MicroStrategy adds $147m worth of Bitcoin to balance sheet

Michael Saylor, founder of MicroStrategy, announced that his company added 5,445 Bitcoin to its massive crypto holdings between Aug. 1 and Sept. 24.

MicroStrategy spent $147.3 million on its latest BTC acquisition, according to a form 8-K filing with the U.S. Securities and Exchange Commission (SEC).

Following its BTC accumulation between August and September 2023, MicroStrategy now boasts $4.6 billion worth of crypto’s top token on its balance sheet.

MicroStrategy began purchasing BTC in 2020 as former chief executive officer Michael Saylor sought to reduce the company’s cash holdings and hedge against inflation.

Since then, Saylor’s company has bought 158,245 BTC in total, acquiring Bitcoin at an average price of $29,582. The firm issued 403,362 MSTR shares to investors in order to finance its latest round of BTC buys as of press time.

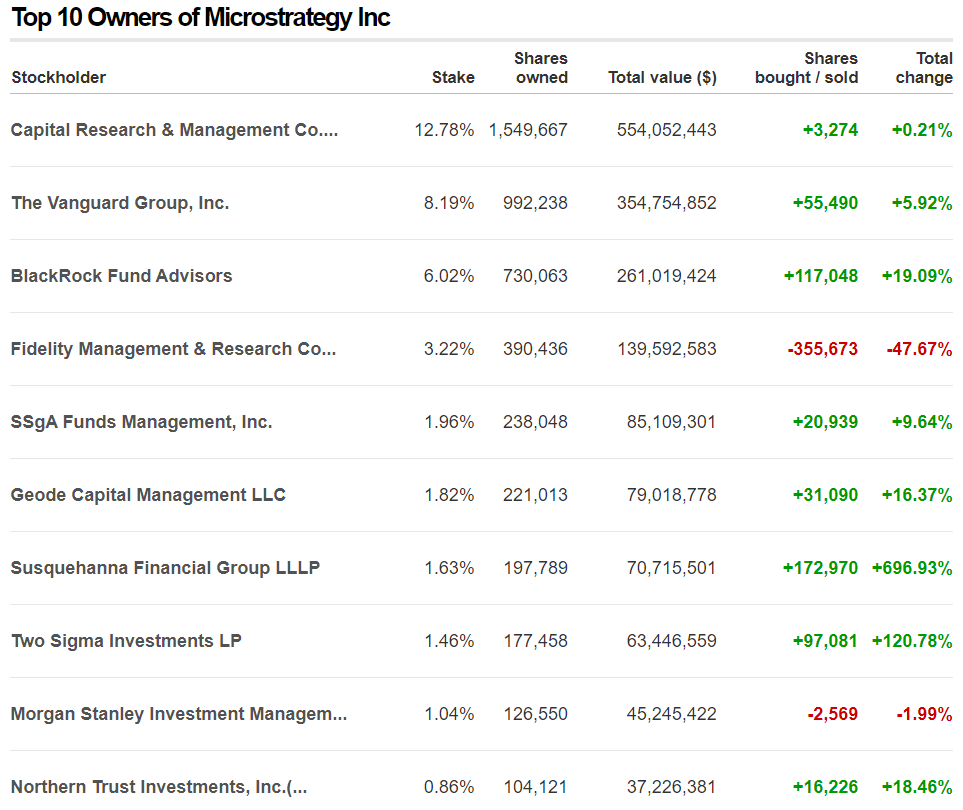

Wall Street heavyweights BlackRock and Fidelity count among the top 10 holders of MicroStrategy stock.

It’s possible that investing in MSTR shares could serve as an indirect way for U.S. companies to access Bitcoin exposure without actually holding BTC itself amid regulatory unclarity.

BlackRock and Fidelity have also filed applications with the SEC toward listing America’s first spot Bitcoin exchange-traded fund (ETF), a financial product that would directly invest in BTC.

BlackRock’s filing also seemingly galvanized other issuers to do the same as a deluge of spot Bitcoin ETF bids from companies like Cathie Wood’s Ark Invest, Valkyrie, WisdomTree, and Franklin Templeton swiftly followed.

While the SEC has not yet approved any filings, many believe a ruling in Grayscale’s lawsuit against the securities regulator could be the turning point in crypto’s quest for its first spot Bitcoin ETF.