daily revenue, claiming the top spot among all other blockchains. In the monthly timeframe, the blockchain has also witnessed a notable amount of revenue, capturing approximately $48.91 million.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.