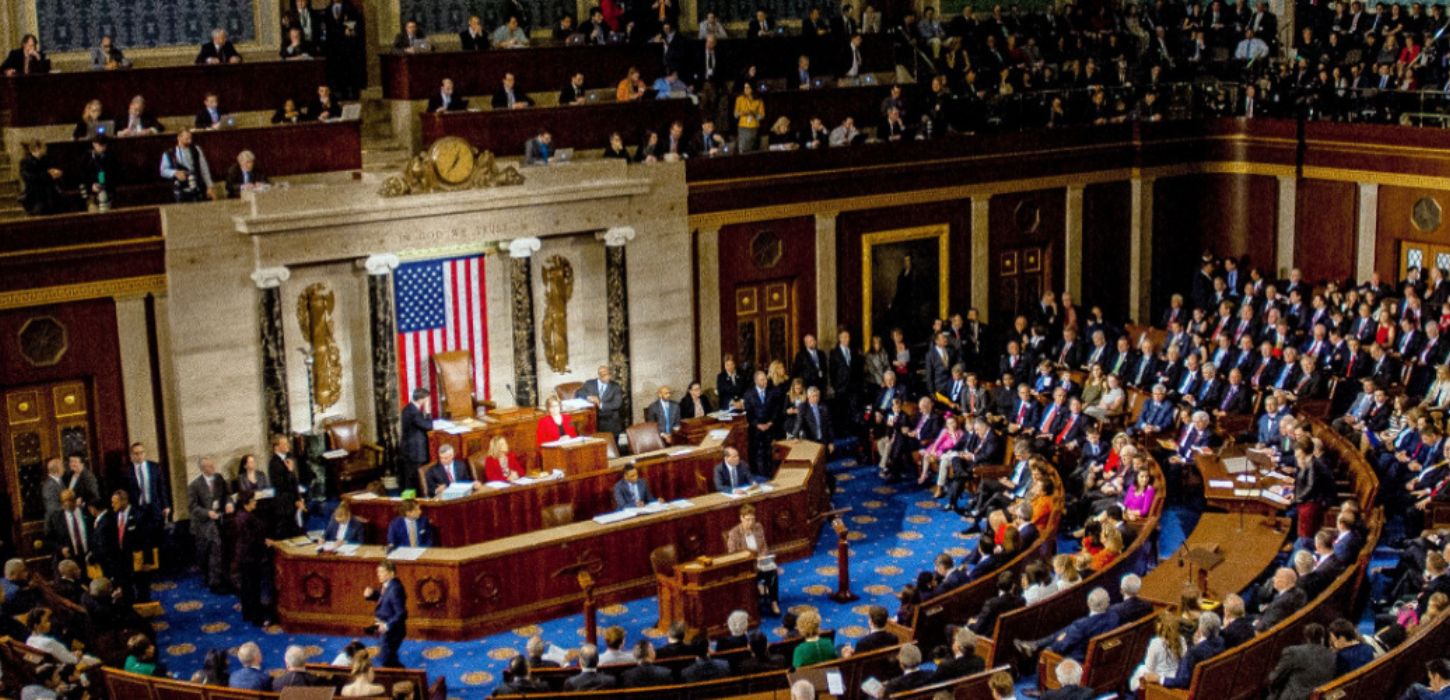

US Senators Introduce DeFi Regulations

A bipartisan group of United States Senators has introduced the CANSEE Act to regulate DeFi platforms in order to curb money laundering and other financial transgressions.

Senators Against DeFi

U.S. Senators are taking a strong stance against money laundering and crypto-facilitated crime by introducing new legislation aimed at regulating decentralized finance (DeFi) services. The Crypto-Asset National Security Enhancement and Enforcement (CANSEE) Act requires DeFi platforms to comply with the same anti-money laundering (AML) and economic sanctions obligations as traditional financial companies.

The bipartisan team of senators behind the CANSEE Act includes Jack Reed (D-RI), Mike Rounds (R-SD), Mark Warner (D-VA), and Mitt Romney (R-UT).

DeFi To Get More Centralized

The CANSEE Act will introduce tighter regulations and laws to DeFi, on par with the governance experienced by centralized institutions like banks, securities brokers, casinos, and centralized crypto trading platforms. Consequently, DeFi services will have to establish AML programs, conduct due diligence on customers, and report suspicious transactions to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

Senator Warner noted,

“I believe these focused measures will help maintain the robust AML and sanctions enforcement we need to protect our national security, while allowing participants who play by the rules to continue to take advantage of the potential of distributed ledger technologies.”

The legislation will also extend to all individuals and entities who facilitate the use of DeFi platforms by sanctioned individuals. The regulations under the act also will hold accountable any investor putting in more than $25 million in a DeFi project without a clear in charge.

Crypto ATMs In Trouble

The CANSEE Act is also extended its reach over crypto ATMs, claiming their higher propensity to be used in money laundering activities. As a result of the legislation, operators of crypto ATMs across the country will need to conduct identity checks for all participants involved in any single transaction.

Senator Reed stated,

“Our bill will also ensure that law enforcement has access to better information about cryptocurrency transactions, which they need to fight crimes like cross-border drug trafficking, weapons proliferation, and ransomware attacks.”

Industry Criticizes DeFi Bill

The bill has been highly condemned by crypto Twitter, with experts deeming it an “existential threat to DeFi.” There have also been questions about the bill’s imposition of control responsibilities, claiming it would discourage VCs from DeFi investments.

The Crypto Council for Innovation stated that the proposal lacks specific guidance on how decentralized protocols can comply with Bank Secrecy Act (BSA) reporting requirements. They advocate for an alternative approach that involves distinguishing elements within the DeFi technology stack and using blockchain transparency and programmability to establish compliance measures tailored to the crypto ecosystem.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.